Dive Brief:

- Pear Therapeutics, a company that makes app-based treatments for insomnia and substance use, announced a restructuring late Monday.

- The Boston-based company plans to save $28 million over the next 18 months by cutting down on the development of new product candidates to focus on selling its existing FDA-cleared treatments.

- After raising record amounts of venture capital last year, digital health companies are laying off staff as they face tougher market conditions.

Dive Insight:

Pear is cutting about 25 employees, or 9% of its full time staff, according to a Monday filing. Because of the restructuring, the company expects to pay just short of $1 million in severance costs in the third quarter.

The move is expected to increase Pear’s runway by at least one fiscal quarter, analysts with financial services firm BTIG wrote in a Monday research note. The company ended the first quarter of 2022 with $89.4 million in cash and equivalents, and $48.4 million in short-term investments and restricted cash, while spending an average of roughly $31.2 million per quarter on operating activities.

“Given the challenging macroeconomic environment, we are not entirely surprised to see Pear take steps to preserve cash and extend its cash runway, and believe it was prudent for management to prioritize commercial efforts,” the analysts wrote. BTIG noted it had a previous investment banking relationship with Pear.

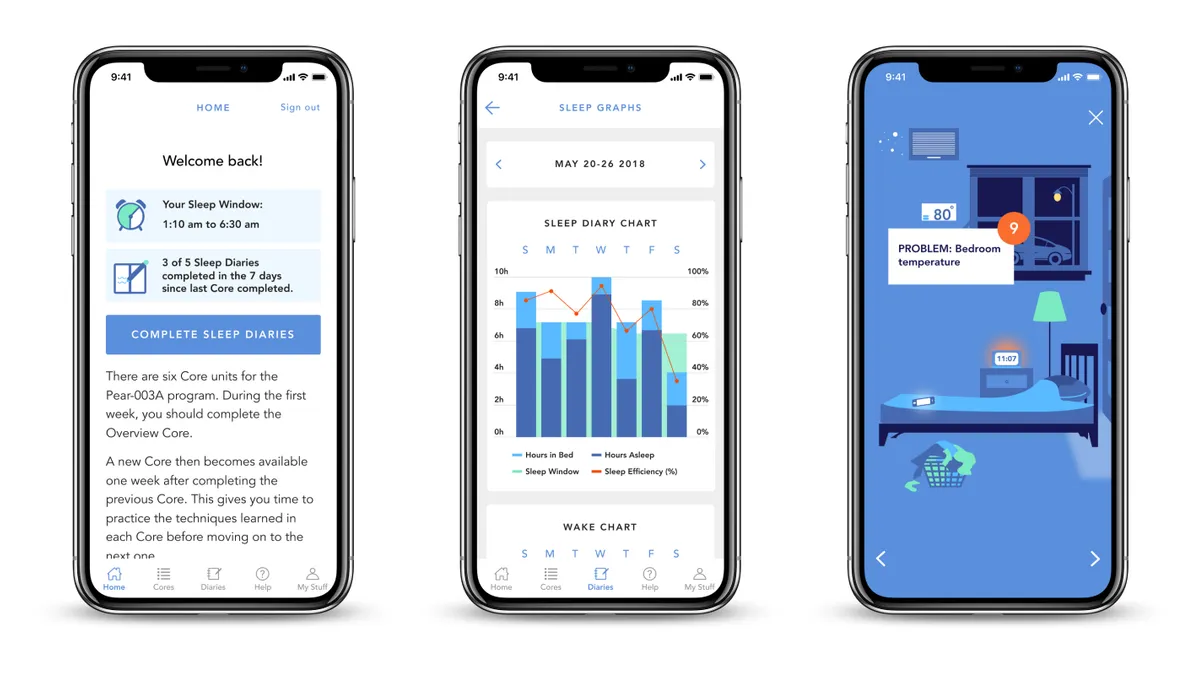

Currently, Pear has three FDA-cleared digital therapeutics: for insomnia, substance use disorder and opioid use disorder. After turning to licensing deals for revenue early on, the company now gets most of its revenue from sales of its products. It faces a challenge in getting insurance reimbursements for its products, since digital therapeutics are a relatively new category.

In the first quarter, the company reported $2.7 million in revenue and a $23.9 million net loss. Pear forecasts $22 million in revenue for 2022.

Clarification: This article has been updated to include $48.4 million in short-term investments and restricted cash on Pear's balance sheet.