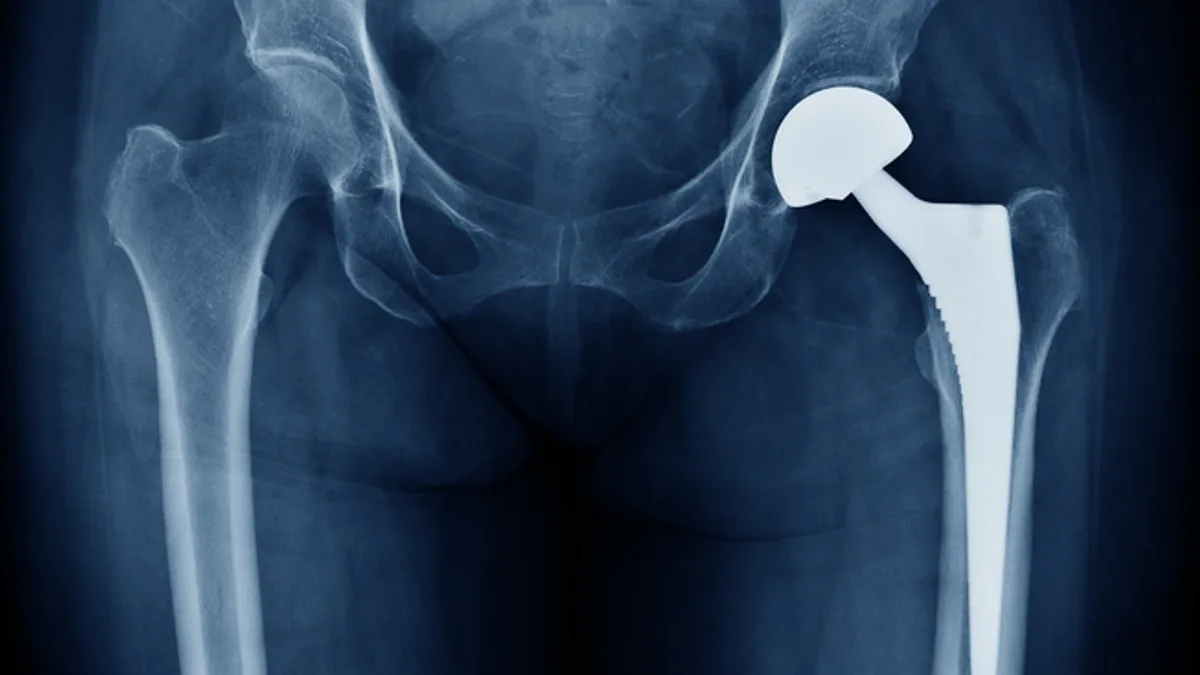

Orthopedics companies such as Johnson & Johnson benefited from rising procedure volumes in the second quarter, even as foreign-exchange rates, material costs and supply chain issues continued to weigh on their earnings.

Based on second-quarter results from Johnson & Johnson, Stryker, Smith & Nephew and Zimmer Biomet, the global market for joint reconstruction increased 6.9% in the quarter from the year-earlier period, analysts at RBC Capital Markets wrote in an Aug. 5 research note.

Still, it was an unequal recovery as Stryker and Zimmer gained share, while J&J and Smith & Nephew lagged, the analysts wrote. For Stryker and Zimmer, knee and hip procedures in the second quarter climbed from a year earlier, while J&J and Smith & Nephew reported a decrease in both.

Hip and knee sales growth in Q2

| Stryker | Zimmer Biomet | Johnson & Johnson | Smith & Nephew | |

|---|---|---|---|---|

| Hip implant sales | 3.2% increase | 2.7% increase | 0.7% decrease | 7.7% decrease |

| Knee implant sales | 5.5% increase | 5.9% increase | 0.1% decrease | 1.3% decrease |

SOURCE: Companies’ earnings statements, Q2 2022 sales compared to Q2 2021.

“On the implant side, we're feeling pretty good. Procedures are largely back to normal in most parts of the world. And really it's about the hospital staffing,” Stryker CEO Kevin Lobo said in a July 26 earnings call. “If that staffing gets better, then obviously there's a lot of pent-up demand for procedures and we’re feeling very good about our position in those businesses.”

Surgical robots

Orthopedics companies reported steady demand for surgical robots, even as Intuitive Surgical warned that placements of its robots dropped as hospital budgets tightened. Both Stryker and Zimmer Biomet said they had strong customer pipelines, but more hospitals were turning to renting or financing large equipment rather than purchasing it outright. Both companies reported a decrease in revenue in the quarter for their segments that contained robotics.

Lobo said that over the past six months, more deals are being financed versus purchased. Stryker had introduced a rental option in response to competitors’ offerings.

“We're really pleased with the number of installations, but the revenue per unit that we can recognize upfront is lower,” the CEO said.

By contrast, Globus Medical reported a 42% increase in revenue for its emerging technology segment. The company chalked up the growth to sales of its surgical robots and the launch of its Excelsius3D mobile x-ray system in May.

The new imaging system integrates with Globus’ ExcelsiusGPS robotic navigation system and is expected to drive growth for the portfolio, Daniel Scavilla, the company’s new CEO, said in an Aug. 4 earnings call. In the second quarter, 150 procedures used Excelsius3D.

Robotic procedures and implant pull-through increased by 30% compared to 2021, and going into the third quarter, “our pipeline is strong for both robots and imaging systems,” the CEO said. He added that the company faces risks for the remainder of the year including inflation, labor shortages, supply chain disruptions and a potential recession that could affect purchasing cycles.

Zimmer also commented on its Persona IQ knee implant, which is in a limited launch and includes a built-in sensor to track patients’ gait, range of motion and other metrics. CEO Brian Hanson said the “smart” implant is marketed as a premium product, adding that early data show the market is ready for the device.

“It wasn't that long ago that there was an assumption that orthopedics would not pay a premium to bring robotics into play. I think we're finding that's changing very rapidly. I really do believe robotics will become a standard-of-care at point,” Hanson said. “I think it's the same thing. This is the next leg of the stool. I really do believe that data collection and the informatics capability as a result of that will be something that people desire and pay for. We have to prove it.”

Supply issues persist

Orthopedic companies say supply issues from the first half of 2022 are expected to linger through the remainder of the year after they recorded an unequal impact from semiconductor shortages and the increased cost of materials.

Stryker said its medical division was the most affected by shortages of electronic components, but it expects the situation to improve. Globus also noted the electronic component market remains difficult, while its procurement efforts have been able to offset these challenges.

Smith & Nephew’s new CEO, Deepak Nath, called out logistics as an area of improvement for the company, which posted a 3.1% year-over-year decrease in revenue in the second quarter and a 5% drop in orthopedics sales.

The company’s orthopedics segment had been a “long-term outperformer” for the company, even though it has trailed the market since 2020, said Nath, who became CEO of the company in February. “A key priority for me has been to understand why that happened, and what we need to do to get back to winning.”

Part of that is because the business is more complex and less agile than its larger peers, the CEO said. For instance, the company has multiple hip stems and knee systems when other orthopedic businesses are focusing on just one.

Nath also pointed to a disconnect between the commercial and operations side, which has resulted in product availability challenges and high levels of inventory.

“The fundamental efficiency and reliability of our supply chain is not where it needs to be,” Nath said.