A system designed to better investigate medical devices' performance once they're on the market is finally getting off the ground.

That real-world evidence (RWE) initiative has been formally in the works for about three years through the National Evaluation System for health Technology's coordinating center, better known as NESTcc.

A Duke-Margolis Center for Health Policy group laid out a structure for NEST in 2015 and an FDA grant to the Medical Device Innovation Consortium in 2016 brought the organization to life.

That FDA support has been NESTcc's mainstay as scrutiny of medical devices has increased amid a spate of high-profile safety issues tied to devices like surgical mesh and metal-on-metal hip implants. Currently, government funding is only set to run through 2022, meaning much of NESTcc's future depends on buy-in from industry.

Convincing device makers to get on board with the research hub falls partly on the shoulders of health economist and researcher Rachael Fleurence, who joined NEST's coordinating center as executive director in 2017. She previously helped develop the Patient-Centered Outcomes Research Institute's (PCORI) comparative effectiveness clinical research platform.

NESTcc recruited 12 initial "network collaborators" — including Mayo Clinic, New York City Clinical Data Research Network, and Anthem-owned data registry HealthCore — which, in total, reportedly represent more than 4,000 hospitals and outpatient clinics with access to nearly 500 million patients records, as well as public and private claims and registries.

Those institutions are tasked with diving into research queries pitched by medtechs, which in NESTcc's first round of eight test cases included device makers Abbott and Johnson & Johnson.

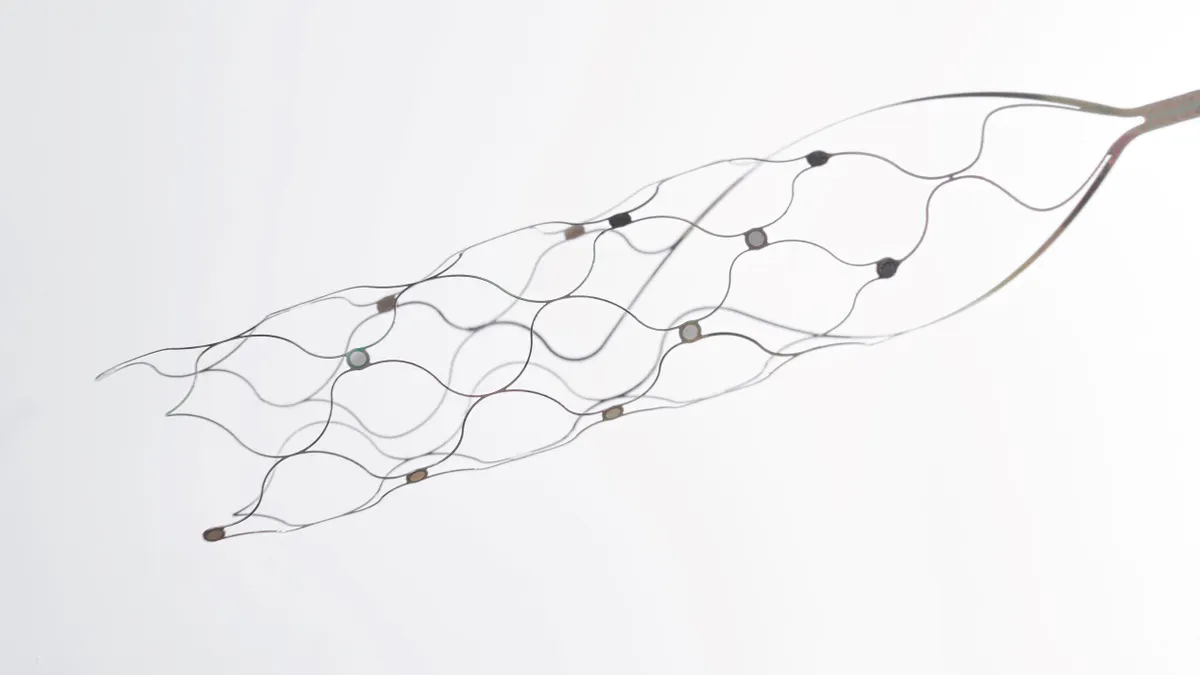

The inaugural round of projects are looking into devices like mechanical aortic heart valves and ablation catheters. They were developed with a variety of uses in mind for the RWE collected, ranging from supporting a premarket submission or label expansion to postmarket surveillance.

A second round of 12 cases (selected from 40 submissions) is likely to be announced in a matter of weeks, this time featuring at least one case proposed by a patient group and one submitted by FDA.

"I think we're still in the building space, but there's a lot of trepidation for us to deliver on the safety side, and a lot of trepidation for us to pivot into being able to do business with medical device companies," Fleurence said in an interview with MedTech Dive.

