Dive Brief:

- Vicarious Surgical has filed a pre-submission with the FDA, marking the start of a regulatory process it hopes will lead to a 510(k) application by late 2023.

- The filing, which Vicarious disclosed in its first quarterly results as a public company, is part of a push to establish the robotic surgical system in a space fought over by Intuitive Surgical, Johnson & Johnson and Medtronic.

- Analysts at BTIG framed the pre-submission as the first in a series of milestones Vicarious will hit over the coming years as it works to bring the system to market in ventral hernia procedures and then expand into other indications.

Dive Insight:

Vicarious established itself as a player in the increasingly congested robotic surgery sector earlier this year by raising $220 million through a SPAC merger. The deal saw Vicarious add Becton Dickinson and hospital chains in the U.S. and Asia to its list of investors and secure the money to support a plan it foresees leading to sales of $1 billion by 2027.

In its first quarter as a public company, Vicarious disclosed the filing of a pre-submission with FDA and set out the next steps. Vicarious CEO Adam Sachs cautioned investors that it may take some time to agree on a path forward with FDA.

"We do expect some amount of back and forth over a number of months. They are fairly backlogged after all. We'll be sharing the results as soon as we come to an agreement at the end of that," Sachs told investors on Vicarious' third-quarter results conference call.

Vicarious is focusing on a single indication, ventral hernia, initially to reduce risk and time to market. The same thinking underpins Vicarious' approach to additional features. While vessel sealing, VR capabilities and other features are in development, which Sachs said many are "very far along," Vicarious is focusing on getting its core product cleared because it expects to need clinical data for the extras and wants to avoid regulatory risk that may delay time to market.

Even without the extra features, Vicarious has already impressed BTIG analysts.

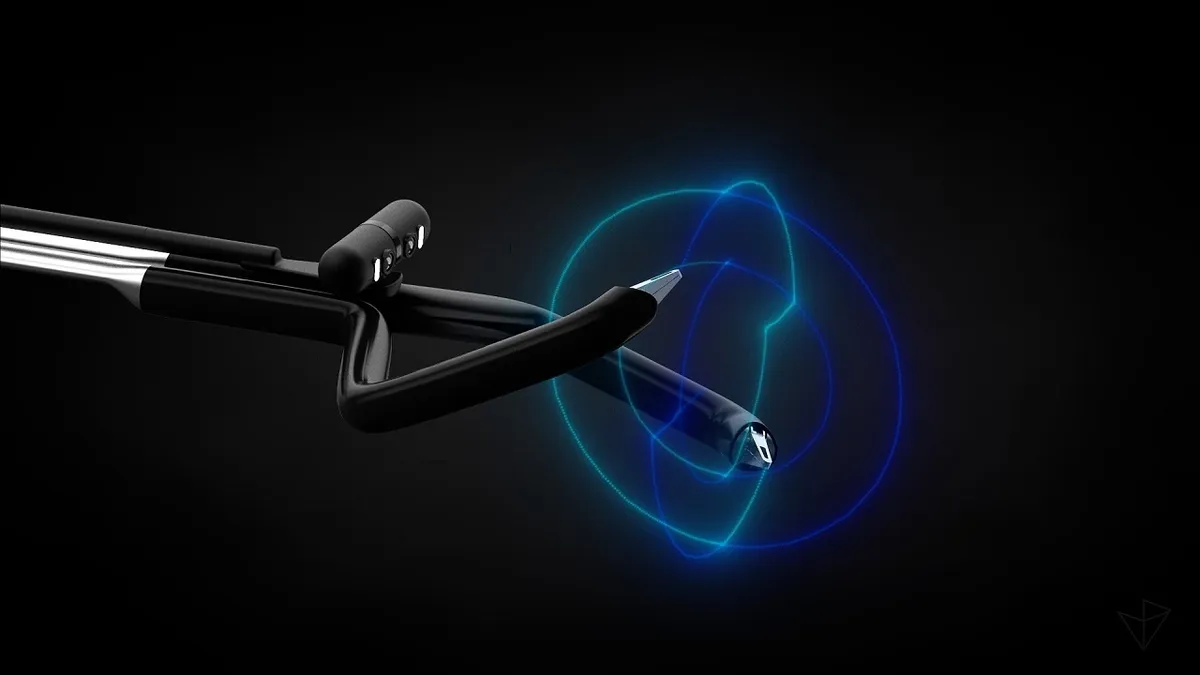

"The features include multiple components that we believe will make the Vicarious Surgical system attractive for users, including more degrees of freedom, smaller ports, 360 degrees of view, and an overall smaller footprint. Collectively these features offer surgeons a lot of value, in our view," the analysts wrote in a note to investors.

Vicarious will face stiff competition, though. As the company acknowledged in its SPAC paperwork, it is going after markets targeted by Intuitive, J&J and Medtronic, companies that may "possess the ability to commercialize additional lines of products, bundle products or offer higher discounts and incentives to customers in order to gain a competitive advantage."