Dive Brief:

-

Moody's has increased its near-term earnings growth forecast for the U.S. medical device industry.

-

The credit rating agency expects earnings to grow by 4.5% to 5.5% a year for the next 12 to 18 months, an increase of half a percentage point over the forecast it made in March.

-

Moody's ramped up its prediction in response to strong sales of relatively-new, high-margin products at companies such as Edwards Lifesciences and Medtronic, and a belief that Abbott and BD will realize acquisition integration synergies.

Dive Insight:

Moody's has become progressively more positive about the prospects of the U.S. medical device industry this year. In March, Moody's increased its outlook from stable to positive after its earnings growth forecasts topped the 0% to 4% range reserved for the stable rating.

Now, the rating agency has bumped up its forecast once again, going from 4% to 5% in March to 4.5% to 5.5%. Moody's expects the industry to stay on that growth trajectory through 2020.

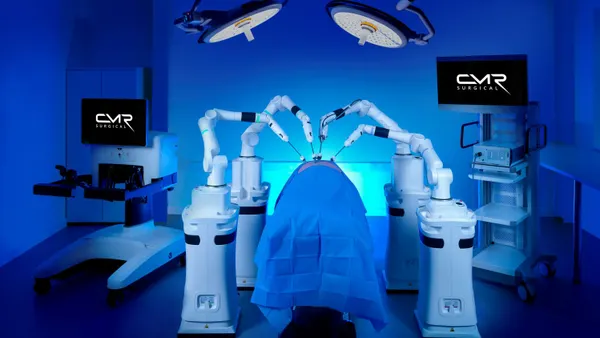

The rosy outlook is underpinned by multiple growth drivers. Moody's expects new products to drive mid-single-digit organic revenue growth. In explaining its forecast, Moody's pointed to the growth of newer diabetes products at Abbott and Medtronic, the success of Stryker's Mako robotic systems and continued double-digit increases in sales of transcather heart valves.

Moody's forecast fits with survey data analyzed by equity analysts at Leerink. The survey showed more than half of hospital administrators expect the number of cardiology procedures performed at their centers to increase over the coming year. One-third of the same administrators said they plan to spend more on orthopaedic robotic systems, such as Stryker's Mako.

The survey data cover U.S. spending plans. Moody's thinks that will be far from the only growth market, though. The forecasts partly rest on the assumption that emerging markets will perform well financially in the coming 18 months, enabling them to continue spending more on devices. Boston Scientific and Medtronic, which make more than 10% of their sales in emerging markets, will benefit if that happens.

Moody's also sees other company-specific near-term growth opportunities. Notably, the rating agency is upbeat about the prospects of Abbott and BD integrating Alere and CR Bard, respectively. If the integrations go smoothly, Abbott and BD could save costs and improve margins.

Integration difficulties, a slowdown in emerging markets and other factors could limit the effects of the tailwinds anticipated by Moody's. Equally, the headwinds the ratings agency sketches out in its report could prove to be stronger than anticipated.

Moody's forecast assumes the 2.3% tax on U.S. device sales, which is due to start in January 2020, will be suspended again. If the tax comes into force, it could wipe more than 1% off earnings growth. The House passed a permanent repeal of the device tax this year, but the Senate has yet to take up the legislation.

Medical device companies could also suffer as a result of the trade tensions between the U.S. and China. Moody's considered the impact of the 10% tariffs imposed by both countries on many devices but does not think they will have a material impact on the industry. That could change if a threatened 25% tariff is adopted, non-tariff barriers to trade are erected or companies invest to move facilities.