Philips’ U.S. sleep and respiratory care business could be set back by years as it now faces a consent decree from the Food and Drug Administration.

The Netherlands-based company said last week that it agreed to halt sales of sleep and respiratory products in the U.S. until it meets the terms of the consent decree. Although the terms haven’t been finalized yet, experts expect it could take Philips years to reach a resolution.

Anthony Petrone, a Mizuho Securities analyst, described the consent decree as a “worst case scenario” for Philips, adding that Wall Street had hoped Philips’ respiratory business would come back in the U.S. at the end of 2024 or early 2025.

“That bar just moved out by a minimum of two years and up to five years,” Petrone estimated.

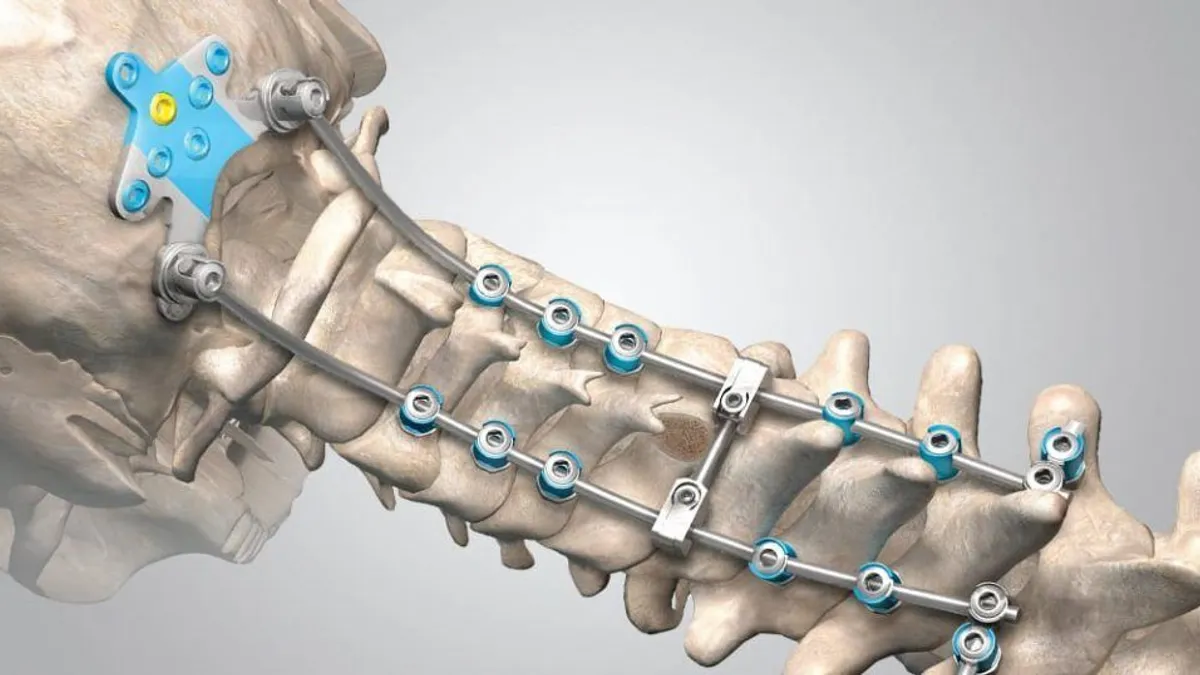

Philips has resumed sales of respiratory machines in some international markets, but sales in the U.S. have been on hold since 2021, when the company recalled more than 15 million sleep apnea devices and ventilators due to the breakdown of soundproofing foam. Inhaling the foam particles can cause nausea, headaches, inflammation and “toxic carcinogenic effects,” the FDA said in its recall notice.

The company tried to allay the FDA’s concerns with testing from independent laboratories, but the agency found that the results were not adequate to fully evaluate the risks.

The consent decree means Philips can no longer sell new sleep or respiratory devices, but it can still service devices that are already on the market, including selling accessories and replacement parts.

“It’s over,” Petrone said. “They’re not selling those to new patients anymore until they’re in compliance.”

