Dive Brief:

-

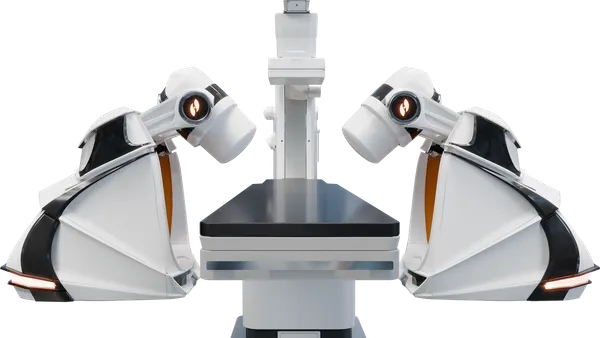

Revenue at TransEnterix plummeted in the first quarter as it sold just one of its Senhance surgical robotic systems globally.

-

The single system sale, plus revenues from instruments and services, resulted in TransEnterix bringing in $2.2 million in the quarter, far less than analysts expected and than it achieved a year ago.

-

TransEnterix expects to sell more systems in the second quarter, but investors reacted badly to the results, wiping 29% off the company's stock price.

Dive Insight:

TransEnterix received FDA clearance for its Senhance system in October 2017, becoming the first new entrant to the abdominal robotics sector since Intuitive Surgical in 2000. In 2018, TransEnterix sold 15 systems, ending the year on a high with a quarter in which it found buyers for five robots.

However, TransEnterix has been unable to continue the momentum into 2019. The company sold one system to a hospital in Taiwan, where it recently won approval, but it struggled to convert interest in business to the rest of the world, resulting in delays to deals it expected to close in the quarter.

"Each of the pipeline sales that did not occur in the quarter had their own reasons that caused them to be delayed, ranging from a change in decision maker to longer than anticipated time to convert surge in interest into an order from hospital administration," TransEnterix CEO Todd Pope said on a first quarter conference call with investors.

Pope said TransEnterix now has a purchase order for one of the delayed deals and expects to get a second in the next week or so, emboldening the company to predict it will record two to four system sales in the quarter. The two imminent sales both involve European buyers.

TransEnterix will likely need to sell more devices in the second quarter to beat its 2018 results. In the second quarter of 2018, TransEnterix sold four Senhance systems, resulting in revenues totaling $6.4 million.

System sales account for most of TransEnterix's revenues, but it also makes money from instruments, accessories and services. Those parts of the business suffered in the first quarter, too. Instrument and accessory sales came in at $546,000, down from $1.1 million in the prior year.

The falling revenues contributed to a first quarter net loss of $22.5 million, compared to a deficit of around $1 million a year ago. On an adjusted basis, the net loss was $18.7 million, 65% more than in the prior period.

TransEnterix's first quarter performance is unsustainable. The company ended the first quarter with $49 million in cash and short-term investments. When combined with an untapped debt facility, TransEnterix thinks the money will keep it going into late 2020.