Dive Brief:

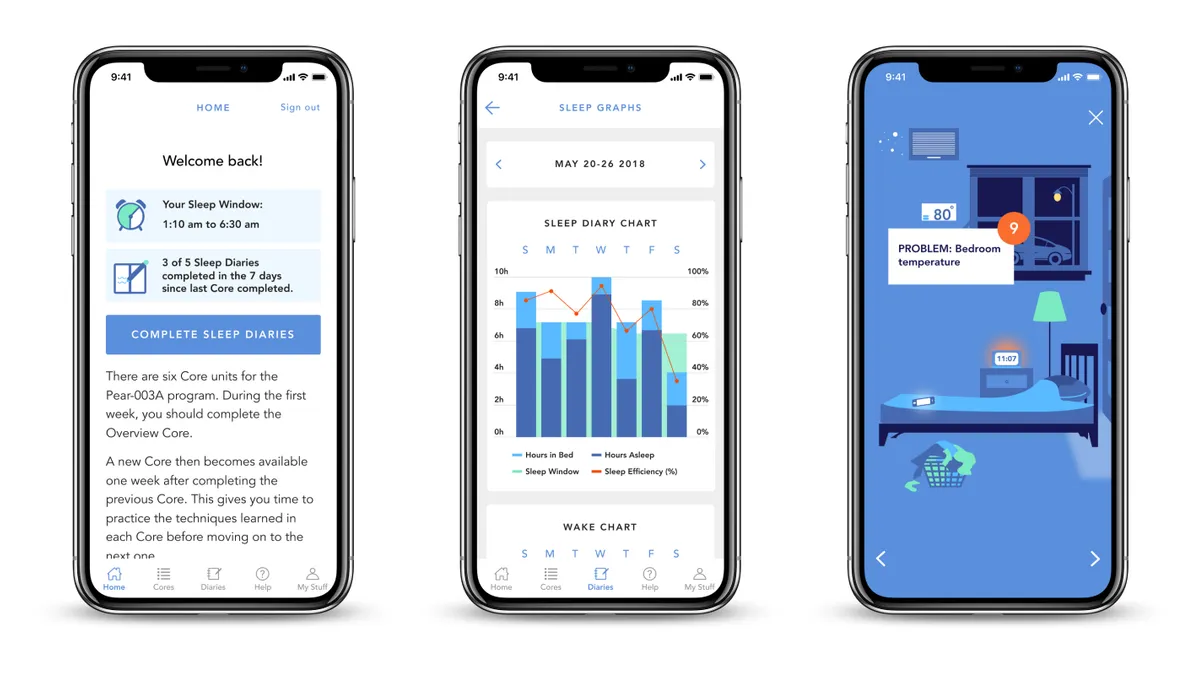

- Pear Therapeutics continued to grow its revenue on a sequential basis. In the first quarter of 2022, the digital therapeutics startup brought in revenue of $2.7 million, up 108% from last quarter and up 618% year-over-year. Most of its revenue stems from sales of its three digital therapeutics: software-based treatments for substance use disorder, opioid use disorder and insomnia.

- Since this is a new category of products, the company is looking to gain insurance coverage through studies proving the health and economic benefits of its treatments. Pear recently shared 12-month data on reSET-O, its digital therapeutic for opioid use disorder, and 24-month data on Somryst, its therapeutic for insomnia, showing a reduction in emergency department visits and hospitalization for patients who used these treatments.

- Pear is keeping its forecast of $22 million in revenue for 2022 and 50,000 to 60,000 total prescriptions for the year. The company stopped tracking total covered lives, which it had used as a proxy for payment rate, and which had gotten increasingly complicated as patients now access its products both through their pharmacy benefit and as durable medical equipment, CEO Corey McCann said on a Monday earnings call. Instead, the company is disclosing the average payment rate and average selling price for its therapeutics.

Dive Insight:

Pear’s new financial disclosures provided more insight into how the company derives revenue from its digital therapeutics. In the first quarter, Pear filled a total of 9,200 prescriptions, about 57% of which were fulfilled. Of those, about half were actually turned into paid prescriptions, at an average selling price of $1,353.

For the year, Pear expects to see fulfillment rates of 50% to 65%, and payment rates of 50% to 65%, at an average selling price of $1,150 to $1,350. The average selling price is expected to decrease throughout the year as Pear uses it as leverage with larger deals, Credit Suisse analysts wrote in a Tuesday research note.

Insurance coverage was a point of focus during Monday’s earnings call. Pear’s leadership discussed getting coverage earlier this year in the states of Oklahoma and Michigan for its therapeutics for substance use and opioid use disorders. However, those agreements are structured around dedicating funding to purchase access to these products, unlike Pear’s agreement with the state of Massachusetts, which provides coverage to all people covered by Massachusetts Medicaid.

When asked by an analyst if Pear hoped to expand other states to broader access, like in Massachusetts, McCann said “it's probably a little bit beyond the scope of what I can speak to today.”

“I think the inference that you made is an apt one, where in many of these arrangements, we have the opportunity to demonstrate not just for a particular state that we’re able to bend the cost curve and generate real-world health economic outcomes, but those projects become demonstration projects, which really help us to then radiate more broadly into additional things,” the CEO added.

The health economic data that Pear presented this week also factors into that effort.

On Monday, Pear shared 12-month data on its opioid use treatment, showing that 901 patients showed significant reductions in inpatient stays and emergency department visits, and increased adherence to buprenorphine, according to a Monday research note from BTIG. On Tuesday, Pear presented 24-month data on its insomnia treatment, showing a reduction in emergency room visits, hospitalization, sleep medication use and outpatient visits in about 250 patients, according to the research note.

“We expect these studies to be important in PEAR's conversations with payors,” the BTIG analysts wrote.