Dive Brief:

- Even as coronavirus vaccines clear regulatory hurdles and administration of the vaccines begin across the U.S., the nation's laboratory giants are indicating that testing volumes remain strong, buoying financial prospects into the first half of 2021.

- Investors in LabCorp and Quest Diagnostics have questioned whether demand for COVID-19 tests will slow now that vaccines for the public are on the horizon, analysts at Jefferies said this week in a research note. Test volumes at LabCorp have moderated from a peak around Thanksgiving, but management expects another surge in demand before Christmas, the analysts wrote.

- Quest this week boosted its 2020 earnings and revenue forecasts, citing "significantly higher" COVID-19 molecular testing volumes than the previous outlook incorporated and relatively steady volumes in its base business.

Dive Insight:

Demand for COVID-19 testing in the fourth quarter at LabCorp is on track to top third-quarter levels, the company's management told Jefferies during a recent event. At the same time, core testing volumes remain stable even as COVID-19 cases surge around the country, potentially diverting healthcare system resources. Jefferies predicts a "solid EPS beat" for LabCorp in the fourth quarter.

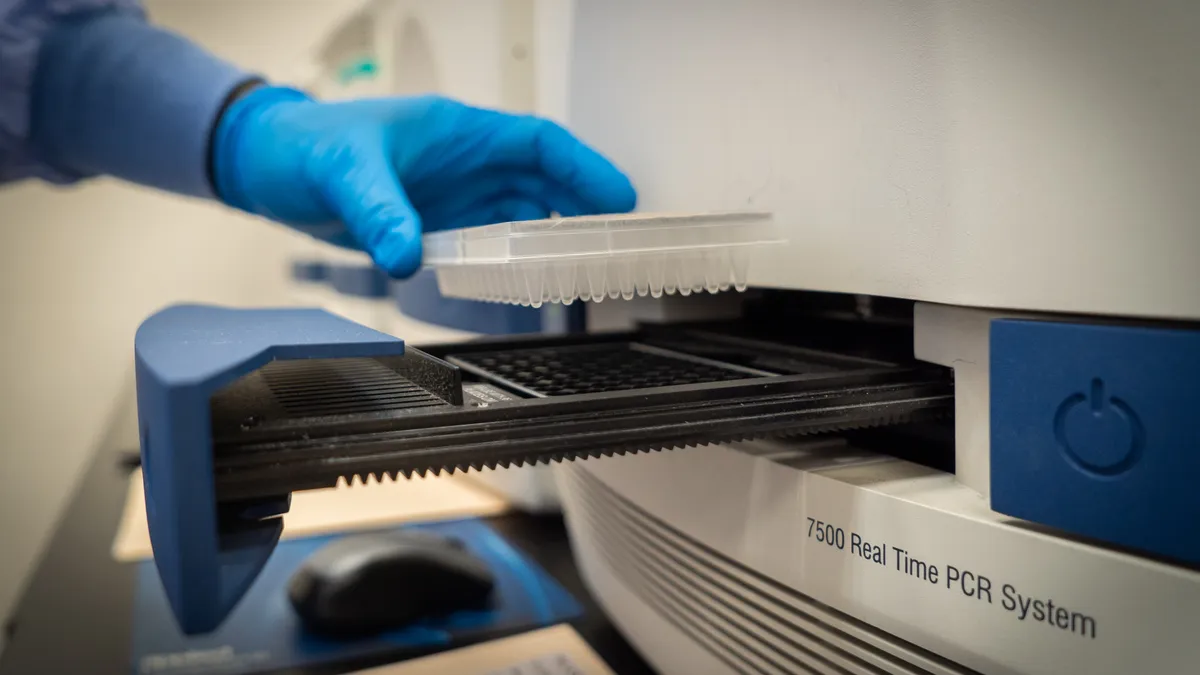

The investment bank and financial services company relayed several points made by LabCorp management supporting expectations for COVID-19 testing volumes to remain strong in the first half of the year. In the first quarter, PCR testing is expected to remain strong while the vaccine is unlikely to be available to the general public yet.

Patients who show COVID-19 symptoms but are unwilling to get the vaccine also factor into expectations that demand for testing will remain supported "well into 2021," Jefferies said. The bank said 20% of U.S. survey respondents have expressed unwillingness to be inoculated.

LabCorp should also benefit from the availability of at-home tests and greater use of antibody testing, given uncertainty about how long the vaccines will remain effective, the analysts said.

In LabCorp's core testing business on a monthly basis, October showed improvement in volumes compared to September, while November was on par with October, and December so far is down only slightly, Jefferies said.

At Quest, the company in its announcement raised its full-year 2020 revenue forecast to at least $9.35 billion, up from the previous outlook of $8.8 to $9.1 billion. Reported diluted earnings per share for the year are projected to be at least $9.98, compared to an earlier forecast of $8.22 to $9.22.

Tests ordered in the company's base business that excludes COVID-19 molecular and antibody testing and the impact of acquisitions declined in the mid-to-high single digits compared to the prior year in October and November. Testing volume declined in early December as a number of state and local governments imposed new orders designed to reduce the transmission of COVID-19, Quest said.