Dive Brief:

- In its first earnings report since it went public, Pear Therapeutics met its guidance for 2021. The company, which makes digital therapeutics for substance use and insomnia, merged with a special-purpose acquisition company (SPAC) in December. The company brought in $4.2 million in revenue for the year, above its $4 million guidance, and also beat milestones for the number of prescriptions and covered lives.

- Even though Pear met its revenue goals for last year, it still saw a 55% decrease from 2020, when a licensing agreement with Novartis came to an end. While this removed the majority of Pear's licensing revenue, it did see product revenue increase 25-fold as it began commercializing its three main therapeutics.

- Pear expects to see its revenue continue to multiply, bolstered by increased coverage and prescriptions. The company is guiding for $22 million in revenue in 2022, as well as 50,000 to 60,000 prescriptions written, and 100 million to 120 million covered lives. BTIG analysts in a Monday note said "there continues to be a lot of positive progress on reimbursement" for Pear and the company's goal is reachable.

Dive Insight:

Despite the uncertainty that comes with carving out a new category of products, Pear Therapeutics met its guidance for 2021. In addition to meeting its revenue milestone, the company had 31.7 million covered lives, within its expectations, and had 14,000 prescriptions written, beating its goal of 12,500. Roughly half of its prescriptions were fulfilled.

Much of that progress has been through striking partnerships with insurers, PBMs and employers to cover Pear's digital therapeutics. The company claims about 30 entities either cover its products on their formularies as a covered benefit or purchase its products in bulk.

"Most of the coverage that we've seen to date is via pharmacy," CEO Corey McCann told investors in a Monday call. "I think there are a number of reasons for that. Simplicity is perhaps the most important here. It's just easier to oversee and adjudicate a pharmacy claim than it is a traditional medical claim."

That said, not all payers are able to process digital therapeutics, which are regulated as medical devices, through the pharmacy benefit. This is where Pear sees a potential benefit from a new CMS' Healthcare Common Procedure Coding System code, which would allow prescription digital behavioral therapy to be reimbursed as a medical benefit.

However, it's too early to say how big of an impact it will make, since the new code doesn't go into effect until April.

Referring to the new code and a Current Procedural Terminology code that would cover remote monitoring, BTIG analysts wrote in a Monday note, "These are encouraging initiatives that add to PEAR's foundation in reimbursement; we expect these wins to help usher in broader access and help the company reach its goal of 100M-120M covered lives this year."

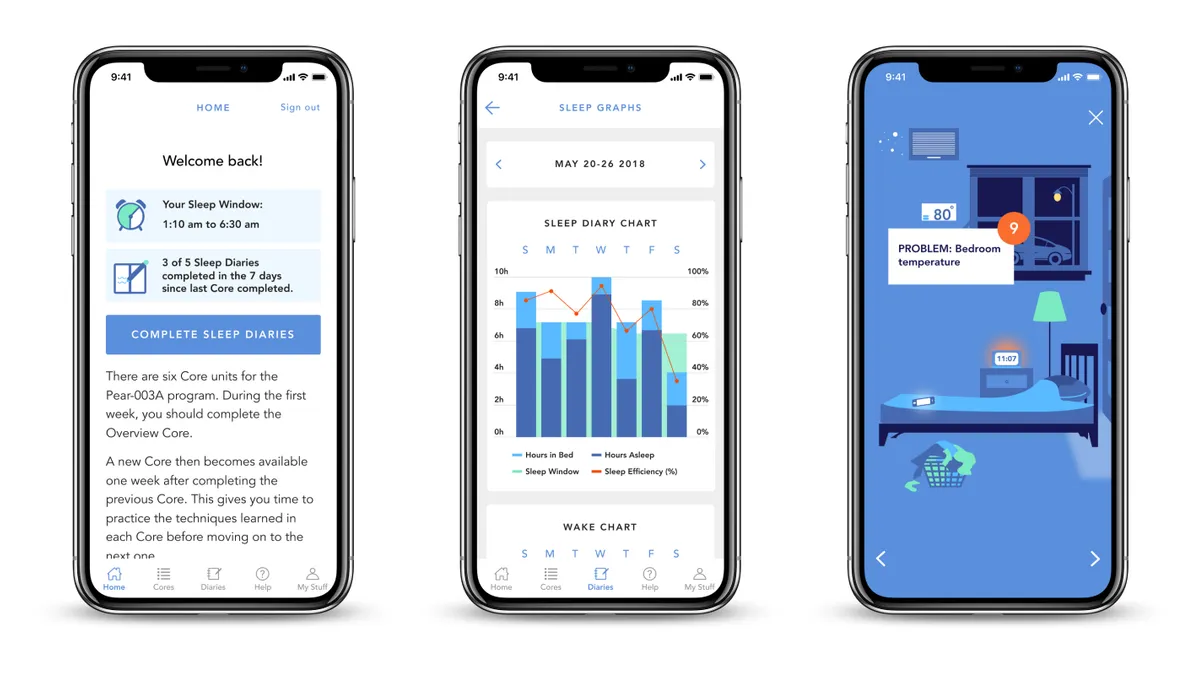

Pear currently has three FDA-cleared digital therapeutics: reSET, a 12-week course for substance use disorder, reSET-O, which addresses opioid use disorder, and Somryst, a digital program for insomnia. The company is looking to expand into some additional indications. For instance, it's looking to expand the label for reSET to include alcohol use disorder, and is also working on a digital therapeutic for depression, chief medical officer Yuri Maricich said.

The company is also working with Softbank, which made a major investment in Pear, to develop an insomnia therapeutic for the Japanese market.

However, Pear still faces substantial challenges going forward, as it faces several unknowns about the long-term adoption and reimbursement of its products. The company has been operating at a net loss, seeing a $65.1 million loss last year, a 33% improvement from 2020.

The company flagged concerns about its ability to fund its operations in an SEC filing.

"While the company has recorded revenue, revenues have been insufficient to fund operations. Accordingly, the company has funded its operations to date through a combination of proceeds raised from equity and debt issuances, including the business combination," Pear noted in its annual report.

As a consequence, the company will need to raise additional equity and debt financing to fund future operations, or might have to scale back some of its development programs. Pear ended the year with about $170 million in cash, enough to fund its operations into 2023.