Intuitive Surgical's near-monopoly over soft tissue robotic surgeries for the last two decades is quickly coming to an end as medtech giants like Medtronic and Johnson & Johnson have set their sites on the space and are bringing systems of their own to market.

Last week, Medtronic gained a CE mark for its Hugo robotic-assisted surgery system for urologic and gynecological procedures, starting the face-off with Intuitive in Europe.

Megan Rosengarten, Medtronic's president of surgical robotics, said that the company aims to not only challenge Intuitive but grow robotics usage overall. Despite interest and hype around robotics, and companies rushing into either the soft-tissue or orthopaedic markets, only a small percentage of total procedures are actually performed with the technology.

Rosengarten contends that as more companies come into the soft tissue space, like Medtronic and J&J, the market should grow.

Medtronic will now focus on submission to the FDA, although there is no specific timeline yet for when Hugo will be available in the U.S.

J&J is developing its own soft tissue robotics system, called Ottava, but the system is still years away. The company announced Tuesday that first-in-human trials will be pushed back by two years due to technical challenges and COVID-19 disruptions, which resulted in a $900 million R&D hit in the third quarter.

First-in-human trials for Ottava were originally supposed to begin in the second half of 2022. The delay now gives Medtronic even more time to solidify itself as a new entrant.

This interview has been lightly edited for clarity and brevity.

MEDTECH DIVE: Can you talk about what the CE mark approval means for Medtronic and the Hugo system? And can you talk about what the European launch is going to look like?

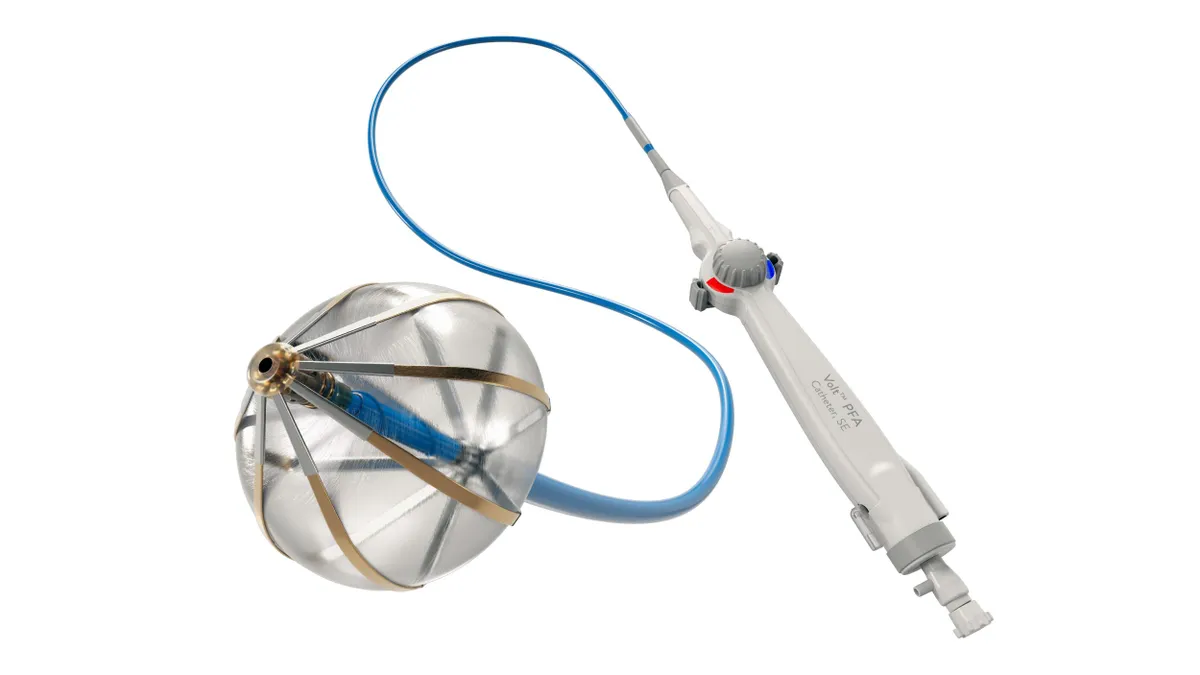

MEGAN ROSENGARTEN: It's a very complex system, so approval of the technology for the European market is a major milestone. We feel that the promise of robotics technology, paired with data and analytics and computational power, really has the opportunity to move the needle on getting more patients around the world access to minimally invasive surgery.

