M&A

-

Medtech firms splitting into ‘haves’ and ‘have-nots’: EY

The number of medtech funding rounds has declined in recent months, but the value of overall deals has increased, according to a new report from EY.

By Elise Reuter • Sept. 29, 2025 -

Biogen to buy startup Alcyone, eyeing easier delivery of RNA drugs

The purchase gives Biogen full access to an implantable device that could help patients avoid the repeat lumbar punctures required for drugs like Spinraza.

By Kristin Jensen • Sept. 19, 2025 -

B. Braun buys True Digital Surgery for microscopy technology

The acquisition gives B. Braun control of a company that provides technology for its Aeos robotic digital microscope.

By Nick Paul Taylor • Sept. 15, 2025 -

AI drives medtech investment in 2025

Medical device companies working with artificial intelligence raised funding and were acquisition targets in recent months.

By Elise Reuter • Sept. 12, 2025 -

GE HealthCare inks Icometrix buyout to acquire brain MRI software

The deal includes AI-powered software for detecting known side effects of recently launched Alzheimer’s drugs.

By Nick Paul Taylor • Sept. 11, 2025 -

Boston Scientific inks $88M Elutia deal to challenge Medtronic

BTIG analysts estimate that Elutia’s Elupro and Medtronic’s TYRX are competing for a $600 million opportunity in the U.S. cardiac rhythm management sector.

By Nick Paul Taylor • Updated Sept. 11, 2025 -

Medtech VC funding on track to hit highest value since 2021: PitchBook

“Larger rounds increasingly favor top-tier companies and AI-native startups, leaving other startups fighting for a smaller pool of capital,” the firm said.

By Nick Paul Taylor • Sept. 2, 2025 -

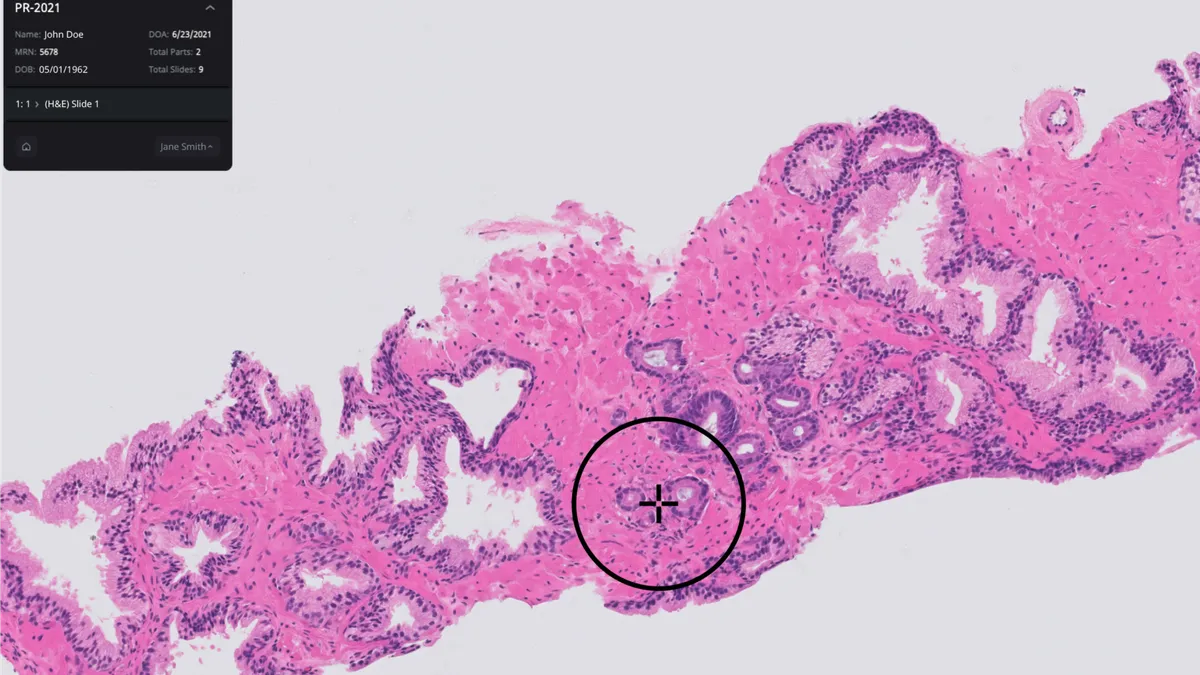

Tempus inks $81M Paige buyout to support AI model development

CEO Eric Lefkofsky said that buying Paige “substantially accelerates” Tempus’ effort to build the largest foundation model in oncology.

By Nick Paul Taylor • Aug. 26, 2025 -

Terumo to buy OrganOx for $1.5B to enter transplant field

OrganOx could capture a greater share of the liver transplant market, where it competes with TransMedics Group, Needham analyst Mike Matson wrote.

By Susan Kelly • Aug. 25, 2025 -

Deep Dive

4 medtech topics to watch for the rest of 2025

From M&A to MDUFA and the developing market in renal denervation, MedTech Dive covers the key issues to watch in the final months of the year.

By Ricky Zipp , Susan Kelly , Elise Reuter • Aug. 25, 2025 -

Masimo appoints several senior execs, resolves cyber incident

The pulse oximeter maker is now fully operational after a spring cyberattack and increased its 2025 profit forecast, but investors have raised questions about the status of a partnership with Philips.

By Susan Kelly • Aug. 8, 2025 -

FTC moves to block Edwards’ JenaValve acquisition

Edwards Lifesciences and JenaValve said they remained committed to completing the deal and would defend the case in court.

