M&A: Page 5

-

3M spins out Solventum

The new company will need to work through debt from the spinoff and sole-source arrangements with 3M.

By Elise Reuter • April 1, 2024 -

Labcorp inks $237.5M buyout of Opko’s reproductive, women’s health testing assets

The acquired assets generate about $100 million in annual revenue, according to the deal announcement.

By Nick Paul Taylor • March 29, 2024 -

J&J, Boston Scientific are top medtech spenders. But smaller deals fill 2024’s M&A list.

Boston Scientific recently closed two large acquisitions, buying Silk Road Medical and Axonics, while other firms made smaller, targeted purchases. Check out MedTech Dive’s roundup of M&A news.

By MedTech Dive staff • Updated Dec. 2, 2024 -

J&J in talks to buy Shockwave Medical: WSJ

The healthcare giant could follow up its $16.6 billion acquisition of Abiomed with another deal for a heart device company, the WSJ reported Tuesday.

By Ricky Zipp • March 27, 2024 -

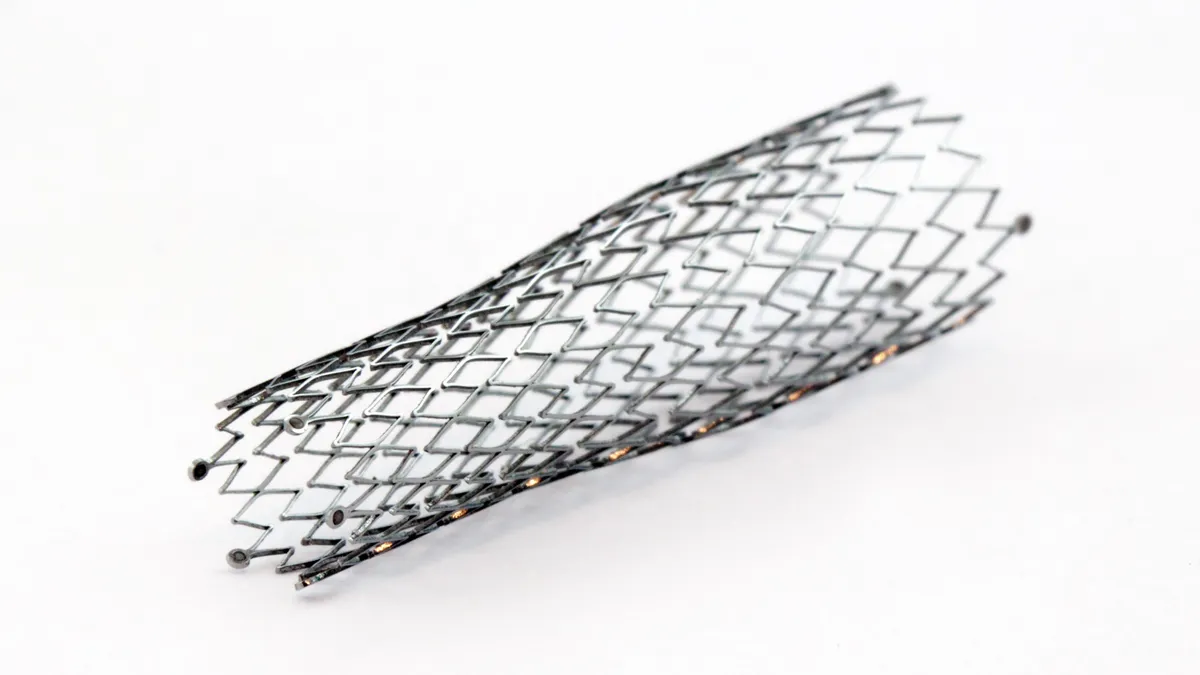

Johnson Matthey to sell medical device components unit for $700M

The segment makes components for medical devices, such as nitinol and metallic coatings.

By Elise Reuter • March 20, 2024 -

Retrieved from Titan on September 12, 2022

Retrieved from Titan on September 12, 2022

Titan Medical to merge with imaging firm Conavi, ending strategic review

The combined company will focus on selling Conavi’s cardiovascular imaging system used in minimally invasive procedures.

By Elise Reuter • March 19, 2024 -

Haemonetics to buy Attune Medical for $160M

Attune’s device to help cool the esophagus during radiofrequency ablation procedures is a key piece of the acquisition.

By Susan Kelly • March 5, 2024 -

Baxter considers selling kidney care unit to private equity

The company expects to divest its largest segment, whether through a spinoff or a sale, in the second half of the year.

By Elise Reuter • March 4, 2024 -

Agiliti to go private in $2.5B PE deal

After the transaction’s expected close in the first half of this year, Agiliti will no longer trade on the New York Stock Exchange.

By Susan Kelly • Feb. 26, 2024 -

Ex-Mazor exec convicted of insider trading conspiracy linked to $1.6B Medtronic deal

A federal jury found Doron Tavlin guilty on one count of conspiracy to commit insider trading and 10 counts related to securities fraud.

By Nick Paul Taylor • Feb. 22, 2024 -

The top medtech trends in 2024

Experts said M&A, orthopedic procedure backlogs and emerging cardiac markets were among the top trends to watch in the medical device industry this year.

By MedTech Dive Staff • Jan. 31, 2024 -

Cook Medical sells ear, nose and throat devices to C2Dx

The transaction completes Cook’s divestiture of its otolaryngology, head and neck surgery product lines.

By Nick Paul Taylor • Jan. 26, 2024 -

Invitae sells reproductive health assets amid liquidity concerns

DNA testing firm Natera could pay up to $52.5 million total, and plans to move Invitae’s customers to its own tests.