The consent decree is being finalized and will be submitted to a U.S. court for approval, Philips spokesperson Steve Klink wrote in an email. When that happens, the consent decree will outline a roadmap of what actions and milestones Philips Respironics must meet to demonstrate regulatory compliance and restore the business. The U.S. Department of Justice is negotiating the order as a representative of the FDA.

The company also must still remediate its recalled sleep apnea devices and ventilators. Klink said Philips has remediated 99% of the actionable registered sleep therapy devices in the U.S., meaning devices that are registered with the necessary information. It is still working on its remediation of ventilators.

How a consent decree works

Agreeing to a consent decree is very significant for a company, said Beth Weinman, an attorney with Washington D.C.-based law firm Ropes & Gray.

“A consent decree is a lot of work both for the agency and the company that is a signatory on it. It requires a massive investment in remediation and means you’re basically under the eye of the FDA and the court for quite a long time,” Weinman said.

Sometimes, a consent decree can be a “blessing in disguise,” Weinman said, because it sets a clear roadmap for what needs to be done to come into compliance, and a company must assign the resources to do it.

“They can be very helpful but they’re also quite painful because it requires a lot of investment,” she added.

Typically, the FDA wants five years of continuous compliance before lifting a consent decree, although the exact timeframe for the Philips agreement has not been disclosed.

“That can be tough for companies, because you might have a good inspection and then a bad inspection,” Weinman said.

A consent decree will spell out what a company is permitted to do, required to do and prohibited from doing, said Jennifer Bragg, a partner with Washington D.C.-based firm Skadden. Both parties agree to the terms of an injunction, and that agreement is backed by a civil court.

Most decrees require a third-party auditor to regularly monitor the company’s systems and make reports to the FDA, in addition to any FDA inspections.

“That will be the basis for a large corrective action plan ... to address any systemic problems that have been identified,” Bragg said.

The decree also will spell out penalties for non-compliance and timelines the FDA expects. It gives the FDA “a lot of power,” Weinman said.

Often, decrees may include a provision that gives the FDA the authority to require a company to shut down, stop doing a certain action, or recall a product.

“Mandatory recalls are very infrequent. [It’s a] very high bar,” Weinman said. “But if you have a letter shutdown provision, typically in that provision, the agency negotiates the right to require companies subject to the decree to take a specific action without having to go back to the court.”

Decrees can also include a change of control provision, which means that if a company is sold, the owner will still be responsible for the consent decree.

Philips discontinues other products

Philips is also discontinuing several respiratory products in the U.S., the company stated in a Jan. 24 customer notice before the consent decree announcement.

The discontinued devices include its line of Alice sleep diagnostic machines, Dreamstation Go portable continuous positive airway pressure (CPAP) machines, home oxygen systems and portable oxygen concentrators. It also includes several ventilator models, such as Philips’ Trilogy portable ventilators and V30 and V60 devices. Since its sweeping recall in 2021, Philips has also recalled its V60 and Trilogy Evo ventilators multiple times.

The end of service for the devices ranges from 2025 to 2029.

Petrone said the news that Philips would stop selling its sleep diagnostic machines was “the biggest tell,” as most patients who come through the funnel with CPAP do an at-home sleep test.

“That tells me you’re giving up on getting new patients,” he said.

When asked about Philips’ long-term view of its sleep apnea business, CEO Roy Jakobs said the company is “committed to that segment” in a Jan. 29 earnings call.

What the order means for Philips’ bottom line

Philips recorded 363 million euros in provisions related to the consent decree last quarter. The company said its sleep and respiratory care segment brought in 1 billion euros in revenue.

In 2019, Philips’ connected care business brought in 4.67 billion euros in revenue, meaning its sleep and respiratory care segment, which makes up 47% of connected care sales, brought in about 2.2 billion euros.

Competitor Resmed, which has the leading market share in the U.S. for CPAP and bilevel positive airway pressure machines, is estimated to have captured about half of Philips’ previous market position during the recall, William Blair analyst Margaret Kaczor wrote in a research note. With Philips likely not returning to the market for more than a year, Resmed is poised to keep those gains.

Resmed spokesperson Brad Lotterman said in an emailed statement the company’s supply chain and salesforce have been meeting the global demand for CPAP devices, and will “continue to meet” that demand.