By Susan Kelly • Aug. 6, 2025 -

Alcon to acquire STAAR Surgical for about $1.5B

BTIG analyst Ryan Zimmerman called the transaction “a solid deal” for Alcon given STAAR’s struggles in the China market.

By Susan Kelly • Aug. 5, 2025 -

J&J’s Ethicon recalls stapler cartridges over issue linked to 1 death

The FDA said the device can lock, leading to adverse events including surgical delay, bleeding and death.

By Nick Paul Taylor • Updated July 29, 2025 -

Olympus, Revival Healthcare partner to start GI robotics firm

Olympus and Revival Healthcare Capital agreed to invest up to $458 million combined to co-found a company that will develop a robotic platform for gastrointestinal treatment.

By Susan Kelly • July 28, 2025 -

Labcorp to buy some Community Health assets for $195M

The deal includes outreach laboratory services in 13 states. Community Health will continue to operate its inpatient and emergency department labs along with other hospital-based testing services.

By Susan Kelly • July 24, 2025 -

ZimVie to sell to investment firm for about $730M

The announcement follows reports that the dental equipment company was considering a sale after receiving takeover offers.

By Elise Reuter • July 22, 2025 -

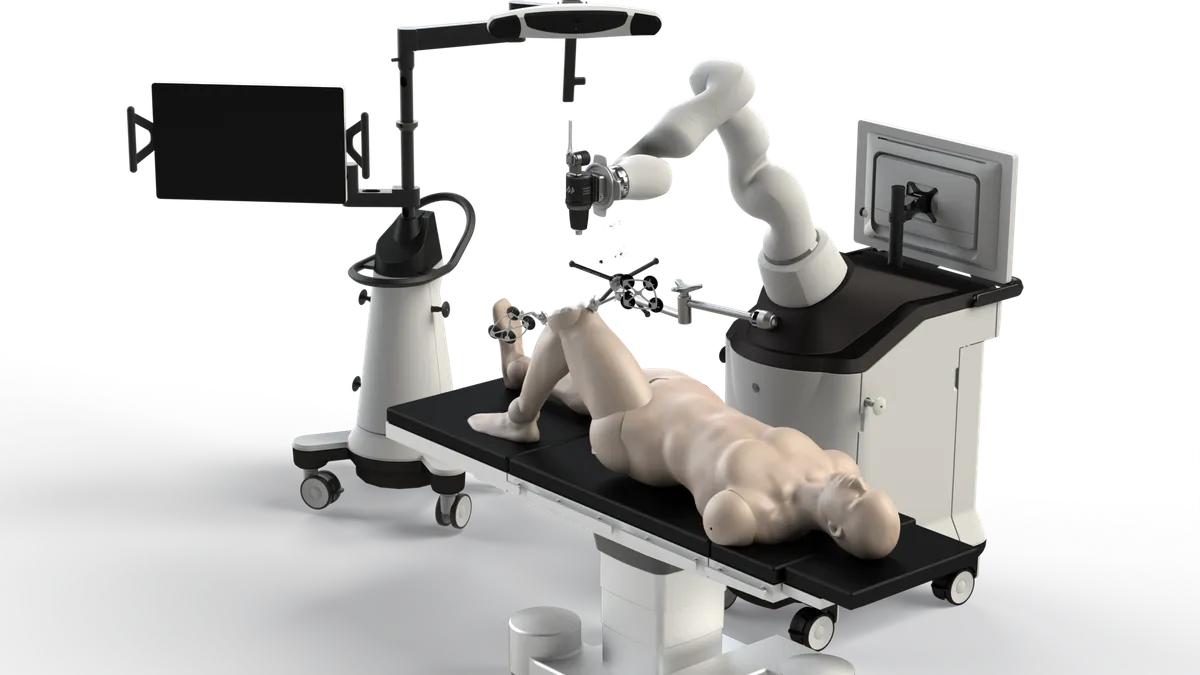

Zimmer bets on autonomous surgery with Monogram purchase

The orthopedics firm is looking to round out its robotics offerings with the planned $177 million acquisition. Some analysts questioned the value of a fully autonomous robot.

By Elise Reuter • July 16, 2025 -

Waters, BD biosciences unit agree to $17.5B merger

The BD business will be spun off and merged with a Waters subsidiary. Waters shares were down about 11% in early trading Monday on the news.

By Susan Kelly • July 14, 2025 -

Samsung to acquire digital health firm Xealth

The purchase of the Providence spinoff bolsters Samsung’s push to unify health data, including through wearables like the electronics giant’s Galaxy Watch line.

By Emily Olsen • July 10, 2025 -

Will medtech M&A pick back up in the second half?

The year kicked off with a handful of acquisitions from top companies. Dealmaking has since slowed amid economic uncertainty but could be poised for a rebound.

By Ricky Zipp • July 9, 2025 -

Illumina to buy SomaLogic for up to $425M

Illumina said adding SomaLogic would support the company’s multiomics strategy and strengthen the value of its NovaSeq X products.

By Susan Kelly • June 23, 2025 -

Rise in VC activity tees up ‘strong year’ for medtech funding: PitchBook

Improvements in VC funding contrasted with M&A activity, which has fallen short of the level PitchBook predicted under the Trump administration.

By Nick Paul Taylor • June 20, 2025 -

Anne Wojcicki wins bid to buy back 23andMe for $305M

A nonprofit led by the co-founder and former CEO of 23andMe outbid competitors for nearly all of the company’s assets.

By Elise Reuter • June 17, 2025 -

Owens & Minor spikes $1.36B Rotech buyout over regulatory barriers

The companies scrapped the merger because securing FTC clearance “proved unviable in terms of time, expense and opportunity.”

By Nick Paul Taylor • June 6, 2025