Dive Brief:

- The leadership shakeup at Resmed could help the company meet and beat its growth targets by growing demand for its sleep apnea devices, according to William Blair analysts.

- CEO Mick Farrell and other Resmed executives spoke to the analysts last week in meetings that left the William Blair team “more positive on the company’s strategy and ability to grow above market growth on the top line.”

- The optimism is underpinned by a belief that Resmed, having increased its market share during the Philips recall, can continue to grow by mounting its first concerted effort to increase demand for its sleep apnea devices.

Dive Insight:

In the past, Resmed has invested little in initiatives to generate demand and stimulate the growth of the market. The company has run some local direct-to-consumer marketing initiatives, notably in parts of the world where it lacks reimbursement, but generally, it has relied on broader awareness of sleep apnea and patients independently seeking care to support market growth.

Resmed’s recent restructuring of its leadership team, which created heads of product, marketing and revenue, is part of a push to pay more attention to demand generation, as the William Blair analysts said in a note to investors.

“These efforts are in their early days, and we expect it to take some time to scale and prove its [return on investment], although we believe this shift toward driving market growth is one that should pay off, particularly as sleep health and awareness is increasing,” the analysts wrote. “As the market leader, Resmed should see a higher ROI in driving patients on therapy.”

The analysts see little opportunity for Resmed to grow by further increasing its market share. As such, the company’s potential to outpace current market growth, which the analysts estimate is mid-single digits on devices and high-single digits on masks, rests on its ability to stimulate demand. Resmed has a lot of headroom, with management suggesting market penetration is in the mid-teens today.

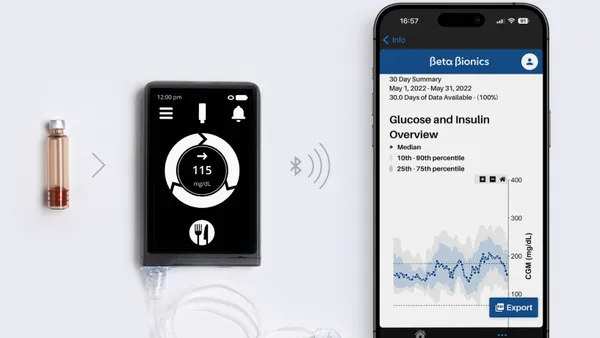

In addition to marketing, Resmed’s management is looking to new products to drive growth, with quieter and smaller devices as a priority. There is also scope for the diagnosis of sleep apnea to improve, both as big tech companies add sleep monitoring features to wearables and as Resmed works to increase use of its own home-testing device, Night Owl by Ectosense.

Fueling growth through demand generation and device development could help allay investor concerns about the future of the sleep apnea market. The William Blair analysts cited concerns about the impact of weight loss drugs on demand for sleep apnea devices as a driver of a 35% fall in Resmed’s share price from the highs it hit earlier this year.

Fewer people who are overweight or obese could mean fewer cases of sleep apnea, and Eli Lilly is running a late-phase trial to assess the effect of its GLP-1 receptor agonist tirzepatide on people with obstructive sleep apnea. Resmed is “indifferent to the results,” according to the analysts. Executives expect the study results to show a 50% to 60% drop in a measure of sleep apnea, but that will still leave many people with clinically meaningful disease, the analysts wrote.