Dive Brief:

- Boston Scientific “appears likely to gain significant ablation catheter market share” as pulsed field ablation products take off in the space, largely at the expense of rivals Abbott and Johnson & Johnson, Needham analysts said Friday.

- The analysts made the comment after conducting a survey of 25 electrophysiologists that suggests Boston Scientific could increase its share of the U.S. ablation catheter market by more than 180% in the next 12 months.

- Electrophysiologists expect Boston Scientific to win share as they switch from radiofrequency ablation (RFA) and cryoablation to pulsed field ablation (PFA), which they plan to use in more than 30% of cases within 12 months. In that time frame, the analysts said, PFA is likely to “cannibalize” both RFA ablation and cryoablation.

Dive Insight:

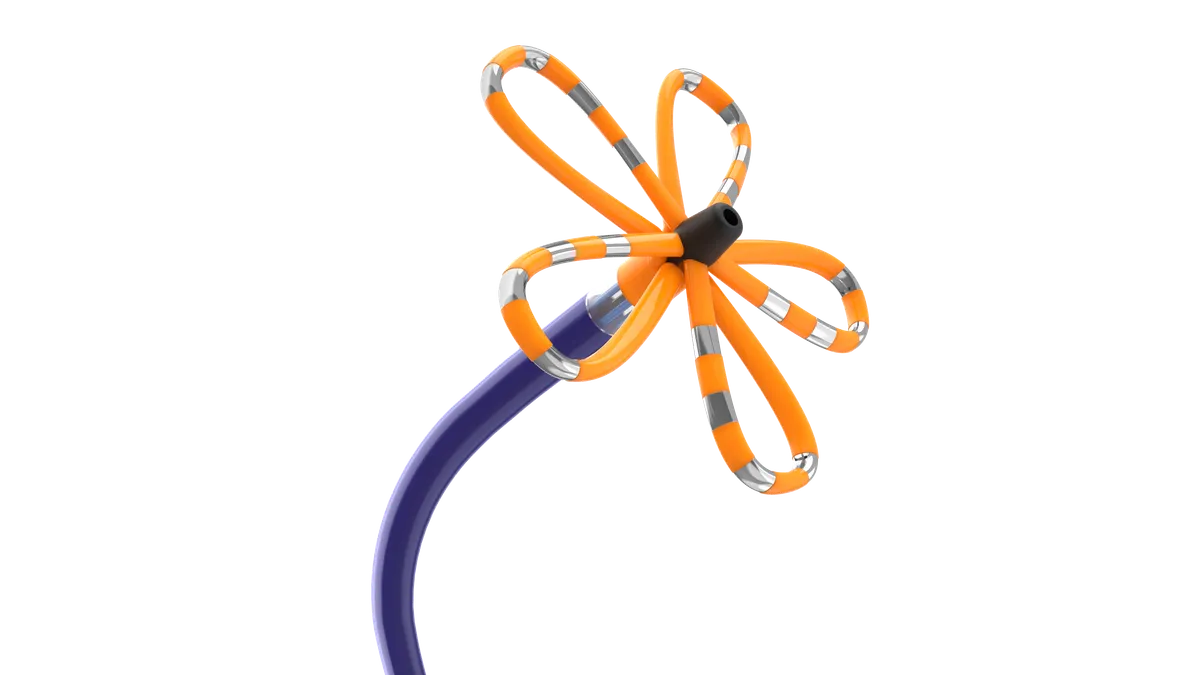

Industry and Wall Street have predicted a quick adoption of PFA for the treatment of atrial fibrillation. The new technology uses non-thermal electrical pulses to target cardiac tissue, compared with the heat of RFA and the extreme cold of cryoablation. Boston Scientific and Medtronic are already competing for the PFA market, while Abbott and J&J have devices on the way.

Twenty-five electrophysiologists surveyed by Needham expect to increase their use of PFA from 9% to more than 30% of ablation cases in the next 12 months. Most electrophysiologists said PFA will enable them to perform more cardiac procedures.

The survey suggests Boston Scientific will be the biggest beneficiary of the shift. Boston Scientific currently holds around 6% of the ablation catheter market, and Needham’s survey found the company’s market share will climb to above 16% in the next 12 months. The analysts estimated that the adoption increase will add about $440 million to Boston Scientific’s U.S. electrophysiology business in the next 12 months if its overall U.S. market share increases by the same amount.

Boston Scientific would still trail Abbott, J&J and Medtronic in the ablation catheter market with the projected gains, according to the survey.

Medtronic, which received the first Food and Drug Administration approval for a PFA device, is also competing for the market. However, the survey suggests the company’s cryoablation share losses will largely cancel out its PFA gains, resulting in its overall ablation catheter market share increasing by less than one percentage point.

The survey forecasts Abbott and, in particular, J&J to lose share of the ablation catheter market. The electrophysiologists expect J&J’s market share to shrink by almost 10 percentage points within 12 months. J&J is the biggest company in the space today, but is forecast to fall to second place behind Abbott as a result of the losses, according to Needham.

J&J’s forecast share losses reflect the anticipated decline in the use of RFA devices such as its Thermocool Smarttouch catheter. The electrophysiologists predict RFA’s share of the catheter ablation market will fall from almost 68% to less than 54% within the next 12 months. Cryoablation’s share is forecast to fall from around 23% to below 16% over the same period.

Abbott and J&J are working to enter the PFA market. J&J filed for U.S. approval of its Varipulse PFA platform in March. Abbott is further behind, with RBC Capital Markets analysts predicting in January that its device could launch in the U.S. in 2026. Abbott contends that its system will address limitations of existing products.