Smith & Nephew, Stryker and Zimmer Biomet have rounded out the current earnings season with third-quarter results, revealing how the orthopaedics industry remains constrained by COVID-19, hospital staffing shortages and lower pricing in China.

Analysts expected orthopaedic companies to fall short of prior revenue forecasts, having heard intra-quarter commentary about the impact of the U.S. delta wave and other forces. Even so, the results managed to throw up some surprises, such as Stryker's orthopaedic and spine sales falling short of Evercore ISI expectations but being offset by MedSurg growth, and provide an outlook for the fourth quarter that disappointed some observers.

None are forecasting a strong rebound in the fourth quarter. Having reported a 5.9% underlying drop in third-quarter orthopaedic sales, Smith & Nephew forecast a deceleration of its overall business in the fourth quarter, reflecting fewer selling days than in the comparable period of last year. Smith & Nephew expects to hit the bottom end of its 10% to 13% full-year sales growth guidance, pointing to a sharp slowdown after nine months in which the business grew 14%.

Zimmer and Stryker also downplayed the prospects of a rapid recovery in the fourth quarter. Stryker expects fourth quarter growth of its more deferrable businesses to be similar to the delta-hit third quarter. Zimmer cut the midpoint of its full-year sales guidance by 23%, reflecting the impact of a weak third quarter and the assumption that the headwinds will persist.

"Until we see a fundamental shift in these trends, we're just going to assume that these pressure points aren't going away, but will be with us into Q4 and possibly into early 2022," Zimmer CEO Bryan Hanson told investors on the third-quarter results conference call.

Here, we look at the pressure points affecting Zimmer and its peers.

COVID-19 and hospital staffing

The coronavirus pandemic remains a significant headwind. For Zimmer, September was "our least attractive month relative to growth," Hanson said. U.S. COVID-19 cases have fallen since mid-September but Zimmer has decided to assume that the pressure it saw that month will continue through the end of the year. "We haven't seen anything in October that would indicate that this logic we're using is incorrect," Hanson said.

Smith & Nephew and Stryker gave somewhat more upbeat appraisals of the situation, with the former noting improvements as it exited the third quarter and the latter assuming that the volume of deferrable procedures will return to "more normal levels" by the end of the year. The positions reflect the anticipated continuation of hospital staffing pressures even if the direct impact of the pandemic eases.

"In terms of staffing shortages, it certainly is playing itself out more so in the hospital setting because, obviously, there's a lot more fatigue that's been there, there's COVID that still exists in the hospital setting. The staffing shortage is something that I think we're going to live with for a little bit as well. And so we'll continue to work through those challenges in the next year also," Preston Wells, vice president of investor relations at Stryker, said on a conference call with investors.

It is possible the situation will improve faster than expected. Analysts at Stifel said they "sense that Zimmer is 'throwing-in-the-towel' on predicting the slope of a post-COVID elective procedure growth trajectory, thus, numbers may yet prove conservative." But the companies will face headwinds even if the COVID-19 and hospital staffing situations improve.

