M&A: Page 17

-

Thermo Fisher-Qiagen deal falls apart after failing to secure shareholder support

Thermo Fisher recently raised its bid for Qiagen shares, taking into account the company's COVID-19 testing gains. But when the offer expired Monday, less than half of shares were tendered.

By Nick Paul Taylor , Maria Rachal , Greg Slabodkin • Updated Aug. 13, 2020 -

Livongo scooped up by Teladoc in $18.5B deal

An explosion in the use of virtual care during the pandemic may have sped up the timeline for the merger. Both companies' share prices are down on the news.

By Shannon Muchmore • Updated Aug. 5, 2020 -

Americas drag on Qiagen as Thermo Fisher deal goes down to the wire

A hedge fund that owns 8% of Qiagen "fully" expects the Thermo Fisher offer to fail, calling it “wholly inadequate.”

By Nick Paul Taylor • Aug. 5, 2020 -

Varian sold to Siemens Healthineers in $16.4B all-cash deal

Breaking with a trend of smaller medtech deal values in 2020, the pact will see radiation oncology equipment and software maker Varian Medical Systems operate as an independent company under Siemens Healthineers.

By Maria Rachal • Updated Aug. 3, 2020 -

Coronavirus could fuel clinical lab M&A by stressing smaller hospital players

Consultancy Kaufman Hall predicts a ramp-up of deals throughout the year, as hospital-owned labs seek support amid the pandemic. That forecast meshes with comments from Quest's CEO last week.

By Nick Paul Taylor • July 29, 2020 -

Medical device deal values down 88% amid COVID-19 disruption: PwC

Going forward, M&A may rise in light of recent deferral of elective procedures, which analysts say “could create the need for significant consolidation as companies work to remain competitive.”

By Nick Paul Taylor • July 23, 2020 -

Thermo Fisher ups Qiagen offer by 10% after investor backlash cites COVID-19 growth

The acquisition was announced weeks before the U.S. doubled down on its need for widespread coronavirus testing, which provided a big business opportunity for Qiagen that it capitalized on during the second quarter.

By Maria Rachal • July 16, 2020 -

Medtronic closes Medicrea buyout, seeking spinal surgery boost

Four months after announcing the deal for the French medtech, Medtronic also highlighted its expanding foothold in AI, machine learning and predictive analytics.

By Maria Rachal • Updated Nov. 16, 2020 -

UK signals Stryker offer to unload ankle replacement product could clear Wright Medical buy

The medtech giant's proposed $4 billion acquisition prompted competition concerns among regulators. Stryker disclosed in a filing Wednesday it pitched divesting its STAR product line, which may satisfy U.K. authorities.

By Greg Slabodkin • July 15, 2020 -

Shareholder challenges Thermo Fisher's $11.5B deal to buy Qiagen

COVID-19 has made "significantly clearer" the importance of Qiagen's testing business, according to investment management firm Davidson Kempner, which is urging other shareholders to reject the offer priced in early March.

By Susan Kelly • July 13, 2020 -

Intersect ENT stock jumps on report of potential Medtronic takeover

A Bloomberg report published late Tuesday said the medtech giant had made an offer for the sinusitis tech maker, citing people with knowledge of the matter. Shares in Intersect were up around 35% early Wednesday.

By Maria Rachal • July 8, 2020 -

UK raises red flags about Stryker's $4B bid for Wright Medical

The Competition and Markets Authority suggested the proposed acquisition would result in Stryker controlling 90% of Britain's total ankle replacement prostheses market.

By Greg Slabodkin • July 1, 2020 -

Invitae cash-and-stock buyout of ArcherDX a done deal

The medical genetic testing company swept in after the assay developer announced plans to go public. Invitae will now offer tests for more stages of cancer care, from assessing disease risk to monitoring its progression.

By Maria Rachal • Updated Oct. 5, 2020 -

Medtronic, Titan Medical ink robotics development, license agreements

The beleaguered robotic surgery company said Thursday it will receive up to $31 million from Medtronic's licensing of technologies. It's the medtech giant's second robotics deal this year as it works to launch its own soft tissue robot.

By Greg Slabodkin • June 4, 2020 -

Haemonetics unveils back-to-back divestitures of blood supply assets

The company saw a 25% to 30% drop in April plasma collections and is now preserving cash, but Wall Street analysts see a few upcoming growth drivers.

By Nick Paul Taylor • June 4, 2020 -

J&J, Takeda cancel $400M surgical patch deal after antitrust scrutiny

U.S. and EU regulators raised concerns over lack of competition in the market for the fibrin sealant products meant to stop bleeding during surgery.

By Susan Kelly • April 13, 2020 -

OrthoPediatrics buys FDA-approved scoliosis tech, challenging Zimmer for market

OrthoPediatrics scooped up ApiFix's minimally invasive deformity correction system, an alternative to spinal fusion procedures and Zimmer Biomet's vertebral body tethering technology.

