Pear Therapeutics, in the wake of layoffs it announced last month, is changing its strategy to cut expenses and focus on driving more paid prescriptions of its digital therapeutics. The company also lowered forecast for revenue and prescriptions for 2022, citing slow movement by commercial and government payers.

“There's a lot of work before we can imagine a world where there's universal coverage for [prescription digital therapeutics],” Pear CFO Chris Guiffre said in an earnings call on Thursday, adding that the company’s small team is working with payers to move as quickly as they can.

“It just doesn't go as fast as we'd like in almost all situations,” he said.

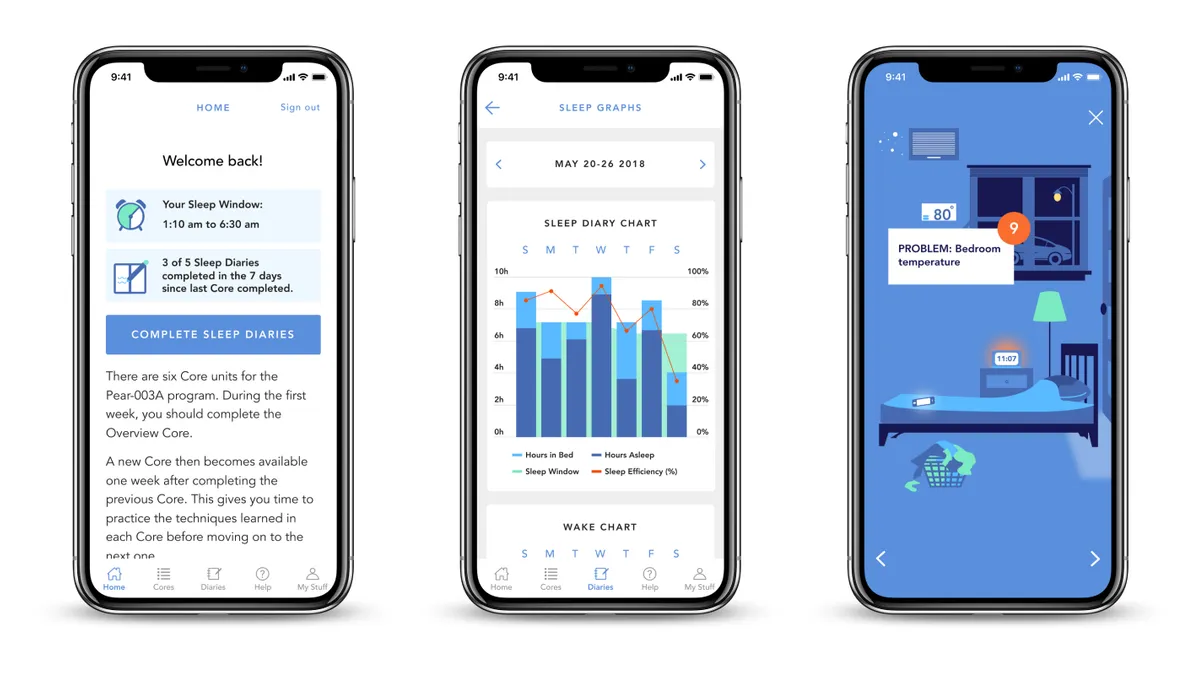

Pear currently has three digital therapeutics for insomnia, substance use and opioid use disorders. Most of its business comes from access agreements with state Medicaid plans to offer its app-based addiction treatments, although garnering coverage of its products has been slow going.

CEO Corey McCann noted the company is in conversations with more than 30 state Medicaid organizations, some of which are further along.

“These are states and organizations that frankly don't move quite as quickly as we would like them to. But with all that said, we continue to see the population of states continue to move forward,” McCann said.

Pear had 11,000 prescriptions in the second quarter, a little over half of which were fulfilled. Of those, only 45% were paid for. That comes in below Pear’s target for 2022, which was a 50% to 65% payment rate.

To boost that, Pear plans to focus on prescriptions in areas where it has moderate coverage density.

“We are not going to put as much emphasis on trying to bring up new sites where there's no coverage density, where we would generate a lot of unpaid scripts that would be quite useful in terms of continuing to generate more data … but would not bring in revenue,” Guiffre said.

As part of a restructuring announced in July, Pear also plans to focus less on developing new products and more on marketing the ones it already has. The company trimmed about 25 employees, or 9% of its full-time staff, as Pear looks to extend its runway.

“The restructuring was designed as a reaction to the macro-economic environment and the difficulty that companies like us face today in raising capital and may face for a good part of next year,” Guiffre said.

The company expects to pay about $900,000 in restructuring costs this quarter and plans to reduce its operating expenses by $28 million over 18 months. That should give the company enough runway to last until 2024, the CFO said.

Given the slower-than-expected growth, Pear lowered its forecasts for revenue and prescriptions for 2022. It now expects revenue of $14 million to $16 million at the end of the year, down from its previous forecast of $22 million.

The company now expects 35,000 to 45,000 prescriptions of its products in 2022, down from its previous range of 50,000 to 60,000.