Amid progress by robotic surgery companies in ramping up system placements and procedures, orthopaedic market leaders like Stryker and Zimmer Biomet say better utilizing patient data is the next step.

Patient data has piled up amid volume taking off over the past several years. The information collected before and after operations, as well as information collected by the robots during surgery, has become increasingly valuable as companies look to improve patient outcomes and fine-tune their systems.

"The big future potential is on the data analytics," Robert Cohen, president of digital, robotics and enabling technologies for Stryker, said. "We're going big on data science and data analytics."

Stryker has become a leader in the orthopaedic robotic market with its Mako system, which can be used for total and partial knee replacements and total hip replacements.

Cohen said that surgeons using Mako can learn from past procedures by looking at metrics like the accuracy of implant positioning. Data of past procedures can also help identify which implants may work better for a specific patient.

Benjamin Domb, founder and medical director of the American Hip Institute, a clinic specializing in hip treatments and surgeries, said that having access to this patient-specific information has improved the quality of robotic procedures.

Domb, who was part of the development team for Stryker's Mako hip platform, said that surgeons can use the robot to look at position of the implants or how a patients' anatomy will impact the placement. For example, he said that surgeons using the robot can look at how much pelvic position moves for an individual patient in a sitting position versus standing, which can help make more accurate placement of an artificial hip and improve the stability of the implant.

Rival Zimmer Biomet has made a similar strategic shift to prioritize data and analytics.

Zimmer CEO Bryan Hanson said during a recent analyst event that after spending "a very small amount of money" on robotics and data informatics, more than 70% of the company's innovation money is invested in these areas.

An example of the company's strategic shift is a recent partnership with Apple.

Liane Teplitsky, Zimmer's worldwide vice president and general manager of technology and data solutions, said the company is working with Apple to collect post-operative data with an application called mymobility. Through the Apple Watch, information like patient step counts or how often they climb stairs are tracked and compared with biometrics like heart rate and breathing frequency.

The data can be transmitted to physicians to analyze a patient's performance after surgery. Patients can also input information like pain levels into the app.

Zimmer released data in November of patients who used the app after receiving total or partial knee procedures. The company has an ongoing clinical trial for patients who receive total or partial knee replacements and total hip replacements. Preliminary results showed a drop in physical therapy visits.

The company hopes that coupling this data with the hundreds of elements collected with Zimmer's Rosa robot can improve outcomes and also lower the cost of care by providing deeper insight into a patients' experience before, during and after an operation, according to Teplitsky.

The emphasis on data is coming as companies' robotics systems further take over traditional surgeries.

Cohen said that over 50% of Stryker's total global total knee procedures can ultimately be done using Mako as opposed to traditional knee procedures. While Zimmer is further behind, the company has seen quick adoption of the Rosa system.

Wall Street analysts believe that how companies use data going forward will be crucial as competition in the orthopaedic robotics market heats up.

SVB Leerink analysts wrote in a November report that how companies differentiate themselves from the competition will not be solely reliant on their individual robotic consoles but will "come down to who best collects/uses data to inform robotic techniques."

Smart implants & predictive analytics

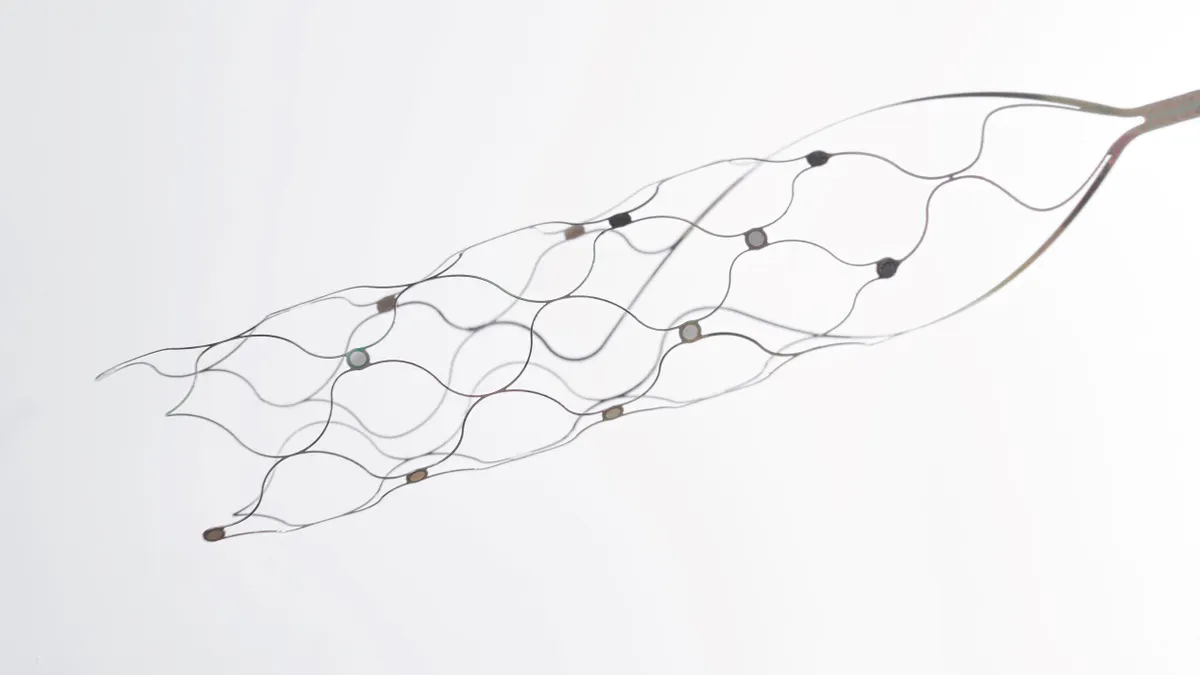

As companies further prioritize the utilization of patient data, they are also looking at new ways to collect information. This has fueled competition in developing or acquiring smart implants, artificial joints that can collect data on implant performance and remotely transmit the information.

Zimmer partnered with medical device company Canary Medical to develop a smart knee implant, which they plan to launch in 2021. The implant will measure a patient's gait and also information like the range of motion, Zimmer's Teplitsky said.

The implants will also give insight over a much longer time than traditional post-operative analysis.

"We've seen in other areas of healthcare and medical technologies that once you get into regular remote monitoring — and really having a better understanding — there really are just so many insights that become uncovered for overall improvement to patient's health," Teplitsky said.

While Zimmer has partnered with Canary Medical, Stryker bought up Canary Medical's competitor OrthoSensor in January for an undisclosed amount. OrthoSensor makes orthopaedic implants and previously partnered with Stryker competitors Zimmer and Smith & Nephew.

Stryker's Cohen said that the acquisition now allows the company to use the smart implant data with what is already being collected in Mako procedures.

Both execs said that the next stage of using data will be in predicting patient care or even outcomes of surgery.

For example, Stryker plans to use an algorithm to analyze past patient data so the information can be compared to patients for future surgeries. Cohen said the analysis can help determine whether a patient is better suited for an inpatient or outpatient setting, the amount of physical therapy a patient may need or how long after a surgery a patient can walk.

The algorithms will be embedded into software for future robotic systems updates, according to Cohen.

Predicting outcomes on a smaller level will be happening in the next several years with the help of patient information that has already been gathered, according to Teplitsky.

"What we can predict, and how we can predict it, and to what level of accuracy we can predict, time will tell on the algorithms that we create," Teplitsky said. "But AI is here to stay."