The robotics surge in orthopaedics has primarily been driven by hips and knees, with offerings from Stryker and Zimmer Biomet leading the way, leaving the spine market further behind.

But momentum has been building in recent years, and now Wall Street analysts and industry predict the spine robotics space has similar potential as the robotic hip or knee markets.

"The majority of the spine market today is still tied to more open, invasive procedures, so there's a lot of runway to convert those open procedures to minimally invasive or robotic cases," Kaila Krum, managing director for Truist Securities said. "Longer term, I do think that robotics is going to make up a bigger portion of the market."

Leading the market is Medtronic, which bought into the spine robotic space with its $1.6 billion acquisition of Mazor Robotics in 2018. However, smaller companies like Globus Medical and NuVasive are looking to compete with the medtech giant as the market grows.

The robotic spine market can be hard to define as system placement numbers are not always clear. Krum estimated a total of about 5,500-6,000 robotic spine accounts, but hospitals or health systems can have multiple robotic systems.

Furthermore, the way companies account for placements can be muddled. Placements may not always mean a direct sale of a system, which can cost upwards of $1 million. A placement can be sold outright, leased and paid off over time or bundled with other products and technologies.

Still, analysts view placements as a strong indicator of revenue development.

Richard Newitter, an analyst with SVB Leerink, said that while other companies like NuVasive and the Johnson & Johnson-partnered Brainlab will compete in the space going forward, the robotic spine market is currently a "two pony race" between Medtronic and Globus.

While Medtronic is in the lead, both Krum and Newitter said that Globus is grabbing market share with its Excelsius GPS system.

Medtronic has more overall procedures and placements with its Mazor system, but Globus is placing robots at a comparable rate to Medtronic, and Globus is likely placing more systems through outright sales versus flexible financing arrangements, according to Newitter.

"If you're collecting a million dollars upfront, for example, per robot, you might have fewer placements because you want to actually charge for the capital piece," Newitter said. "Whereas if you're using a more flexible financing arrangement, you might be able to get higher placement numbers, but you're not actually charging the same upfront."

Robotic systems will have a different strategic purpose for each manufacturer as the space further develops and adoption grows.

Globus, which accounts for about 10% of the U.S. spinal implant space, can use their robot to grow overall spine procedure numbers by attracting new customers and stealing a larger share of the total spinal implant market, Newitter said. The company's U.S. core spine business is growing three times as fast as Medtronic's, fueled by robotic adoption.

Medtronic may use it as a way to maintain its market-leading position by transferring existing customers to a robotic system.

Regardless of the jockeying among market leaders, the robotic spine market is still in its infancy.

Linnea Burman, vice president of enabling technologies for Medtronic, said robotic spine procedure volumes are a single-digit percentage of the company's total spine procedures. However, Burman said momentum has been growing since the Mazor acquisition and the company believes robotics will eventually become the standard of care.

"We see robotic-assisted spine growing faster than many other segments of the market," Burman said.

Medtronic estimates that global robotic-assisted procedures volumes will be over 30% in 10 years, according to an emailed statement from the company.