By Maria Rachal • April 2, 2020 -

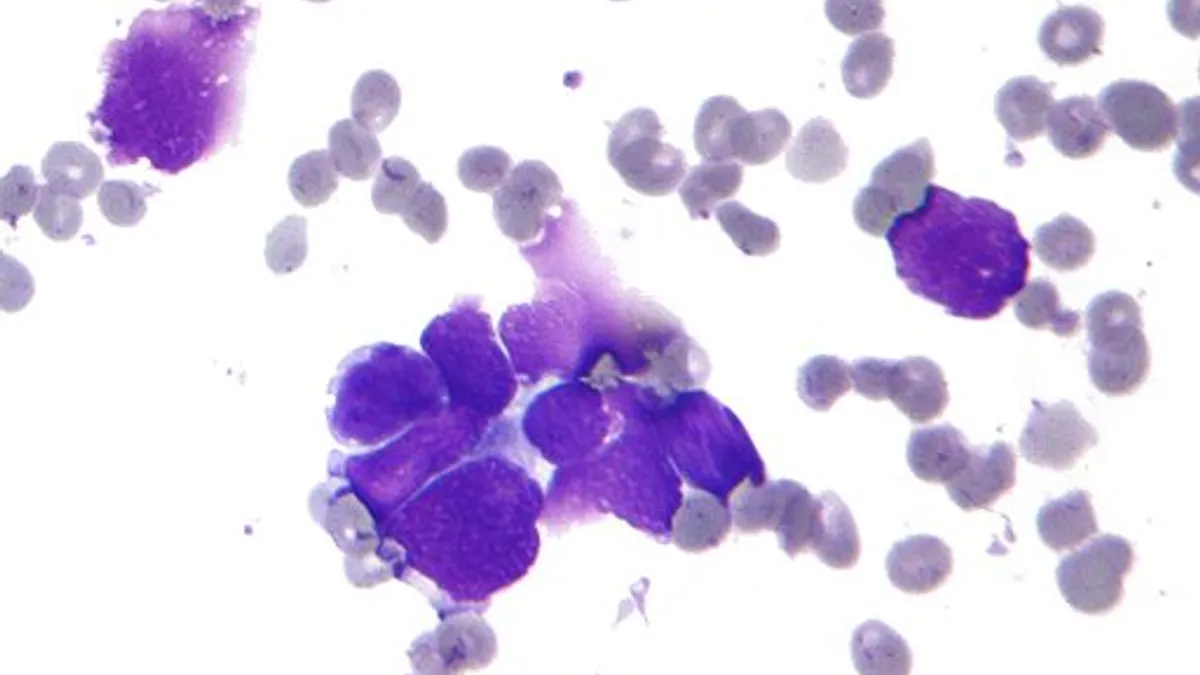

Exact Sciences closes takeovers of 2 cancer testing businesses

The deals give the diagnostics company a solid tumor test and R&D capabilities as it aims to expand beyond its flagship Cologuard product.

By Nick Paul Taylor • March 4, 2020 -

After waffling, Qiagen agrees to $11.5B buyout by Thermo Fisher

Months of will-they-won't-they M&A rumors culminated in the Dutch test maker accepting an offer for a 23% premium on its shares, as Thermo Fisher aims to strengthen its molecular diagnostics and infectious disease efforts.

By Maria Rachal • March 3, 2020 -

Teleflex strikes $260M deal, gaining parts used in TAVR procedures

In releasing quarterly results, the Wayne, Pennsylvania-based medtech also gave updates on a new direct-to-consumer ad campaign and headwinds expected from the coronavirus outbreak.

By Nick Paul Taylor • Feb. 20, 2020 -

Private equity medical practice takeovers more than doubled from 2013 to 2016

Heart, eye and radiology medical practices were among the increasingly attractive targets, according to research published in JAMA.

By Samantha Liss • Feb. 19, 2020 -

Medtronic buys British surgical AI company, adding to Hugo robot effort

The acquisition of Digital Surgery comes as Medtronic inches its own soft tissue robot toward competition with Intuitive's da Vinci.

By Maria Rachal • Feb. 13, 2020 -

Intuitive buys IT startup for surgical video sharing, archiving, analysis

The acquisition of clinical video and image documentation company Orpheus Medical comes as big players like J&J and Medtronic are preparing to shake up the robotic surgery market.

By Maria Rachal • Feb. 11, 2020 -

Qiagen, still independent, limps back from 2019

The Dutch maker of infectious disease instruments and consumables is seeking a rebound, with an early boost from coronavirus-driven demand. Cowen analysts noted the firm beat expectations but added: "The bar was quite low."

By Nick Paul Taylor • Feb. 5, 2020 -

Smith & Nephew acquires Tusker's PMA-winning ear infection device for ENT portfolio

The buyout of Tusker Medical comes two months after it won FDA premarket approval for an ear tube delivery system that can be used in young children with local anesthesia alone in a doctor's office.

By Maria Rachal • Jan. 24, 2020