Dive Brief:

- Medtronic Diabetes is handing the reins to 15-year Medtronic veteran Sean Salmon, previously president of the coronary and structural heart business, the company said Monday. Hooman Hakami, who has led the unit for a little more than five years, will continue in an advisory role "on an as needed basis" through February, but is otherwise leaving Medtronic.

- In assuming leadership of the company's diabetes unit, the least lucrative of Medtronic's four core groups, Salmon takes on a growing market for automated insulin delivery systems but increasing competition for new users. Last quarter, Medtronic Diabetes had 3.5% overall growth but faced "more competitive pressure than we'd like in the U.S.," CEO Omar Ishrak told investors in August. Sales in the U.S., which account for about half of the unit's business, declined 5.6%, but grew 13.8% in developed international markets and 22.2% in emerging markets.

- Medtronic said in its announcement Monday it continues to expect the diabetes business will have low-single digit organic revenue growth during the current quarter. The company plans to report financial results from the second quarter of fiscal year 2020 on Nov. 19.

Dive Insight:

Since Hakami left GE Healthcare to take over Medtronic Diabetes in 2014, the company has seen competition accelerate on both the glucose monitoring and insulin delivery sides of diabetes tech.

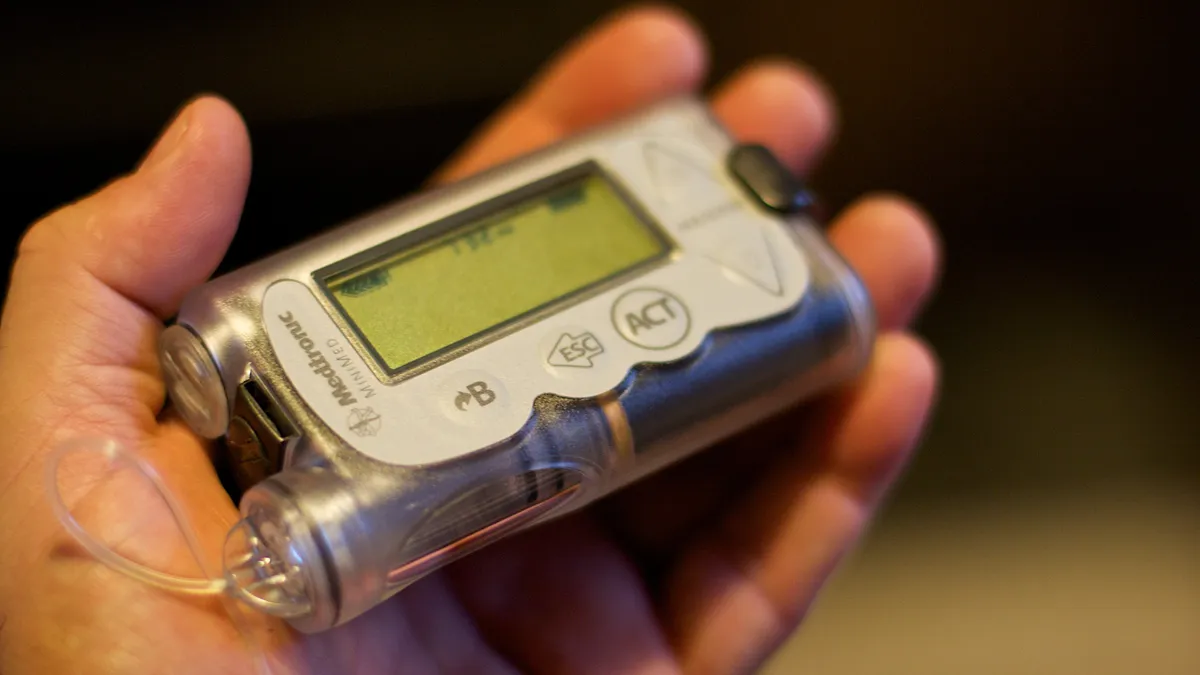

Hakami oversaw the 2016 FDA approval of Medtronic's MiniMed 670G as the first automated insulin delivery system authorized for use in people with Type 1 diabetes; about 200,000 people worldwide use the system today, the company said in August.

But his tenure also saw continuous glucose monitor devices like Dexcom's G6 and Abbott's FreeStyle Libre grow in popularity as insulin pump offerings like Tandem Diabetes's t:slim X2 and Insulet's Omnipod also posted big gains. Current and future integrations between these CGM and insulin pump makers allow individuals seeking automated insulin therapy options beyond Medtronic.

Combined CGM and pump sales for Medtronic last quarter totaled $592 million while Dexcom and Abbott reached about $336 million and $496 million, respectively, on CGM sales alone in their most recently reported earnings. Tandem's quarterly pump sales recently hit $93.3 million, up 173% year over year, and Insulet's reached $177.1 million, up 43%.

Increasing market competition prompted at least one major medtech, Johnson & Johnson, to exit the diabetes business entirely. J&J completed the $2.1 billion sale of its blood glucose monitoring business to a private equity firm a year ago.

Medtronic in its announcement Monday credited Salmon with leading expansion of its transcatheter aortic valve replacement business including "commercializing multiple product innovations, extending global penetration [and] expanding treatment indications." He also has prior experience at C.R. Bard and Johnson & Johnson.

At the American Diabetes Association's annual meeting in June, Medtronic signaled a move to adopt the sector's move toward interoperability with the announcement it will work with Tidepool to create an alternate controller enabled, or ACE, version of its MiniMed pump compatible with the future Tidepool Loop app.

Medtronic has also aimed to increase adoption of its CGMs among patients using insulin pens, announcing an agreement in September with Novo Nordisk to link Medtronic CGMs with future versions of the Danish pharma's connected insulin pens.