Dive Brief:

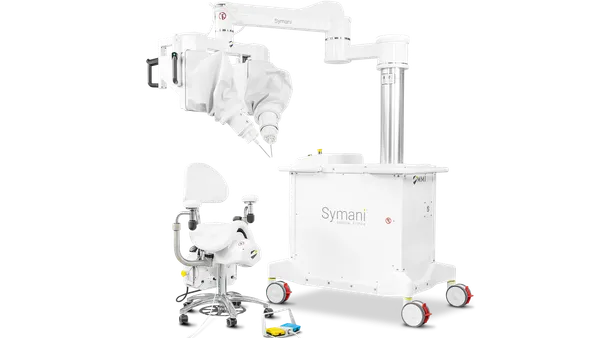

- Titan Medical is pushing back its expected 510(k) application filing date for its single-port robotic surgical system for minimally invasive surgery from late 2019 to the first half of 2020, the company announced Monday. The company also moved its anticipated investigational device exemption filing from the third quarter of 2019 to the fourth quarter.

- The decision comes following a "reassessment of ongoing preparations" for the device's IDE filing that found additional time is needed to finalize the device amid an effort to reduce Titan's third quarter research and development spend. Titan CEO David McNally said the company is searching for future funding opportunities "which may include strategic sources."

- In a July 30 Securities and Exchange Commission filing, Titan Medical told investors it could take "approximately six months to receive final 510(k) clearance," which the company projected it would receive in the third quarter of 2020. It's unclear if the company still expects that timeline to hold.

Dive Insight:

Titan Medical warned investors in late July the window for its 510(k) application was "very tight," but the company's decision to take additional time to improve its robotic system before submitting its IDE filing is the latest setback after it posted a net loss of more than $42 million in the first half of 2019.

Titan Medical recently completed good laboratory practice and human factors evaluation studies to support its IDE filing, according to McNally. The CEO said the product "achieved the expected results," but the company appears to be working on a number of changes.

"We will now take additional time to perfect our system and implement all planned system and sterile instrument interface components, software enhancements and training tools, in order not only to further de-risk our IDE studies, but also to introduce a more refined product in the marketplace," McNally said in a statement.

The company also announced it recently hired a contract research organization to manage its human studies. By delaying its regulatory filings, McNally said the company will be able to reduce its cash spend as it works to "better manage workflow and associated payments to our contractors."

With only approximately $19 million on hand as of June 30, the company appears to be running out of money on its path to regulatory submission. But the company is seeking to raise up to $125 million in securities over three years after filing a Form F-3 with the SEC. The company said it anticipates spending $9.4 million over the first half of 2020 as its research and development spend diminishes.

"This new capital will finance the Company's operations through a transition from product development to manufacturing and planned commercialization," McNally said when reporting the company's second quarter earnings.

The company did not mention an altered schedule for its CE mark application in Europe, which is scheduled for filing by the end of the year.