FDA's fall meeting lineup includes a roster that could impact a broad swath of the medtech industry, with sessions on evidence for spinal devices, how recalls are communicated, the safety of endovascular stents and artificial intelligence technology.

Like last year, FDA is holding the events virtually in light of the COVID-19 pandemic.

Spinal devices. The season gets underway on Sept. 17 with a public workshop on FDA's approach to the clinical review of spinal devices. FDA is holding the workshop to discuss the major elements it assesses in its reviews of submissions to bring spinal devices to market.

FDA is yet to disclose who will be giving presentations though the agenda includes presentations from regulators, industry and other stakeholders. Sessions include those on the "Limits of Non-Clinical Performance Testing of Spinal Devices" and "Evaluation of Safety for Spinal Devices: Adverse Events and Evaluation of Subsequent Surgical Procedures."

FDA has issued broad documents on some of the topics in recent years, but its guidance documents specific to spinal devices date back to 2008 and earlier.

Last year, FDA wrote to healthcare providers, outlining hundreds of reports of deaths and tens of thousands of injuries and malfunctions with spinal cord stimulators, reminding physicians to follow product labels calling for a simulation in patients prior to permanently implanting the SCS devices.

That warning came after a report from Public Citizen called for FDA to tighten how it regulates the devices, including requiring original PMA submissions for all new models and reassessing whether any approved devices should be removed from the market. Device Events has also highlighted dangers with spinal cord stimulators.

Abbott Laboratories, Boston Scientific, Medtronic and Nevro are among those that sell SCS devices.

Recall notices. On Oct. 6, FDA is set to convene its Patient Engagement Advisory Committee to discuss medical device recalls. FDA is gathering patient engagement experts to glean recommendations into how it and the medical device industry can effectively communicate information about recalls to patients and the public. The agency wants recommendations about the content, format, timing and medium of recall communications.

FDA also plans to ask the experts about the concerns patients have when they learn about changes to their devices in response to a recall, and how they approach decisions about recalled products in collaboration with their healthcare providers. The discussion is part of an effort to consider how FDA and industry can incorporate the views of patients into benefit-risk decisions.

The agenda singles out implanted devices as a topic of focus for the meeting. Implants carry specific safety concerns given the time they spend in the body and have been the focus of many of the most high-profile safety concerns of recent years, such as actions involving Allergan's breast implants and mesh products. Implants are frequently the targets of Class I recalls, with Boston Scientific, Cardinal Health's Cordis and Medtronic among the companies subject to the FDA notifications this year alone.

Among the most high-profile recalls this year include a series of recalls for Medtronic's Heart Ventricular Assist Device pump system, which eventually resulted in the medtech giant discontinuing the system entirely. One of the most far-reaching recalls involved up to 4 million of Philips' ventilator and sleep apnea devices, raising questions about how the public finds out about such actions.

AI and transparency. FDA's public workshop on Oct. 14 grew out of the artificial intelligence and machine learning action plan it published at the start of the year. In the plan, FDA revealed stakeholders had called for more discussion with the agency about "how AI/ML-based technologies interact with people, including their transparency to users and to patients more broadly." FDA vowed to meet the request by holding a meeting into how device labeling supports transparency and trust.

The agency has set two goals for the workshop. Firstly, FDA wants to "identify unique considerations in achieving transparency for users of AI/ML-enabled medical devices and ways in which transparency might enhance the safety and effectiveness of these devices." Secondly, FDA is looking to gather feedback on the types of information to include in the labeling and other materials linked to AI/ML-enabled devices.

In the action plan, FDA said it would use the input to inform recommendations to manufacturers about what information they should share to support user transparency. The recommendations could help mitigate transparency challenges created by the inherent opaqueness of algorithms and their ongoing evolution in response to new data.

Integra's breast reconstruction device. The General and Plastic Surgery Devices Panel of the Medical Devices Advisory Committee is set to meet on Oct. 20 to discuss Integra LifeSciences' premarket approval application for the SurgiMend PRS Acellular Bovine Dermal Matrix. Integra is seeking approval for the device for use as soft tissue support in post-mastectomy breast reconstruction.

