Enthusiasm for home health technologies continues to mount, fueled by the aging population, demands for personalized healthcare and convenience, population health efforts and the shift to value-based care.

The global smart home healthcare market is set to hit $30 billion by 2023, up from $4.5 billion in 2017, according to ResearchAndMarkets. Of that, fall prevention and detection accounts for the largest share with 39% in 2017. Other major categories include safety and security monitoring, health status monitoring, memory aids and nutrition and diet monitoring.

That includes popular home assistants like Google and Amazon, as well as apps, wearables and devices for monitoring glucose and blood pressure. In September, voice-powered care assistant Aiva Health got an undisclosed injection from the Google Assistant Investment Program. The startup uses Google Home, Amazon Echo and other smart speakers to engage patients and the elderly and connect them with their caregivers.

Retailers are eyeing the market, too. Last summer, Best Buy put down $800 million in cash to acquire GreatCall, a mobile device that connects health and emergency response services to older people and their caregivers. The deal is part of a broader plan to expand Best Buy's electronics expertise into the aging-in-place and personal health technologies markets.

Meanwhile, investors are pouring billions of dollars into technologies that can enhance care in the home. Patient empowerment tools received the most funding of any function in 2018, according to a recent StartUp Health report. The bulk of these tools focus on helping patients navigate the health system, telehealth and patient engagement. The top-funded specialty within this function was primary care at $591.8 million, followed by specialty agnostic companies at $463.4 million and aging/senior care at $417.5 million.

Looking ahead to the coming year, two themes pop up over and over again: convenience and communication.

"Anytime you see solutions where it's saving time for the care provider and making it easier for them to connect with the patient, but it's also doing the same thing for the patient, is where we're seeing success," says Unity Stoakes, president and cofounder of StartUp Health, which invests in healthcare companies.

Providers eye diagnostics, patient monitoring

While aging-in-place is a big investment category, Stoakes sees home health products targeting all demographics and age groups because of convenience and cost savings.

One Medical and Forward for example are targeting millennials and younger consumers who want to schedule an appointment or fill their prescriptions online, or have a video chat with their doctor from the convenience of home.

Enthusiasm for telehealth has grown steadily and will continue to do, with major health systems like Kaiser Permanente, Mayo Clinic and Intermountain Healthcare investing heavily in the technology. For example, Kaiser Permanent CEO Bernard Tyson has attributed a shift from in-person to virtual visits — 52% of the integrated health system’s 100 million annual encounters in 2017 — to strong investment in technology. Roughly a quarter of Kaiser Permanente’s $3.8 billion annual capital spend that year was IT-related.

Mayo Clinic has a teleneonatology program that has helped reduce unnecessary transfers and increased patient referrals to the health system. And Intermountain Healthcare launched a 'virtual hospital' to spur the transition to digital health while addressing population health issues.

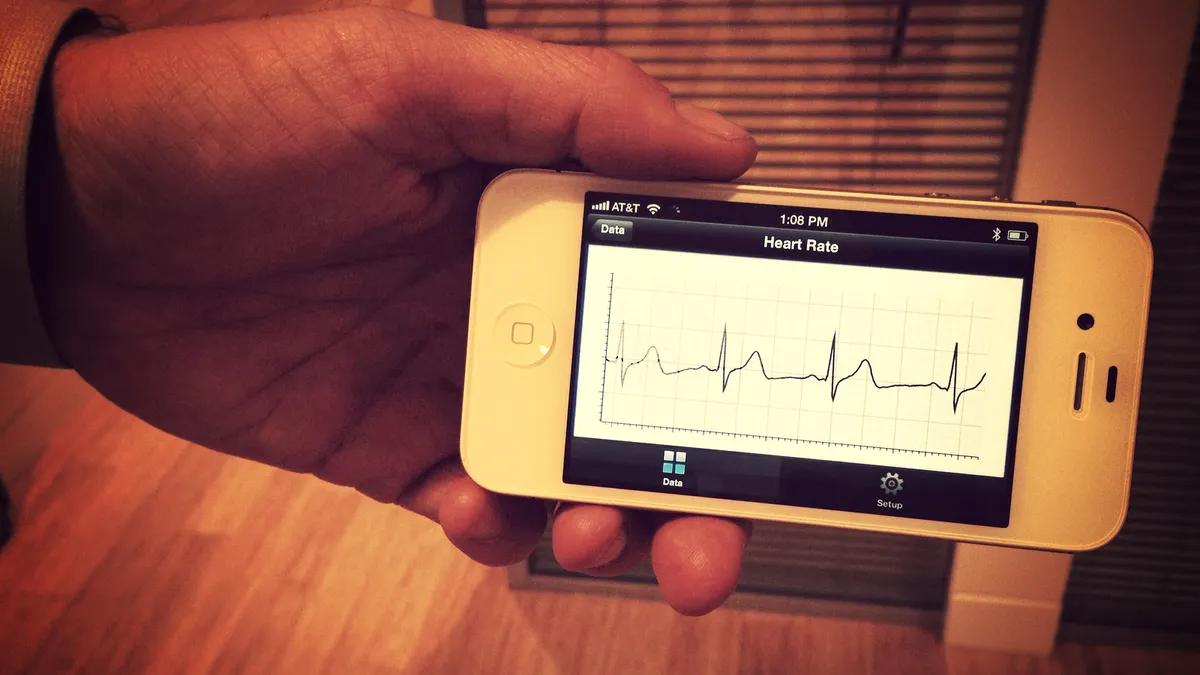

Diagnostics and continuous monitoring are very big areas, as are products that focus on prevention and wellness, stress reduction, behavior change and other things that impact long-term health and outcomes, Stoakes told Healthcare Dive.