If we look at Europe today, only about 2% of procedures that are applicable to be done with a robotic approach are done with robotics. So, despite Europe being a very developed market in general, it's still very nascent in terms of access to robotic technology. And most of the markets that we're entering are in that state where robotics is pretty nascent.

Is Medtronic planning a slower, rollout launch in Europe or a quick push into multiple countries in the market?

ROSENGARTEN: We have a program that we're calling Partners in Possibility, which is a pretty exclusive program. We're working with partner hospitals and surgeons in Europe who are really the most excited to be at the forefront with us on this. We have a global clinical data registry, which is capturing the procedural information from all of the procedures that are performed with Hugo, and we're enrolling European partners in that.

We can't share what those hospitals are, for confidentiality reasons, but we do have the first several hospitals and partners lined up to be in that program.

What are Medtronic's near-term expectations for Hugo?

ROSENGARTEN: For our first year of the launch, we are projecting a global number of $50 million to $100 million in revenue. That's how to think about it without backing it into the number of system placements we're at today. We have placed systems and launched in Latin America and India. We don't have systems that are sold and installed in Europe yet, and procedures have not yet started. However, we do have a lot of ongoing conversations and partnerships lined up, and we have an idea of what the next year-plus ahead will look like.

Do you have any updates or a timeline about an FDA submission?

ROSENGARTEN: We don't have a specific date or timeline yet. We applied for our investigational device exemption at the end of March and have since received that approval. What that means is that we can start our U.S. clinical trial, which will be in urology. The trial has not yet started, but we have that approval.

The timing of the U.S. approval and market entry is dependent on patient enrollment in the clinical trial, completion of the trial, submission of the data and review by the FDA. But urology will be the first indication in the U.S.

Intuitive Surgical has been the clear market leader in soft tissue robotics for some time, and J&J is developing a system. How do you approach the market with two large medtechs to compete against?

ROSENGARTEN: For all of us — Intuitive, Medtronic, J&J and other possible entrants — it's still so early. That's hard to say when robotic-assisted surgery has been around for 20 years. But, again, Europe has 2% penetration and worldwide is still only 3% penetrated. This is really the cusp of what technology can bring to bear on migrating more and more procedures to a minimally invasive approach via a robotic platform.

In the announcement of the CE mark for Hugo, Medtronic highlighted the high cost of robotic systems as a barrier to adoption. How did Medtronic approach cost for the Hugo system?

ROSENGARTEN: Economics and cost is a primary barrier to the broad adoption of robotics. Interestingly, we found during the development of Hugo that the upfront cost of technology was not the primary barrier. Rather, the primary barrier was the total cost of ownership — the cost over time — and even more specifically, the cost per use. Each time a robotic-assisted surgery procedure is done versus a traditional laparoscopic procedure or an open procedure, you're typically seeing an increased cost associated with that.

That's the place we really narrowed in on, making the cost per hospital per use as close as possible to what they're doing today to serve that patient.

That becomes even more important when you look at different markets, countries or geographies around the world where there's a different level of reimbursement versus private and out-of-pocket costs for patients. We really focused squarely on the cost of ownership over the lifetime of the robot as well as each time it's used and getting that as close to parity of the care that hospitals are providing today.

Can you share where you expect the cost of Hugo to end up compared to Intuitive's da Vinci robot?

ROSENGARTEN: I can't share the dollar amount. We're really focused on how do we differentiate over the utilization and the cost per use in order to open up new users and bring new purchase and new adoption into the market and expand.

What is it like developing the technology and now getting ready to enter a new market during the pandemic?

ROSENGARTEN: Launching a complex product that's disrupting a 20-year almost-monopoly during a pandemic is somewhat stressful. Not just for me, but for the team. We've had to come up with new ways to do things like installing robotic systems in many different places around the world for demos, training, and R&D processes when we can't send people to do those installations. We've had to adopt and build software platforms that allow us to do virtually aided installations of systems in different parts of the world.

We've also used that same idea for using augmented reality and virtual reality for training, and training of our own internal employees, people who install and maintain and service Hugo's systems as well as people who are in sales or commercial areas.

So, we really adopted virtual approaches to help us during the pandemic.