Fleurence discussed challenges in kicking off NEST's research, the potential for real-world evidence to change payers' understanding of new medical technologies, and how FDA could use postmarket insights to adjust its standards for entire classes of devices.

First results expected this fall

Transitioning NESTcc from an FDA-backed program to a fully operational, independent business has been slow, Fleurence said.

Since NESTcc announced the first round of cases in November, partners have been ironing out contracts and have only in recent weeks formally begun research. That means interim results from the eight to 12 month-long studies, including methods and lessons learned, won't likely be shared before this fall.

Aside from the slowdowns that come with setting up NESTcc's infrastructure, coordinating legal agreements and awaiting institutional review board IRB approvals, Fleurence said inconsistencies in unique device identifier (UDI) reporting present a different challenge. Clinical teams are not required to record UDIs in electronic health records — and many don't. The absence of UDIs can make NEST's "low-hanging fruit" retrospective studies less useful.

"We're really dependent on the health systems being able and willing to adopt UDI in their EHR," Fleurence said, noting a common refrain among clinical teams that each additional data field needing to be filled in a record, like a UDI, contributes to physician burnout.

"Once the health system cracks that nut — which I'm pretty optimistic that that's going to happen in the next two to five years — then that will really support the kind of work that NEST does because of the ability to identify the device directly in the EHR."

With or without robust UDI use, Fleurence said the organization plans to first focus on using retrospective studies to gather evidence supporting label expansions.

"There's no good reason not to use that data and analyze it properly and look at wider uses," Fleurence said.

The organization will gradually move to conduct prospective postmarket surveillance studies, in which patients consent to follow up via their electronic health record, an effort Fleurence thinks could be launched in the next two years.

Similarly, within the next three to five years, Fleurence hopes NESTcc will facilitate randomized clinical trials on devices using EHR data. She likened such an idea to an ongoing, PCORI-backed "interactive" clinical trial called ADAPTABLE, which examines impact of varied aspirin dosing through EHR mining.

Sustaining operations

To date, NESTcc has received more than $10 million from FDA, with the current award set to run out in November 2022.

At the start of the year, the organization proposed a business model wherein device companies pay NEST for its research services.

Because NEST is an initiative of MDIC, Fleurence said the organization has gotten face time with a number of leaders in MDIC's member companies, whose ranks include Medtronic, Boston Scientific and Edwards Lifesciences.

"[E]arly adopters . . . are quite excited about the potential for the use of the real world evidence," Fleurence said. "And then you have companies that are more in watchful waiting, thinking, 'let's see what NEST can do first and how to work with it before we dip our toe in the water.'"

Fleurence said she thinks enough early adopters are "highly interested" to sustain the business model.

One pitch to companies is that RWE could provide FDA with a fuller picture of a product's performance compared to the agency's medical device reporting database, which may include inappropriately coded reports, or indicate problems in cases with confounding variables, she said.

"We don't know if it's due to the device or if it's due to the learning curve or how the device is being implanted," Fleurence said. "It's to the advantage of companies that the FDA has access to better, more robust data on the safety issues, so that it's not just anecdotal reports."

Real-world evidence could also improve reimbursement, Fleurence said, as NEST's research could generate evidence that doesn't just satisfy FDA's standards, but those of payers.

But RWE could also expose unfavorable trends in products' performance. This possibility hasn't deterred companies, Fleurence said. Indeed, companies signed up for test cases with the understanding most of the network collaborators' contracts have provisions to publish research, regardless of a study's outcomes.

Even under a largely industry-supported model, an arm of NESTcc will field postmarket surveillance queries from FDA. Earlier this year, NESTcc created the Active Surveillance Task Force to develop a roadmap for this type of work, which Fleurence said will be released for public comment in the next two to five months.

One example of that work for FDA is likely to show up in NEST's second round of test cases, due to be announced in early June. Fleurence said the case involves a device that drew the agency's interest due to a mass of adverse event reports, and a high level of uncertainty related to the cause of those complications.

In addition to monitoring postmarketing safety, Fleurence said RWE also could be used to reach consensus on a class of devices' safety and efficacy in large populations, thereby helping FDA develop objective performance criteria for evaluating newer products.

"That gives the review teams some sort of yardstick and standards by which to compare new devices that would come in submitting data," Fleurence said, adding much premarket data is based on very small sample sizes.

Going forward, Fleurence said she'd like NESTcc to source data inputs from international networks too. In the future, a device approved in Europe, for example, could potentially submit real-world evidence as part of a premarket application to FDA, she said.

"We're really intent on this being very high quality work that the FDA will be able to be confident in as they accept submissions using real world evidence, and that industry will be confident in when working with NEST" Fleurence said.