Dive Brief:

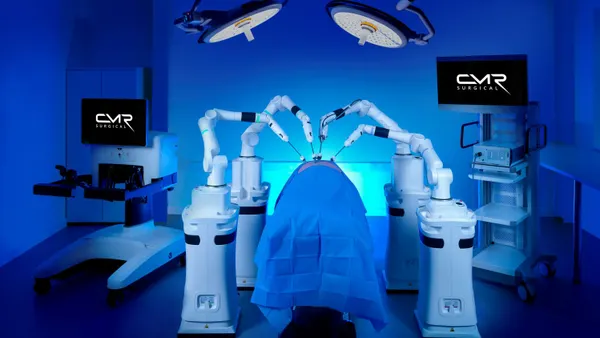

- Zimmer Biomet's knee business accelerated to its best growth in three years even without contributions from the limited launch of its Rosa robotic surgery platform, executives said on a second quarter earnings call Friday.

- Beginning in the second half of this year, the company will increase investments in robotics research and development, CEO Bryan Hanson told investors.

- Second quarter revenues of approximately $1.99 billion, down just under 1% from last year but up about 1% on a constant currency basis, were roughly in line with analysts' expectations. Executives tightened full-year sales growth guidance up from -0.5% to 0.5%, to 0% to 0.5%.

Dive Insight:

Management repeatedly referenced Zimmer Biomet's "turnaround" on Friday morning's call. Wall Street shared in the optimism, sending the company's stock price up more than 7% in morning trading.

Earlier this year executives warned of flat sales and headwinds from negative effects from foreign exchange.

Zimmer has enlisted fresh leadership in an to attempt to build on the second quarter's momentum. The third quarter is the first period the company is operating under a new CFO Suketu Upadhyay. The medtech and pharma veteran took over the role July 1 from CFO of 12 years Daniel Florin. Upadhyay most recently served as SVP of global financial operations at Bristol-Myers Squibb, with previous experience in financial roles at BD, Johnson & Johnson and AstraZeneca.

Continued second half improvement in the knee franchise and the surgical, sports medicine, extremities and trauma (SET) business are the two biggest potential sources of confidence going into 2020, Hanson told investors.

Knees drove the lion's share of revenues, which reached $704 million in sales, a $10 million increase from the first quarter, and up 0.1% from last year (2.5% on a constant currency basis). Florin, who oversaw second quarter finances, said the period marked the best growth rate in knees the company has seen over the last three years. Florin said gains were due to the Persona revision knee system, cementless knee offerings and the Rosa platform.

Hanson called the Asia-Pacific region a huge revenue source for the knee business. But even more important, he said revenue pick-up in the Americas is something the company "[hasn't] been able to say [for] a very long time," Hanson said.

Despite the positive momentum, Zimmer's Rosa Knee has a lot of catching up to do compared with Stryker's Mako platform. Although Zimmer executives said "hundreds of procedures" have been completed during Rosa's limited rollout, Stryker said on its earnings call Thursday that Mako knee operations to date number more than 18,000.

Zimmer's sales of SET products also contributed to its slight growth in the quarter, with the unit growing 2.5% year over year to $444 million. And dental, one of the company's smallest businesses, had its best quarter since the Zimmer-Biomet merger closed in mid-2015, Hanson said.

The spine unit was a weak spot, falling 6.2%. The launch of Rosa Spine has been put "on the back burner" until early 2020 because the company has steered resources toward the rollout of Rosa Knee. Now Zimmer needs to redouble its efforts to launch Rosa Spine in early 2020, Hanson said.