Dive Brief:

- Regenerative medicine startup Sernova has hit back against “misleading statements” by activist investors who are trying to secure seats on its board.

- The investors accused Sernova’s board of “complacently” overseeing “a period of eroding shareholder value” in which the company’s R&D programs have made “sluggish progress.”

- Sernova defended its record, putting its share price performance in the context of a tough time for biotech stocks, and accused the investors of making claims that are “simply untrue.”

Dive Insight:

While famed investor Carl Icahn is waging a proxy battle against DNA-sequencing firm Illumina, with a market capitalization of $33 billion, a group of investors is waging their own battle for seats on the board of a tiny Canadian biotech firm, Sernova, whose market cap is only $200 million and which has yet to produce any revenue. In both cases, the investors feel the board is being too complacent and allowing management to dilute the value of the company.

Sernova. based in London, Ontario, is developing an implantable medical device for housing therapeutic cells. By putting cells inside the organ-like vascularized device, the startup aims to support the cells’ long-term survival and functioning and protect them from the immune system. In the context of diabetes, the device could provide patients with their own insulin-producing islets to reduce or eliminate their dependence on injections or pumps.

The company has struggled to ignite investor enthusiasm over the past year, in which time its share price has fallen by 44%. The stock closed down 6% on Thursday to finish at 66 Canadian cents (about 49 U.S. cents). The stock price erosion has spurred the group of activist investors to seek to change the course of the company.

Last month, investors who owned 12% of Sernova revealed plans to nominate two directors to the board of the biotech. The situation escalated on Monday, when a “concerned shareholder group” accused the board of a “general lack of transparency and responsiveness to shareholders' concerns.”

According to the group, the board “rebuffed or simply ignored” their attempt to add new voices through “an amicable and cooperative agreement.” The shareholders’ desire for change reflects a belief the company has made sluggish progress outside of diabetes.

“This includes the lack of advancement of thyroid trial or progress that had been promised for over three years. Despite numerous catalysts, Management has failed to create positive momentum. It has failed to build on the Corporation's successful results in January 2021 and it has failed to execute a coherent business plan,” the shareholders said in a statement.

Sernova responded on Thursday with a statement that disputed some of the claims and defended its record. While the investors focused on the share price decline since May 2022, Sernova noted that the stock has outperformed the Nasdaq biotech index so far this year. Sernova plans to release interim diabetes data later this year and start a clinical trial in hypothyroid disease in 2024.

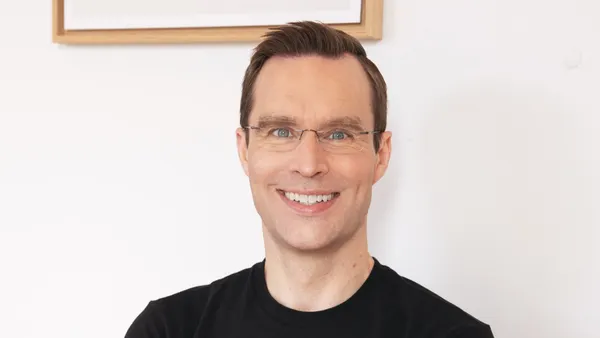

In December, Sernova said CEO Philip Toleikis will become the firm’s chief technology officer after the company secures a new chief executive.

The dueling statements are precursors to a shareholder vote on nominations to the board of directors. Sernova is encouraging shareholders to vote for its slate of directors, while the activist investors want to get two of their people on the board. The company’s annual meeting has not yet been scheduled.