ResMed has been given a unique opportunity to grow its share of the sleep apnea and respiratory device market as the company’s biggest competitor, Philips, is shut out of the space because of a recall.

Philips’ recall of sleep apnea and ventilator devices has grown to more than 5.5 million machines over the last 15 months, creating a surge in demand that ResMed has rushed to fill. Still, supply chain challenges have limited ResMed’s ability to meet that demand.

CEO Mick Farrell says that an improving supply chain and a redesigned AirSense 10 machine, which doesn’t require cellular communication chips that have been in shortage, will help the company address the 12-month backlog and sell every device it builds.

“We’re going to have sequential growth throughout the whole year,” Farrell said. “We’re not going to quantify it because we’ve lapped the recall stuff. So, basically, it’s just a market now.”

While ResMed originally forecast a revenue range of $300 million to $350 million from the recall, the company brought in about $230 million to $250 million for its full fiscal year 2022.

ResMed still may have some time to grow without Philips re-entering the market. Philips said in July it’s in negotiations on a consent decree with the U.S. Department of Justice, casting more uncertainty on the company’s recovery.

Farrell spoke about meeting the demand in the space, prioritizing patients with severe diseases as production ramps up, and the need to focus on the medical device industry as semiconductor chip availability increases.

This interview has been edited and condensed for clarity.

MEDTECH DIVE: Can you talk about how the second half of 2022 — the beginning of your fiscal year 2023 — will go in regard to meeting the patient backlog that’s built up since the Philips recall?

MICK FARRELL: I don’t really think about our competitor anymore. They’re just out of the market. They’ve been out of the market for 12 months, and they’re going to be at least another six, nine, probably 12 more months before they’re truly back. So, I don’t really think about them.

What I do think about are the patients. There are a billion people worldwide who suffocate from sleep apnea. They’re going through a screening or diagnostic process, a therapy prescription process with a doctor that can take weeks and months, and then they get a prescription. Now, due to the recall and supply chain problems, they can’t get therapy. So, our laser focus is on the supply chain and getting all the supplies that ResMed can to not only be the number one player on the market, which we were before our competitor tripped over themselves, but to be the number one and the number two player in the market.

Every product we make we sell right now. We were winning share before our competitor left the market, but now it’s, make a product, sell a product. Every quarter, we’re going to get more components, more parts, and make more products.

There was about a $70 million to $120 million gap between forecasts for revenue coming from the recall and what was brought in for your last fiscal year. With the ongoing issues at Philips and an improving environment, will ResMed make that up?

If we had more parts, we would have been able to take care of more patients. And yes, we would have gotten more revenue. Look, it’s a semiconductor chip crisis, it’s a supply chain crisis. There have been issues like increased costs for air and sea freight. You’ve seen all the unprecedented things that have happened to the world. But we are starting to see a leveling out of those issues. We’re seeing air freight get a little more available and affordable, and sea freight is picking up again. Those backlogs at ports in Los Angeles, Europe and Asia are starting to come down somewhat.

We told investors on our earnings call that we’re confident in seeing incremental growth throughout our whole fiscal year 2023, which started in July. We’re going to get more parts, more pieces in the front end, and the product is going to be sold as soon as it leaves the production line. This will allow us to try and get patients’ wait times as short as possible.

One issue is that patients are waiting for long periods without a replacement device or maybe even a first device after diagnosis. What are average wait times right now, and when can ResMed get those back to normal?

Every country has different models. For example, our products are available without a prescription in Australia, Singapore and the U.K. But if you take the United States, where the market is driven by prescriptions, providers and home care providers … anecdotally, the wait times for patients went from what used to be just days to weeks and, in some cases, months. I think we’re starting to get back from that multiple months to, now, it should go back down towards weeks.

It’s not going to be the same for everybody. Wait times will vary depending on the patients. But the wait times got really bad with the COVID crisis, and then the competitor recall crisis — both of those trends are getting better.

As production improves and more devices are shipped, will patients be prioritized based on need?