Supply constraints

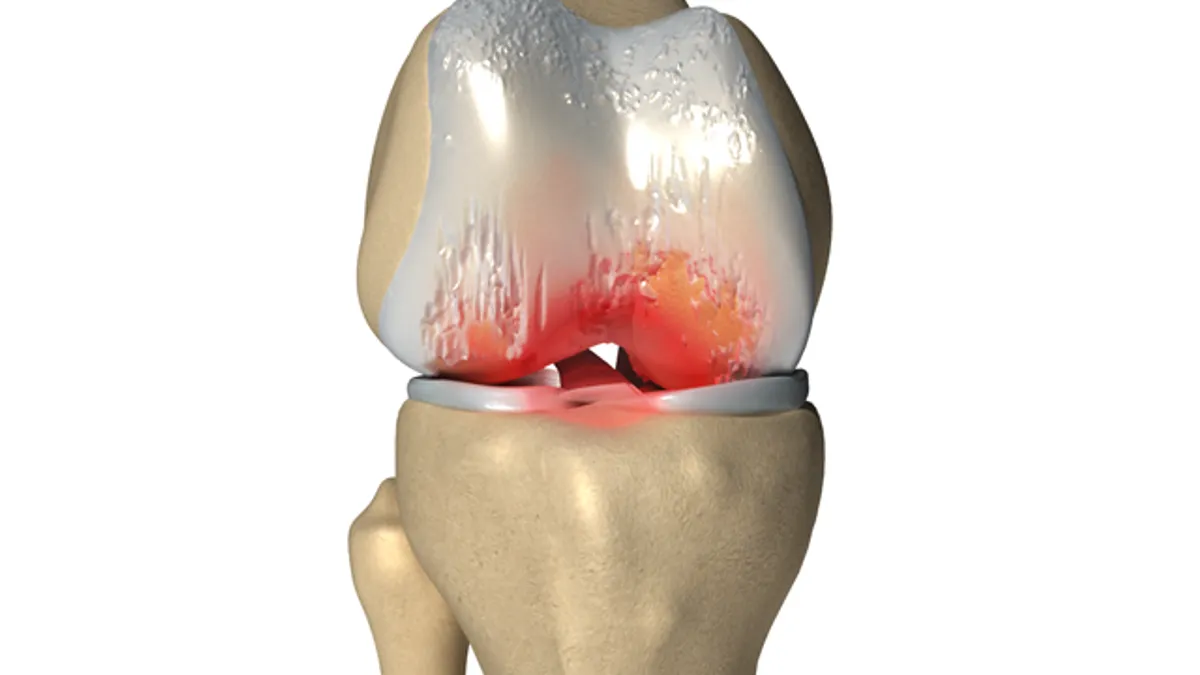

Management teams at the orthopaedic companies reported some impact from the supply chain. Smith & Nephew has ongoing specific problems, which it disclosed over the summer and is working through while contending with shortages of resin, silicon and electronic components. Zimmer noted supply constraints "that will put a little bit of a damper" on the rollout of a knee replacement surgery system that has an extension sensor technology.

Stryker's Wells also reported "shortages in things like electronics or resins" but said the company has been able to effectively meet all of its customer needs so far. The situation is expected to continue and, while for Stryker at least it is yet to have a big impact on financial results, the industry is looking to insulate itself from the effects.

"We're also looking to seek a priority for medical applications and medical products as an industry and as an individual company for raw materials shortages to be actually then prioritized to the medical device industry," Smith & Nephew CEO Roland Diggelmann said.

Pricing in China

The orthopaedics sector faces an additional headwind in addition to the macro pressures faced by the broader medtech industry. Value-based tendering in China is set to lower the prices of some devices. The lower prices are yet to take effect but are already affecting the orthopaedic industry.

"Patients are beginning to defer their procedures until the implementation so they can secure a lower out of pocket," Suky Upadhyay, CFO at Zimmer, said. The upshot is the impact of the new prices hit Zimmer earlier than expected. China is an important market for Zimmer, with Hanson claiming its Asia-Pacific knee business is bigger than its three main competitors' ex-U.S. units. "That gives you some sense for our market share inside of Asia-Pacific and inside of China," Hanson said.

Stryker is less exposed. Products accounting for less than 1% of its total revenues are affected by the Chinese tenders. Even so, with Wells saying an "about 80% price reduction from the end market sale is going to be taking place across the entire industry," Stryker is monitoring the situation and will factor it into the guidance it provides in the fourth quarter.

Smith & Nephew flagged the impact of the tender earlier in the year and said the effect continued in the third quarter. "The inventories have been reduced. We think that for now, this has been to the tune of about $20 million to $30 million for us," Diggelmann said.

Despite all the headwinds, analysts are still broadly positive about the orthopaedic sector. Analysts covering Stryker and Zimmer said the near-term choppiness distracts from longer-term potential, leading to buy and outperform ratings from groups including SVB Leerink and Truist Securities.