Dive Brief:

- Zimmer Biomet agreed to acquire Embody, a closely held Norfolk, Virginia-based maker of collagen-based implants for tendon and ligament repair.

- Zimmer will pay $155 million upfront and as much as an additional $120 million over a three-year period if the company meets regulatory and commercial milestones.

- The acquisition is a further investment by the company in high-growth markets, including sports medicine, according to Zimmer Biomet CEO Bryan Hanson.

Dive Insight:

Embody is Zimmer Biomet’s first acquisition since it spun out its spine and dental businesses into ZimVie at the start of 2022. The purchase “further solidifies Zimmer’s global sports medicine market position in a submarket that’s growing ~18%-20%,” Stifel analyst Rick Wise wrote in a research note on Thursday.

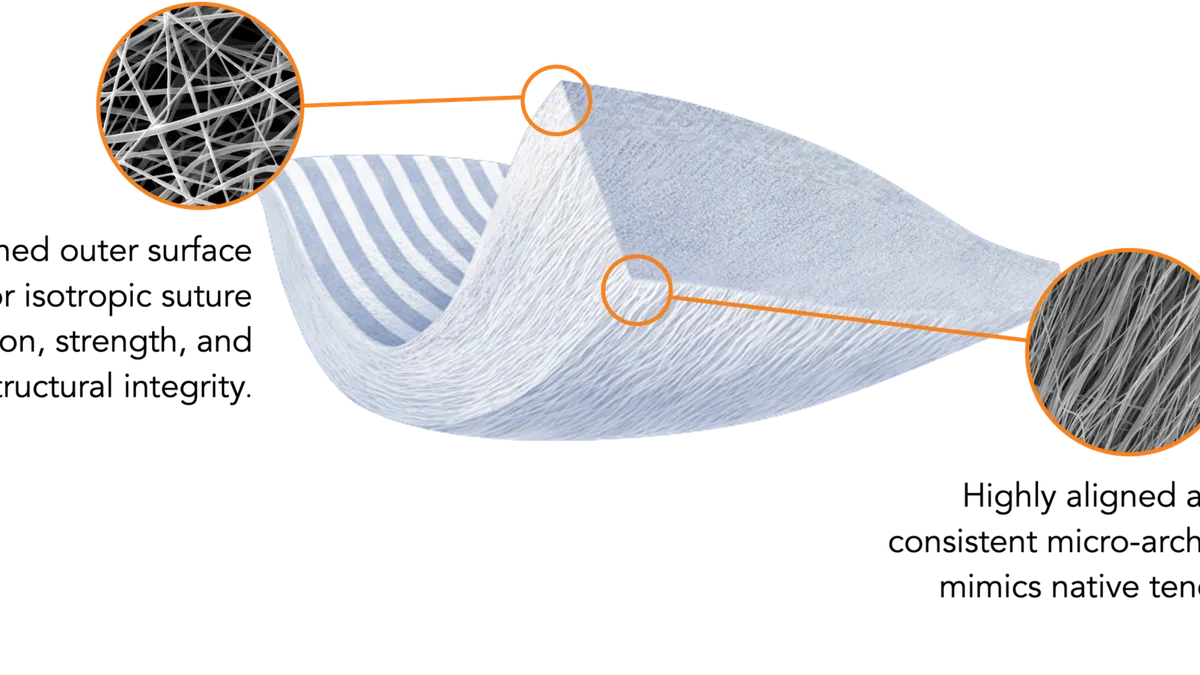

Through its planned acquisition of Embody, Zimmer Biomet will gain access to the firm’s Tapestry implants for rotator cuff, tendon and ligament repair. Embody received 510(k) clearance from the Food and Drug Administration for the rotator cuff repair product in May and for tendon and ligament repair in October.

Embody raised $10.4 million last year in a funding round to expand its manufacturing facility.

"Embody's differentiated products and innovative pipeline in the area of sports medicine support our continued focus on and investment in high-growth markets and underscores our commitment to bringing meaningful new advances to patients and surgeons," Hanson said in a statement. "The planned acquisition of Embody is an important step in the ongoing transformation of ZB and the execution of our strategic priority to increase long-term growth and drive value creation."

Currently, Zimmer Biomet’s segment for sports medicine, extremities and trauma products (SET) is its smallest by revenue, following hip and knee procedures. For the quarter ended Sept. 30, the segment brought in $409.4 million in revenue.

The Embody acquisition is expected to close in February. Zimmer Biomet forecasts it will be accretive to its overall revenue growth and dilutive to its adjusted earnings per share in 2023.