Dive Brief:

- Uber Health is attempting to address provider gripes with its non-emergency medical transportation platform through a handful of new features that began rolling out late last year, the San Francisco-based rideshare company said Wednesday.

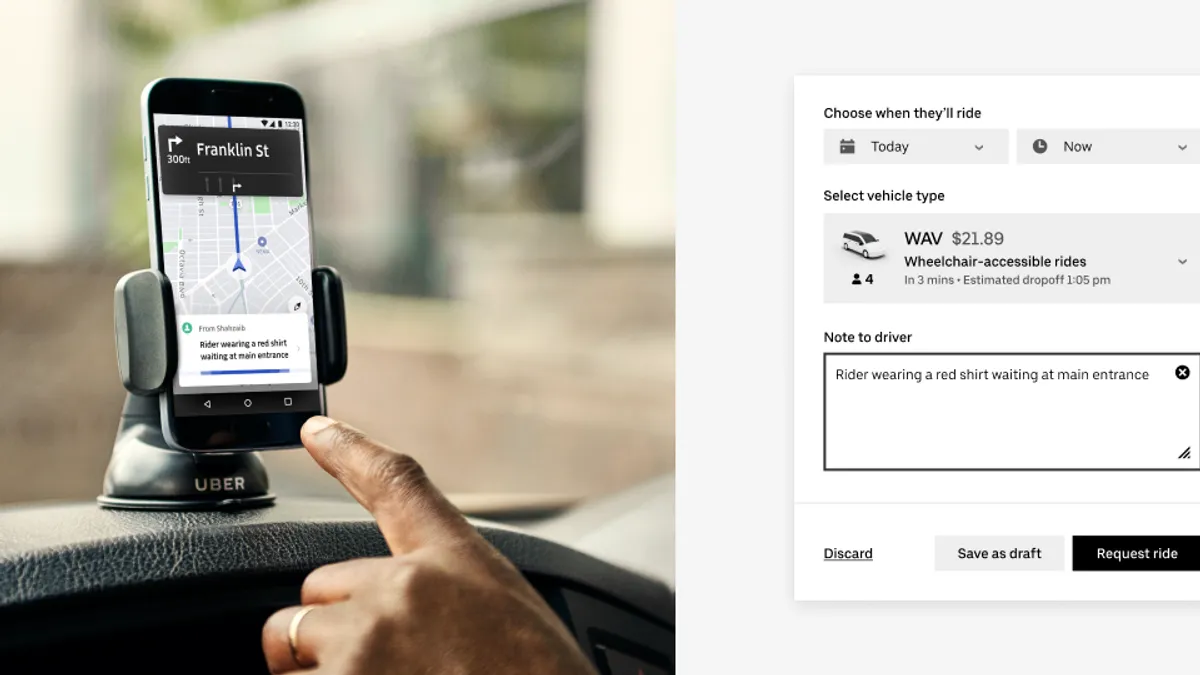

- Providers can now select specific pickup and drop-off sites at large hospitals, similar to how the app is used in airports, and people can receive details of their ride like driver name, make and model of car as well as time of arrival over a landline phone, instead of just text messages.

- Uber Health has grown 300% year over year since its launch in 2018 and plans to double the size of its team this year.

Dive Insight:

The new suite of services, slated to become widely available by April, also allows clinical staff to message drivers directly on the driver app so the driver doesn't need to toggle between SMS notifications and the app to read pickup and patient information. Patients can elect to receive pickup notifications in 44 different languages, and providers can request round-trip rides for patients to and from their appointments, instead of having to order two separate journeys.

"The core Uber app serves its own audience. But within health, you're serving almost an even wider set of demographics" from young to old, from the tech-savvy to people who don't own a smartphone, from consistent rideshare users to people who have never heard of it, Akarshan Kumar, product lead at Uber Health, told Healthcare Dive. "It's a situation where you can't just copy-paste what exists on the Uber app and make that work."

Uber is seeing some early success with the offerings. A fourth of Uber patients in Miami use Spanish as their primary language, and as a result, their appointment adherence has improved, Kumar said. He declined to share what percentage of Uber's patients use landlines, but said it was "significant" and only likely to grow as the NEMT-reliant Medicaid population increases.

Uber has doubled down in healthcare, saying it's committed to growth in the multi-billion dollar NEMT market following a lackluster IPO in May. Some 3.6 million people miss appointments due to a lack of transportation annually, resulting in downstream costs of roughly $150 billion.

Lyft and Uber are both aiming to lure providers seeking to reduce patient no-shows and recapture lost revenue, and clinch some themselves. It's fertile ground as NEMT, already a mainstay of Medicaid, is increasingly included in commercial and Medicare Advantage health insurance plans.

Uber generally focuses on the provider and employer spaces for growth, while Lyft has targeted the government and payer spaces. Like Uber, Lyft doesn't disclose specific numbers, but the company told Healthcare Dive last year it's netted "thousands" of partnerships in the industry since it jumped into NEMT in 2016.

"We're here and we're here to stay," Kumar said. "This is not like a side experiment that the company is doing and seeing if it works out or not. It's something that the full weight of the leadership is behind."

Uber has more than 1,000 partnerships in the healthcare industry, including providers like BayCare Health System, Boston Medical Center, Yale New Haven, MedStar Health and the Cleveland Clinic, as well as access to thousands of additional systems through an October integration with Cerner's EHR. Many of these providers worked with Uber to formulate the functions aimed to be more consumer friendly.