Procedures evolving

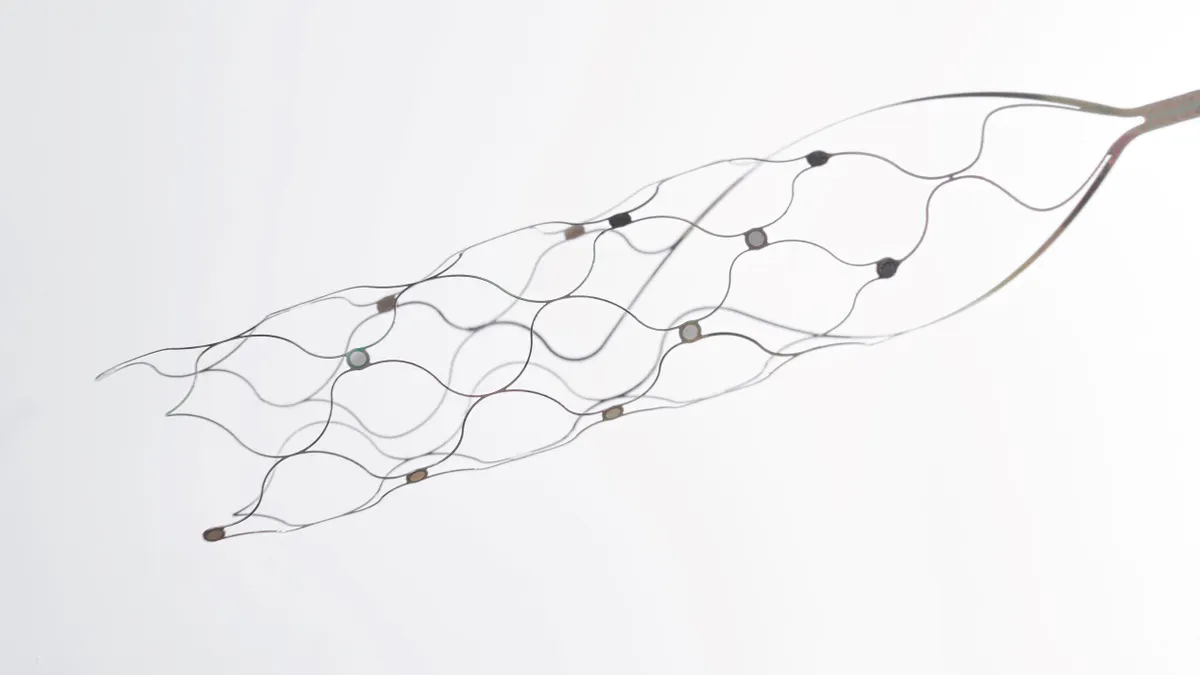

Robotic spine technology is different from other orthopaedic robots. For example, spine systems are primarily used for screw placements to secure spinal implants as part of minimally invasive surgeries. That contrasts with Stryker's Mako or Zimmer's Rosa systems, which are used in total and partial joint replacements and can cut bone.

Medtronic, Globus and Brainlab couple their systems with navigation, so surgeons can navigate patient anatomy with pre-operative CT scans. NuVasive is also developing a navigation system to go with its robotic arm.

Themistocles Protopsaltis, an orthopaedic surgeon with NYU Langone Health who consults for both Medtronic and Globus, said the complexity of spine procedures in general, such as managing neurological elements and cerebrospinal fluid, has contributed to slower development.

But Protopsaltis added that the technology has caught up to procedure complexity.

NYU Langone was hesitant to get into the robotics space but now owns three Globus robots across its health system, all acquired in about the last three years.

For certain surgeries, like anterior/posterior lumbar fusions or lateral/posterior lumbar fusions, average procedure times at NYU Langone dropped 110 minutes when using a robotic system, according to Protopsaltis. Infection and re-operation rates for certain robotic procedures are lower as well.

Robotic systems are also shaping how spine procedures are conducted.

For example, Protopsaltis would previously move the position of patients multiple times throughout the procedure to either place screws or close wounds, which increases procedure times. But the robotic system allows for Protopsaltis to keep patients in a lateral position to place screws and allows other steps of the procedure to happen simultaneously.

Medtronic's Burman also said that spine robotics systems are impacting how procedures are being done and creating standardized procedures for a field with much variation.

There are safety risks as surgeons learn how to use robotic systems because they are unfamiliar with the techniques. According to Protopsaltis, NYU Langone has set up a committee to review navigation or safety concerns with procedures that have had issues in order to "catch problems before they become disasters."

Robotics 'revolution'?

Along with Globus, Medtronic will have to deal with competition from Brainlab and NuVasive.

Brainlab, which is privately held and based in Germany, received FDA clearance in February for its spine robotic imaging system and robotic surgery system, after receiving CE marks for the two systems in the summer of 2020. NuVasive will be a bit later to the market, however. The company plans to launch its Pulse imaging and navigation platform in 2021, but delays have pushed first-in-human trials of its robotic arm into 2022.

Newitter said that NuVasive will be "notably absent" as Medtronic and Globus grow their businesses; however, the company should benefit from being a top-three spine player once its full system hits the market.

Stryker will also eventually develop a spine offering for its Mako system, which is currently used in hip and knee replacements, according to Newitter. SVB Leerink estimates a spine product is about three years away.

And while Zimmer has an FDA-approved spine offering for the Rosa system, the company plans to spin off its spine and dental segments into an independent company by mid-2022, creating questions about the orthopaedic company's future in the space.

Krum believes that as the spine market grows and smaller companies build their robotics businesses, there is "room for multiple players."

Another factor in the coming years is not just how the market changes but how will the technology evolve. Robot systems are currently used for a specific area of spine surgery, but companies are looking to grow capabilities.

NYU Langone's Protopsaltis believes that robotic spine systems will eventually be used in more complex procedures, even for small bone cuts.

Medtronic plans to add more offerings through its robotic system, such as spinal deformity, Burman said. The company, however, is not likely to use the Mazor platform to extend into any other orthopaedic categories.

"Right now, we are very focused on spine. We think it's exciting growth and a really long runway," Burman said. "I don't anticipate that we'll be jumping into other parts of the orthopedic space."

There is still hesitancy among surgeons about adopting robotic navigation systems, which will likely continue to drag on overall adoption in the near term.

At the same time, though, robotic procedures are taking over traditional methods. At NYU Langone, robotic systems are being used on roughly 50% of all lumbar procedures, which make up roughly 40% of spinal procedures for the health system, according to Protopsaltis.

"I think it is a trend, and it's going to be something that's here to stay," Protopsaltis said. "I think that there'll be a revolution in a half dozen years, whereby navigation robotics will be more common than not using it."