We are going to allocate parts, pieces and products to the highest acuity patients with the toughest diseases first. That’s how we’ve done it in the past.

On your recent earnings call, you said the semiconductor shortage is improving a bit. How will this impact the medical device industry? And do you think devices will actually be prioritized over other products that may have more powerful industries and companies backing them?

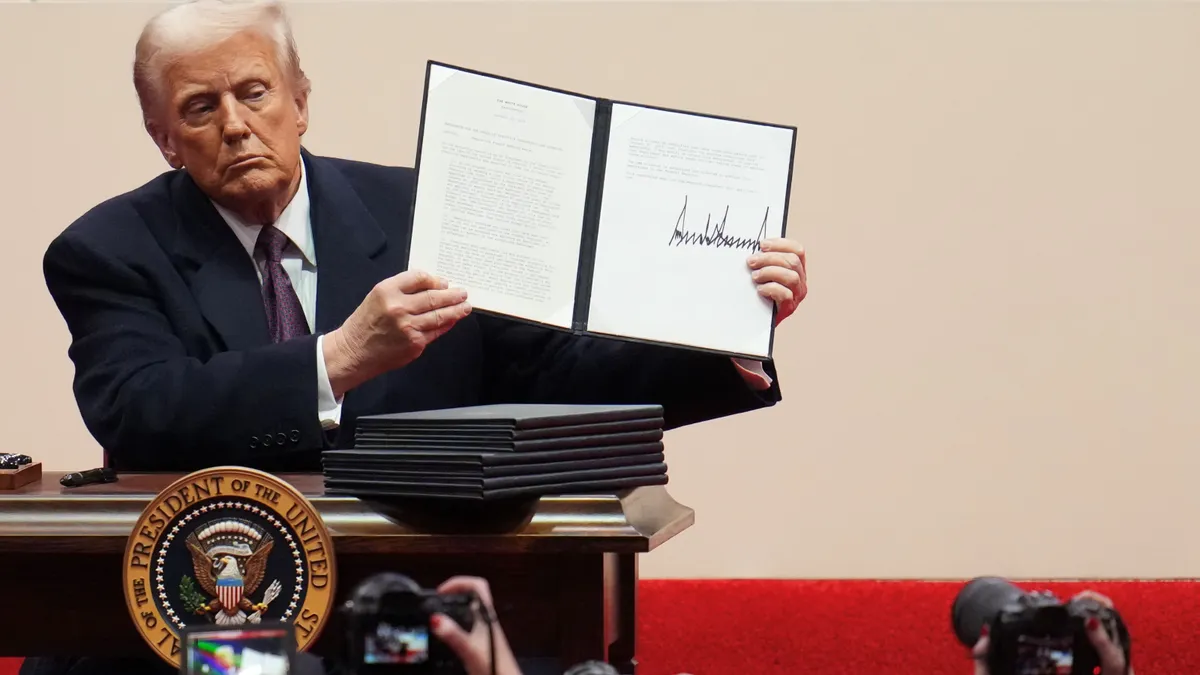

If the high demand from the phone companies and the automotive companies starts to go down, naturally, it’ll free up more capacity for us. I was in Brussels, and I spent some time with MedTech Europe working with the European Union about prioritizing the medical device sector. I also went to Washington, D.C., and spoke with Secretary Gina Raimondo at the Department of Commerce — I and five other CEOs talked about how the semiconductor crisis was impacting the device sector and patients who depend on life-sustaining therapies like a ventilator or even a CPAP machine.

She heard it, and she went on CNBC, she went on FOX and CNN and got the word out. Now, did the semiconductor companies listen to Washington and Brussels, or was the demand coming down? I don’t know. Maybe it was a combination of both of those.

The medtech industry makes up less than 1% of the total semiconductor sales, so it’s hard to get their attention. But we saw the environment improve a bit in June, and I think sequentially throughout the rest of this calendar year and into 2023, we're going to see much more parts and pieces become available.