Teleflex, a provider of specialty medical devices used in critical care and surgery, said on Thursday it completed the acquisition of Standard Bariatrics for $170 million.

The company could pay as much as $130 million more if the unit reaches certain commercial targets, which weren’t specified in the statement.

The deal is expected to reduce Teleflex’s adjusted earnings per share in 2022 and 2023, it said, adding that next year the acquisition should add $30 million to $35 million in revenue and will increase adjusted earnings per share beginning in 2024.

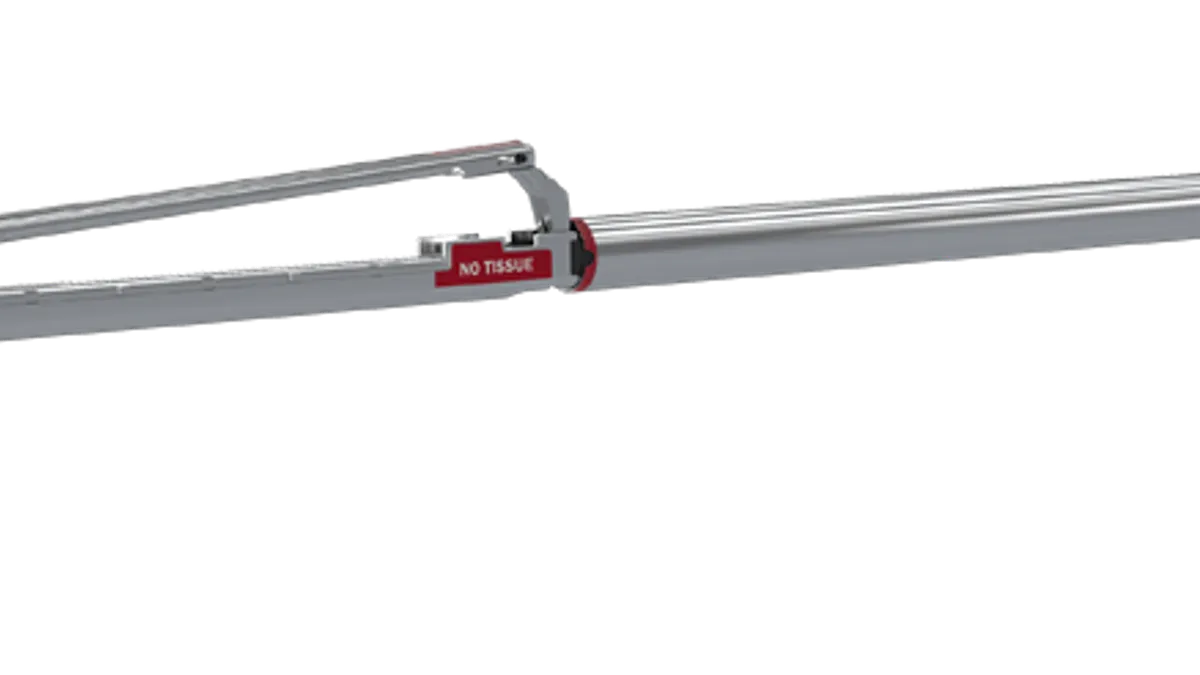

Standard Bariatrics, based in Cincinnati, produces products for the surgical treatment of obesity.

Teleflex, based in Wayne, Pennsylvania, had revenue of $2.4 billion last year. Shares of Teleflex fell 2.5% to $202.97 in morning trading Thursday on the New York Stock Exchange.

The announcement comes amid a slow year for medtech merger and acquisition activity. A report in June by consulting firm PwC found the value of medical device M&A fell 85% in the first half of this year, compared to a bumper 2021, as companies focused on integration and value capture activities. PWC said at the time that it expected activity to pick up in the second half of 2022.

By PwC’s count, medical device companies spent $76.4 billion across 93 deals last year. Acquisitions such as Baxter’s $10.5 billion takeover of Hillrom were among the biggest transactions struck across the life sciences sector. PwC said none of the takeovers in the top 10 life-science deals in the first half of 2022 met its medical device definition.

Abbott Laboratories, Johnson & Johnson and Medtronic are seeking M&A targets, PwC noted in the June report, while adding that a range of barriers that could stop acquisitions, including supply chain issues, scrutiny from the Federal Trade Commission and geopolitical concerns.

Growing regulatory scrutiny is another obstacle. Illumina may be forced to reverse its $7 billion acquisition of cancer testing startup Grail, completed in 2021, if the company loses a challenge from European regulators who say the deal stifles competition.