By Elise Reuter • Jan. 22, 2024 -

Integer acquires Pulse Technologies for $140M

Pulse specializes in the micro machining of components for medical devices used in markets such as structural heart.

By Nick Paul Taylor • Jan. 16, 2024 -

Deep Dive

5 medtech trends to watch in 2024

From the M&A outlook and tough year-over-year comparisons to emerging markets like pulsed field ablation, here are the top medical technology trends to watch this year.

By Ricky Zipp • Jan. 9, 2024 -

Retrieved from Axonics on August 22, 2023

Retrieved from Axonics on August 22, 2023

Boston Scientific to buy Axonics for $3.7B to gain incontinence treatment

The acquisition provides a high-growth addition to Boston Scientific’s urology business, analysts said.

By Susan Kelly • Jan. 8, 2024 -

Q&A

‘Healthy pullback’: GSR Ventures’ Sunny Kumar on normalizing digital health funding, accelerating M&A in 2024

Sunny Kumar discusses digital healthcare investment, the landscape for M&A and when the public markets could open back up.

By Emily Olsen • Jan. 8, 2024 -

Roche to buy LumiraDx’s point-of-care technology for $295M

LumiraDx faces financial pressures amid declining test sales and a potential delisting from the Nasdaq.

By Elise Reuter • Jan. 2, 2024 -

Roundup: Illumina’s long goodbye to cancer test maker Grail

From the start, the DNA sequencing leader faced pressure to unwind its $8 billion acquisition of the cancer screening developer. As 2023 drew to a close, it has finally agreed.

By Susan Kelly • Dec. 21, 2023 -

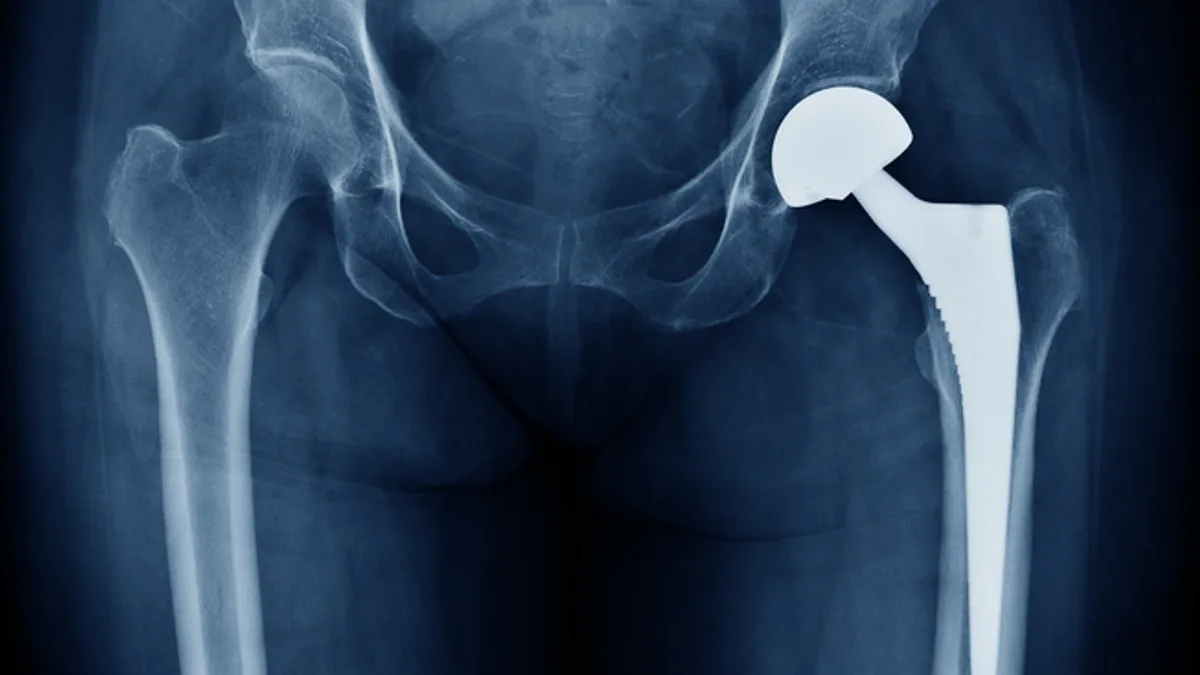

Stryker buys joint replacement business Serf Sas

The purchase is expected to complement Stryker’s business in Europe and its joint replacement portfolio.

By Elise Reuter • Dec. 20, 2023 -

Roundup: Medtech M&A slump continues but analysts predict uptick in 2024

Globus Medical and Thermo Fisher were among the companies to announce billion dollar deals this year, while Medtronic and Boston Scientific called off acquisitions.

By Nick Paul Taylor • Dec. 19, 2023 -

Illumina to part with Grail, ending battle with regulators

Activist investor Carl Icahn, who is suing the company over its acquisition of Grail, continued to push for the removal of several board members in a letter to fellow shareholders.

By Susan Kelly • Dec. 18, 2023 -

Zimvie to sell spine business for $375M

Zimvie said the sale to H.I.G. Capital will leave the company focused on its dental business and help reduce debt.

By Elise Reuter • Dec. 18, 2023 -

Integra to buy J&J’s Acclarent for $275M

Integra said the purchase, which includes a portfolio of balloon dilation products for the sinuses and eustachian tube, would make it a market leader in ENT procedures.

By Elise Reuter • Dec. 13, 2023 -

Illumina prepares to divest Grail with Form 10 filing

The DNA sequencer is preparing to unwind its 2021 acquisition of the liquid biopsy test maker while still appealing orders to do so from regulators in the U.S. and Europe.

By Susan Kelly • Dec. 13, 2023