Dive Brief:

-

Soaring second quarter demand for sports medicine joint repair products in the U.S. enabled Smith & Nephew to raise its revenue outlook for the year.

-

The double-digit growth in some franchises and geographies was offset by continuously declining sales in established markets ouside the U.S. and falling revenues from arthroscopic enabling technologies.

-

Smith & Nephew bumped the upper and lower ends of its target range up slightly to 3% to 4% on the tail of a mid-teens rise in U.S. sales of shoulder repair devices powered performance.

Dive Insight:

Smith & Nephew began 2019 on a high note, certainly compared to its difficult end to the prior year, and continued that momentum into the second quarter. Sales rose 3.5% on an underlying basis. As reported, growth came in slightly below that level at 3.1%, with the positive effect of acquisitions only partially offsetting unfavorable foreign currency exchange.

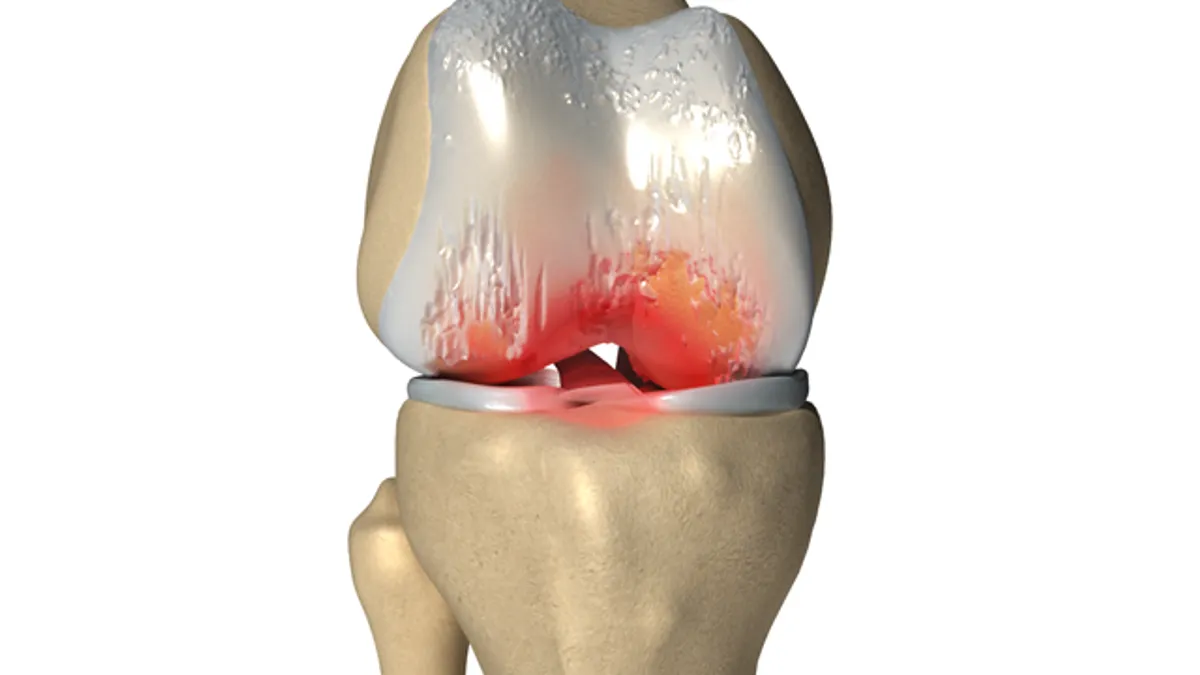

The company-wide growth masks divergent performance at different units within Smith & Nephew. Sports medicine and ENT was the star of the second quarter, achieving 2.8% and 5.6% growth on a reported and underlying basis, respectively.

The company achieved the growth despite continuing weakness at sports medicine’s arthroscopic enabling technologies subunit. Sales fell 2.1% on an underlying basis. Smith & Nephew CEO Namal Nawana attributed the decline to strong performance a year ago resulting in a tough comparison, rather than an underlying problem at the business.

“The [arthroscopic enabling technologies] business remains very much on track to return to growth in the second half,” Nawana said on a conference call with investors.

Falling arthroscopic enabling technology revenues were more than offset by a 11.9% jump in sports medicine joint repair sales. U.S. growth in the mid-teens underpinned the accelerating growth.

All of Smith & Nephew’s orthopaedic subunits posted low to mid single digit growth on an underlying basis and were close to flat on a reported basis. The advanced wound care management business delivered more dramatic results. Advanced wound care sales fell on a reported and underlying basis but growth at the device subunit ensured revenue at the overall business increased.

Revenue at the wound care bioactive subunit fell 1.2% on an underlying basis, continuing its streak of flat to down quarters. However, the completion of the Osiris Therapeutics acquisition in April meant bioactive sales jumped 31% on a reported basis. Smith & Nephew is looking to Osiris to drive growth at the bioactive subunit.

The company-wide growth seen in the second quarter came from the U.S., where underlying sales were up 2.3%, and emerging markets. Sales in China rose more than 30%, resulting in revenue from emerging markets coming in up 16.2%. Sales in Europe and other established markets outside the U.S. fell, a trend Nawana attributed to the fact that those regions were “particularly affected by the one or more fewer trading days."