Orthopaedic device makers have endured a bumpy ride over the past two years with hip and knee replacements among the first to be postponed when the COVID-19 virus struck.

Just as elective procedures were bouncing back in the first half of this year, the delta variant emerged to strain hospital capacity again in parts of the country, and widespread staffing shortages have added to the difficulties facing hospitals.

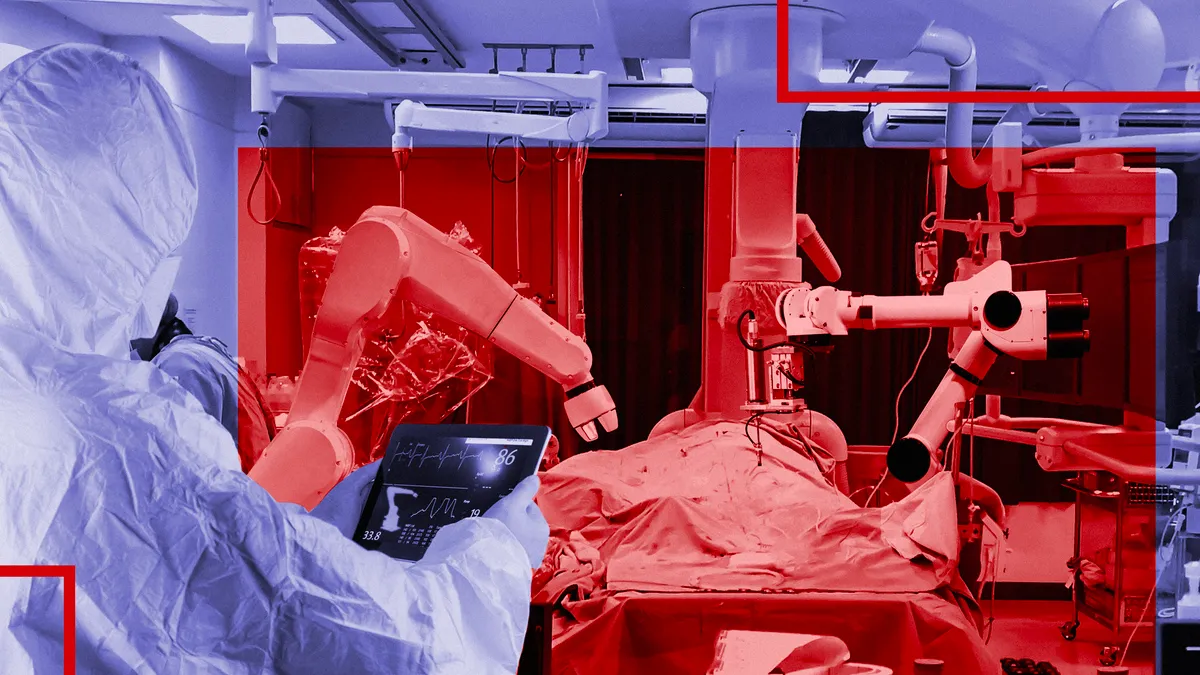

The persistence of the virus, though, and the challenges it has brought to the healthcare system have not slowed the expansion of robot-assisted surgery among orthopaedics-focused medtechs Stryker and Zimmer Biomet. Now, Johnson & Johnson's DePuy Synthes unit is ramping up its presence in the market with its Velys robotic system for total knee replacement procedures.

"I don't think it's a market share battle as much as market expansion. All the companies are riding this wave," said Needham & Co. analyst Mike Matson.

At Stryker, which has benefited in recent years from being first out of the gate with its Mako robot, CEO Kevin Lobo credited the platform with being a key driver of sales growth in the second quarter. The company's U.S. orthopaedic sales alone climbed 26% vs. the same period in 2019, largely due to Mako, Stryker executives said.

Zimmer is also seeing strong demand for its Rosa robot, which was cleared for partial knee surgeries in April and total hip replacements in August. The system gained U.S. clearance for total knee replacement surgery two years ago.

Hospital customers with healthy capital budgets bought more Rosa systems in the second quarter than expected, CEO Bryan Hanson said on the company's second-quarter call.

"That momentum, that demand is very real," Hanson emphasized.

Even with robotic technologies becoming more pervasive, the majority of hip and knee replacements are still performed manually. With robot-assisted surgery, the aim is to be able to offer patients a better experience and outcome. Because manual hip replacements already are largely associated with positive outcomes — a Cleveland Clinic study in 2019 found almost 97% of patients who got the procedure experienced less hip pain after one year and about 90% reported improved hip function — more of the focus in robotics for orthopaedic applications has been on knees.

"It's the latest opportunity to address the fact that, very consistently, roughly 20% of people who get their knees replaced are not happy with the result. Nobody really quite knows how to fix the problem," said Morningstar analyst Debbie Wang.

Patients who are unsatisfied with their implants typically say the new knee feels unnatural or unstable.

"The thinking is, if you can do things very precisely, by the millimeter, that will make it possible to get a better outcome," Wang said. "That's the overall hope that's associated with these robots."

Zimmer's Hanson contends robotic technology will improve outcomes for patients in orthopaedics, and this will motivate more people to get the procedure who might otherwise have hesitated to do it, increasing adoption across the field.

"I believe more patients will enter the funnel because they're going to have higher confidence in the procedure," the CEO said.

Zimmer also sought to differentiate the Rosa robot by designing the system to ensure that the technology did not add to the time it takes to perform a joint replacement, according to Hanson.

BTIG analysts who attended the American Academy of Orthopaedic Surgeons conference this summer noted in a report to clients that the Rosa system is unique in offering a selection of pre- and intraoperative imaging modalities to support patient-specific operating plans.

J&J's Velys robot has now entered the mix, and the company is expecting the launch of the system for total knees, which received 510(k) clearance in January, to reinvigorate its sluggish knee sales. J&J is aiming to appeal to surgeons with the platform's smaller footprint and integration into operating room workflows, executives said on the company's second-quarter conference call.

The Velys platform for knees saw higher utilization on the systems placed to date in hospitals than the company had initially projected, J&J CFO Joseph Wolk said last week on the company's third-quarter conference call.

Stryker has maintained that it does not expect competition in the robotic space to slow demand for Mako. Lobo in July said some hospitals are now buying their second, third and fourth Mako robots.

Analysts predict there is room for growth among all three competing systems as interest in the technology continues to build. The biggest challenge for the orthopaedic device makers will be converting existing customers into users of the robotic platforms, according to Needham's Matson

Orthopaedic surgeons are known to prefer to work with the implant brands they have trained on and become expert at using.

"There are some high switching costs to move over to a competing vendor because you have to climb that learning curve all over again, and there are some clinical risks to that," Morningstar's Wang said.

Wang predicts hospitals that already have a Mako robot could add a Rosa or Velys system, noting that "it's not really a zero sum game with the orthopaedic robots."