Dive Brief:

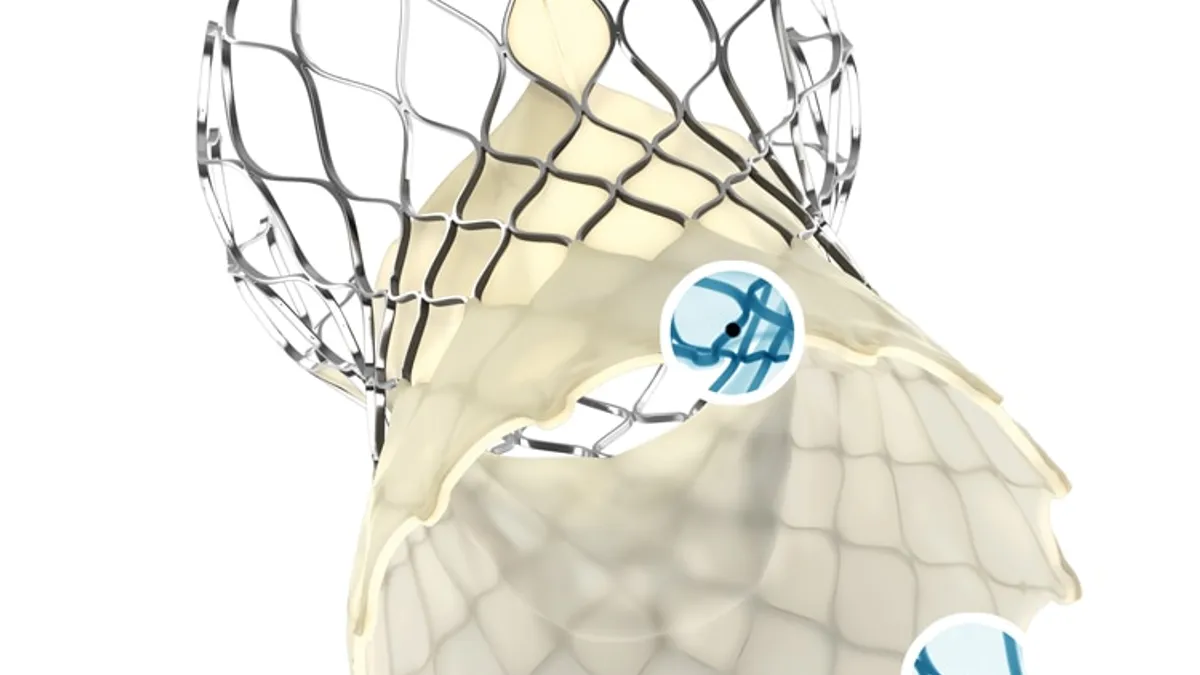

- The recovery of structural heart procedures such as transcatheter aortic valve replacement (TAVR) will continue to lag the broader medtech industry next year, according to analysts at Goldman Sachs. Edwards Lifesciences competes with Medtronic for the TAVR market.

- Lower-than-expected TAVR procedures this year are the result of hospital staffing shortages and a historically high mortality rate among seniors since the pandemic began.

- Other medtech markets will rebound faster, especially neuromodulation devices and orthopedics, the analysts said.

Dive Insight:

The analysts have identified two factors constraining U.S. medtech growth: hospital staffing and excess deaths. While the Goldman Sachs analysts expect hospital staffing to improve throughout next year, excess mortality is forecast to continue constraint growth in 2023.

Using data from the Centers for Disease Control and Prevention, the analysts calculated that around 686,000 excess deaths have occurred in people aged 65 years and older since 2020. Deaths continue to track above historical trends.

“Excess deaths in the elderly have been concentrated in populations with comorbidities, and therefore these patients would have been disproportionate healthcare utilizers if COVID had not occurred. In retrospect, it seems like this issue particularly relates to markets like TAVR, mitral repair and ischemic stroke, where slowing growth was perhaps most visible during the COVID era,” the analysts wrote.

The average age of TAVR patients is 79 years, and around two-thirds of intermediate and higher-risk patients have comorbidities, suggesting candidates for the procedure are among the excess deaths seen in recent years. As such, the analysts think excess deaths are a factor in the slow TAVR recovery and expect “some impact continuing into 2023 before potentially establishing a new baseline by 2024.”

The analysts were more upbeat on other medtech markets. They expect “some recovery” in neuromodulation. In orthopedics, the analysts expect “continued improvement in 2023, with some potential for strong upside if backlogged patients return or hospital staffing improves. The analysts say some firms will benefit as the number of procedures rises, and they called out two firms: Zimmer Biomet, which they expect to “do better,” and Stryker, whose shares they expect to “stabilize.”