In the senior healthcare monitoring area, two companies generating buzz are CarePredict and Emerald. Plantation, Florida-based CarePredict uses a wearable and smart sensor system placed throughout the home to learn behaviors and trigger interventions by caregivers or families if Grandma didn't get out of bed, use the bathroom, eat or show other signs of normal activity.

Similarly, MIT startup Emerald creates a radio mesh network that interacts with the water composition in a person's body and measures their breathing, heart rate and movements on an entire floor of a home. It can also tell if a person is sitting, standing, crawling or falling, making it useful in fall detection and prevention.

"Anything where you can measure gait and get out in front of it — we can anticipate there may be a problem — is super important," says Andy Miller, senior vice president for innovation and product development at AARP.

Digital therapeutics

Digital therapeutics and technologies to improve medication compliance are also hot items. Last fall, Otsuka America Pharmaceutical rolled out a digital version of its antipsychotic drug Abilify, called Abilify MyCite, which contains an ingestible device that tracks whether the pill was taken. The digital drug is indicated for people with schizophrenia, bipolar 1 disease and major depressive disorder.

Another player in this area is Pillo Health, which uses a robotic companion and facial recognition technology to dispense medications to people at home. The hands-free, HIPAA-compliant platform also acts as an extension to the caregiving team, allowing clinicians and family members to push content, such as side effects or a nutritional plan, into the device.

There's also smart pill bottle AdhereTech, which notes whether patients take their medication, in the right amount and at the right time, and wirelessly beams the data to their care provider. If someone forgets to take their meds or takes the wrong dose, the provider can contact them and help them get on track. The device also includes reminders and alerts.

In the area of diagnostics, Butterfly Health sells a low-cost, handheld, personal ultrasound and smartphone app that lets users upload images to the cloud for analysis by a healthcare professional. The device — which sells for about $2,000 versus $15,000 and more for a standard ultrasound machine — received FDA clearance in 2017 for diagnostic imaging of urological, cardiovascular, fetal, gynecological and musculoskeletal anatomies.

Butterfly raised $250 million last year in a Series D funding round led by financial services firm Fidelity. The round also included China-based Fosun Pharmaceutical and the Bill & Melinda Gates Foundation. While initially aimed at doctors and consumers, co-founder Jonathan Rothberg told MIT News that he hopes eventually to sell the device directly to consumers.

Integration

Experts say integration is key to advancing home health tools.

Like Amazon two years ago, Google Assistant "was everywhere" at 2019's Consumer Electronics Show, Miller says. That's noteworthy not just for Amazon or Google, but for what it means about the ability to leverage voice to navigate devices and information in a way that works for individuals.

"When you see this integration, as it's happening with both Amazon and Google, it's unlocking all kinds of potential with what were otherwise just thought of as point solutions," he tells Healthcare Dive.

As more integration occurs, people will be able to seamlessly use a variety of devices to capture their health data, nutrition, activities and other information for personal use and to share with providers or loved ones.

Privacy and data security remain big issues where personal health data is involved. Users need to know what's being integrated, who's doing it, where the data are going and whether it is benefiting them and their outcomes, Miller says. But the potential to expand access and improve outcomes is there.

Stoakes agrees. "The more we see these larger platforms used, I think that's better for the ecosystem," he says.

Stoakes points to recent success in China and India, where healthcare tools are working on established platforms like WiiChat and others with hundreds of millions or billions of users. "It can be a very effective way to bring health into the home," he says.

Barriers remain

Despite growing awareness and use of home health technologies, challenges remain. The main barriers are cost and perceived sophistication tied to integrating into or using technologies in the home, since it's often adult children who are buying and setting up these tools, Miller says. Caregivers want to feel comfortable with setting up and maintaining technologies for their loved ones.

Unfortunately, there's no 'curated package' of home technologies that work seamlessly together — plug this in and this in and this is and go, he adds. AARP recently started working with a company out of Brooklyn, New York, called tech.ur.elders, a chatbot to empower millennials caring for older parents.

Meanwhile, payers are trying to get out in front of the costs associated with people aging in place. Miller notes a UnitedHealthcare pilot around falls in the home found it was often cheaper to go into peoples' homes and replace carpeting, which has edges people can trip over, with tile or hardwood floors than to reimburse for repeated falls.

"They're very much looking at it," Miller says. "I think they're trying to figure out and qualify the data as to these difference devices or solutions and what it means for an ROI if they were to go down that path."