Dive Brief:

-

Zimmer Biomet has reported a 2.1% drop in net sales and earnings per share, in part due to the anticipated negative effect of foreign currency exchange rates.

-

On a constant currency basis, Zimmer sales grew 0.7% and the results were strong enough to beat analyst earnings and revenue forecasts.

-

Yet, the results also reveal ongoing difficulties beyond the effect of foreign exchange, such as a 1.7% drop in sales of knee devices in the Americas on a constant currency basis.

Dive Insight:

Zimmer primed investors to expect a low-key start to the year last quarter, warning that the negative effects of foreign exchange would hit hardest over the first half of 2019 and predicting flat sales for the year as a whole.

The first quarter results are in keeping with those expectations. A negative 2.8% foreign exchange hit wiped out the little growth Zimmer achieved in the first quarter, resulting in sales falling 2.1% on a reported basis to $1.98 billion. Even so, sales came in just above analyst expectations, as did adjusted EPS of $1.87.

SVB Leerink analysts called the quarter "'good enough,' considering a low bar for ZBH which is still in the early innings of its turnaround under new leadership (and just coming off supply issues)," they wrote in a note Friday.

The foreign exchange effect was felt most strongly in Europe, the Middle East and Africa, where sales fell 6.6% on a reported basis. Sales in the region grew 1.5% on a constant currency basis. Zimmer’s knee and hip units both contributed to the growth.

Such consistency was lacking in the Americas. Whereas Zimmer’s hip unit achieved constant-currency growth of 0.1% in the Americas, sales at the larger knee business in the region fell for the third quarter in a row, coming in 1.7% below the amount achieved this time last year. The knee and hip units performed worse in the Americas on a reported basis.

As in previous quarters, Zimmer recorded its strongest growth in Asia Pacific. Sales in the region were up 5.6% on a constant-currency basis as a result of rising demand for both knee and hip products, although most of that growth was eliminated by foreign exchange.

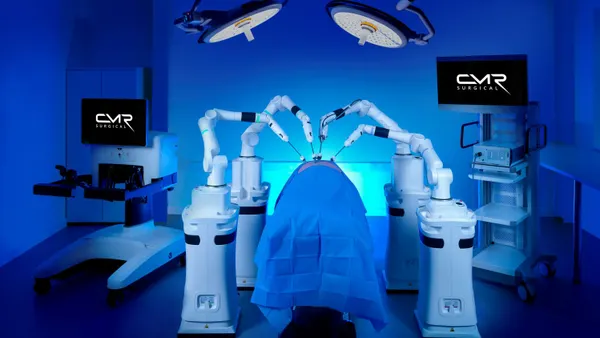

Zimmer expected to make a slow start to 2019 but management thinks efforts to turn the business around will reach an inflection point later in the year, driving improved performance in the second half. One driver of the anticipated improvement is the move from a limited to full launch of the Rosa robotic system.

The technology is central to Zimmer’s efforts to attract more interest in its products and return the business to growth. At the American Academy of Orthopaedic Surgeons annual meeting last year, Zimmer had fewer than 100 leads. This year, Zimmer had 2,000 leads, executives said.

“A decent portion of those were on Rosa,” Zimmer CEO Bryan Hanson told investors on a conference call to discuss the first quarter results. The list price of Rosa is over $1 million, although Zimmer primarily sees the product as a way to push adoption of robotic procedures and the long-term sales that can drive.

Zimmer expected Rosa to attract that level of interest and has factored it into its existing guidance. That guidance is unchanged, despite the first quarter going slightly better than expected, as Zimmer expects rising sales of Rosa to be offset by persistent headwinds, in the bone cement franchise, for example.