The device is part of a range of native, non-denatured collagen products Integra sells in flat sheets for use in plastic and reconstructive surgery, muscle flap reinforcement and hernia repair. In July, Integra highlighted the SurgiMend range as a driver of the mid-single-digit growth at its wound reconstruction business.

Integra is seeking approval amid safety concerns in the wider market. In March, FDA issued a safety communication about complication rates of cellular dermal matrix products used in implant-based breast reconstruction. SurgiMend was one of two brands that FDA linked to a lower rate of major complications. Integra responded with a statement about the approved indications for SurgiMend.

Seeking approval in the specific indication of breast reconstruction is part of Integra's strategy for strengthening its position in fast-growing parts of the soft tissue reconstruction market over the next few years. Integra expects the total opportunity to grow from $500 million in 2020 to $900 million in 2025.

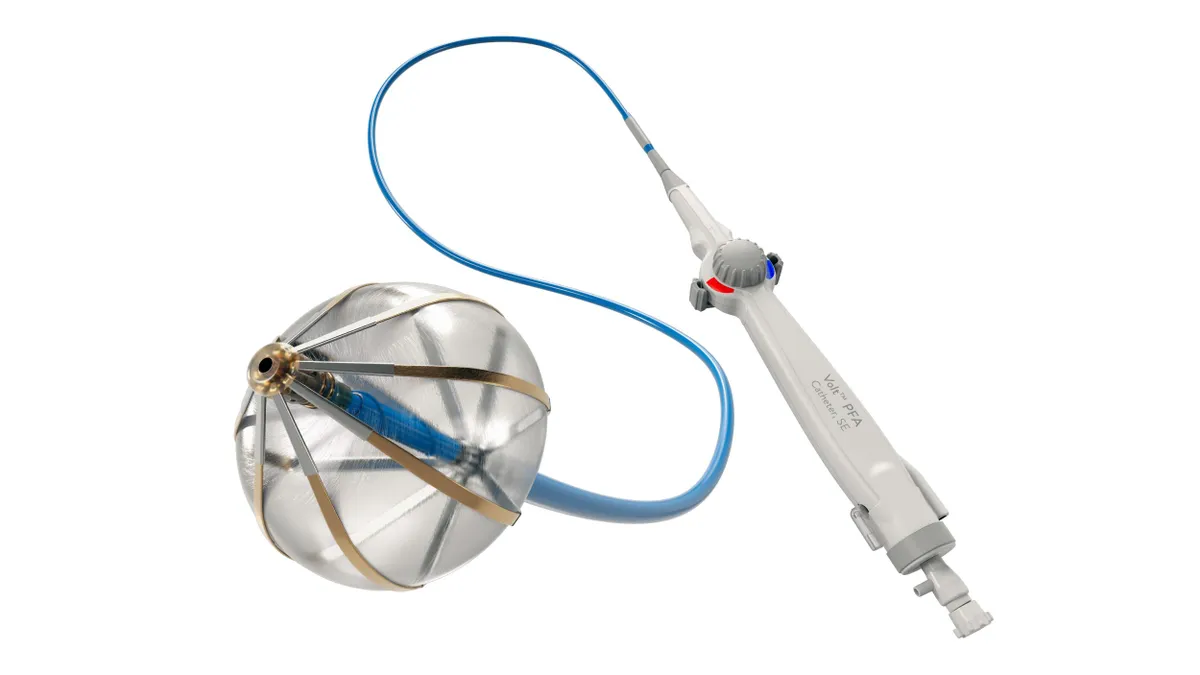

Endologix's endovascular graft system. FDA is set to gather the Circulatory System Devices Panel on Nov. 2 and 3 to discuss the benefit-risk profile of the Endologix AFX endovascular graft system. The meeting follows a series of notices about the risk of blood leaking into the aneurysm, an event known as a Type III endoleak. Late in 2019, FDA issued a safety communication about real-world data on the risk of Type III endoleaks.

The panel, which FDA disclosed earlier this year, will evaluate data on the medical devices and make recommendations on the risk-benefit profile of Endologix AFX and how to strengthen the collection of real-world data on long-term performance.

The panel of outside experts is also expected to make recommendations on postmarket surveillance strategies for all endovascular grafts used to treat AAA. Other companies that sell endovascular AAA graft products include Medtronic, Cook Medical, Gore and Terumo.