Q4 Trends:

Stryker CEO Kevin Lobo said he expects “positive trends” in procedure recovery and demand for capital products in 2023, and a more gradual improvement in component availability. The company is taking action to address higher costs of materials and labor, including pricing adjustments and “targeted restructuring plans.”

“We will remain disciplined with our spend and will continue to invest in innovation, including potential tuck-in M&A,” Lobo said in an investor call on Tuesday.

For the full year, Stryker estimates organic sales growth will increase by 7% to 8%, and predicts net earnings per diluted share of $9.85 to $10.15.

“We believe that there will continue to be macroeconomic volatility, including supply chain constraints, recession and inflationary risks, and currency fluctuations,” CFO Glenn Boehnlein said.

“Despite this environment, we have positive momentum in many parts of our business heading into 2023, including continued procedural recovery, many new product introductions and a very robust order book for our capital products,” he added.

Record revenue:

“During my 10-plus years in this role these were record quarterly and annual growth rates,” Lobo said of Stryker’s revenue.

That growth was balanced across sales of its implants, disposables and capital equipment. Stryker’s medical division, which includes its emergency care and acute businesses, had “outsized” revenue growth that Lobo attributed to working through a backlog of orders.

Growth in international sales also exceeded the U.S. for the fifth year. “International growth remains a significant opportunity in the years ahead and should continue to complement our strong U.S. business,” said Lobo.

Mako update:

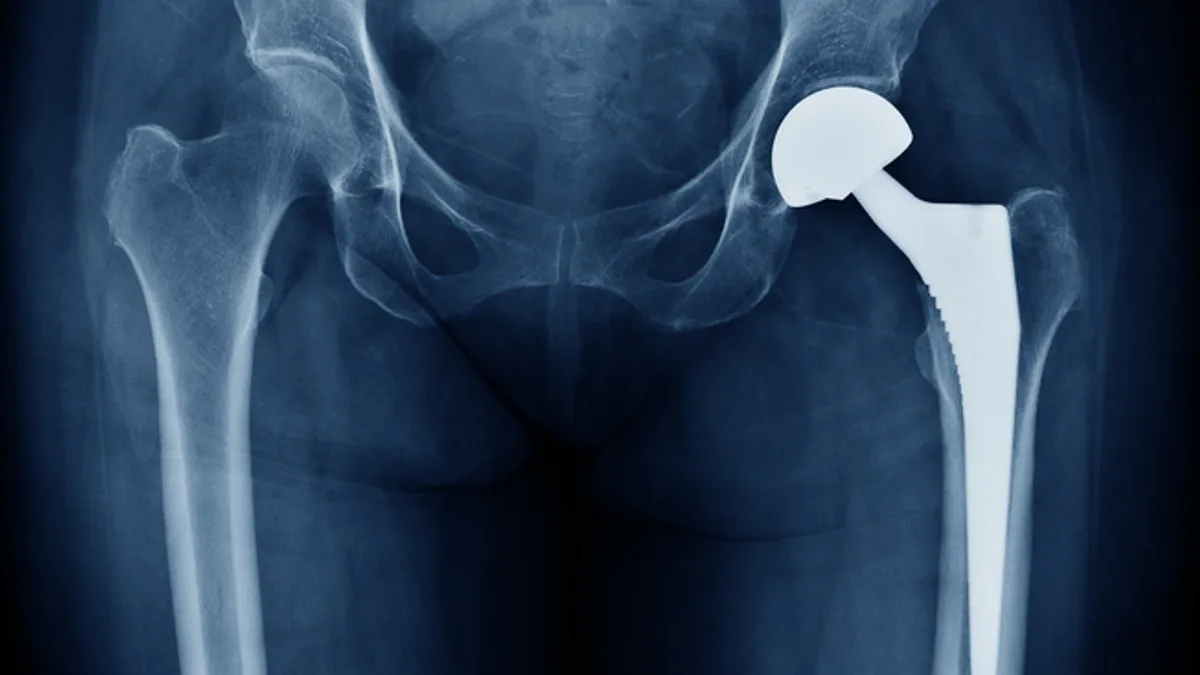

Installations of Stryker’s Mako surgical robotic arm, which is used for knee and hip surgeries, also hit a record in the fourth quarter. Jason Beach, the vice president of investor relations, said Stryker is “agnostic” to the form Mako installations take as more hospitals shift to financing the systems, rather than purchasing them outright.

Stryker also hopes to expand indications for the Mako robot to spine and shoulder surgeries, with an expected launch for spine in the second half of 2024, and an expected launch for shoulder at the end of 2024.

Hospitals would be able to add that functionality with a new attachment and a software upgrade, which BTIG analyst Ryan Zimmerman wrote “will be a major advantage for [Stryker] given the large existing install base of Mako systems today.”

In the fourth quarter, roughly 55% of procedures to implant Stryker knee replacements and 30% of hip joint procedures used the Mako robot, and cementless knee procedures continue to drive use, Lobo said.