Medtronic CEO Geoff Martha said new product introductions in high-growth markets and a comprehensive transformation underway at the company are combining to drive sustainable earnings growth.

“We've changed everything from our operating model to our incentives to our culture, and even people in some cases. This is showing up in our results, and why we believe our financial performance is durable,” Martha said Monday in a presentation to investors at the J.P. Morgan Healthcare Conference.

The company has posted mid-single-digit revenue growth for four consecutive quarters and is forecasting mid-single digits in the coming quarter as well, based on a pipeline of new medical devices, Medtronic executives said.

Those products make up 20% of the company’s revenue today but are in large and fast-growing markets, getting a disproportionate amount of capital investment and are expected to become a bigger part of revenue going forward, said Martha.

The aim is to leverage that momentum to deliver double-digit returns for shareholders again, CFO Karen Parkhill said.

“Our top priority is restoring our earnings power, full stop,” Martha said.

Beyond product innovation, Medtronic has made foundational changes to the organization over the past few years to support improved performance, the CEO said. Those moves include changing the operating model to give profit and loss responsibility to businesses, centralizing the supply chain, bringing in experienced leaders from outside the industry and implementing a more performance-driven culture.

“We believe [Medtronic] is making operational progress, but the key debates on investors' minds remain consistent execution (there is growing confidence on the top-line) and its ability to deliver meaningful EPS growth above sales growth,” RBC Capital Markets analyst Shagun Singh wrote in a note to investors Monday.

Medtronic is in the process of closing five manufacturing sites and consolidating eight distribution centers into two super distribution centers, Martha said.

Among the product areas poised for the highest growth, Martha highlighted:

Cardiac ablation

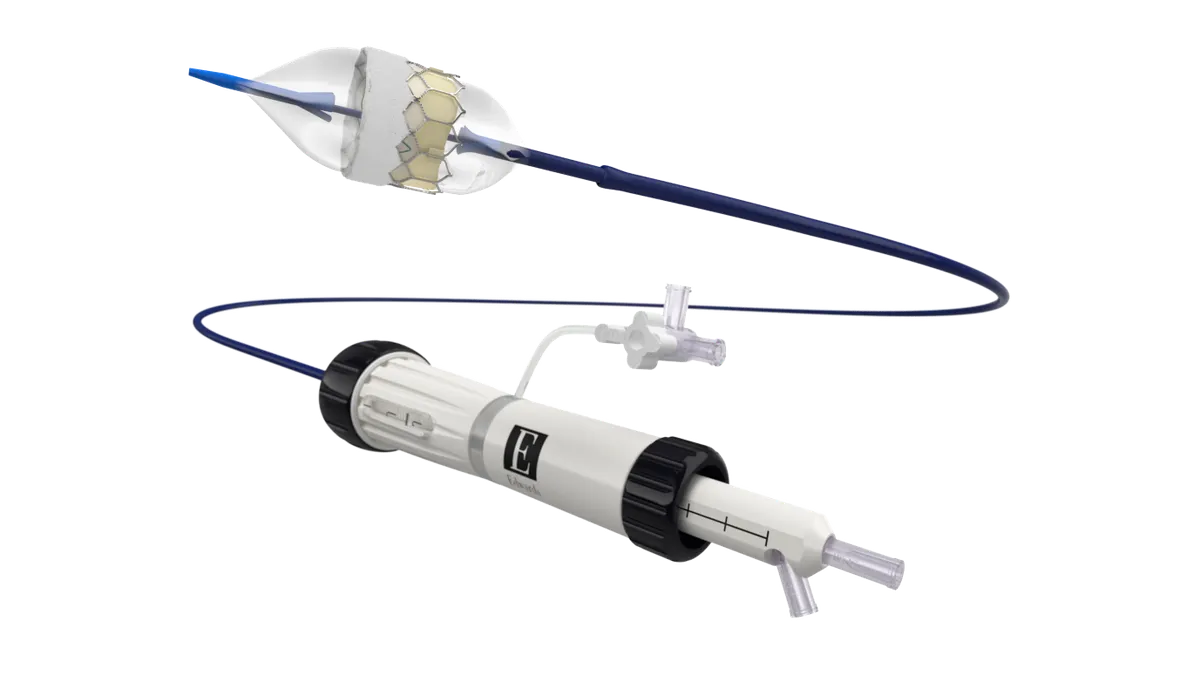

Medtronic has made several significant investments in its electrophysiology business as it positions itself to gain share in an $8 billion-plus-market that is growing in the low-double digits. The company recently was the first to gain U.S. regulatory approval for a pulsed field ablation catheter, called PulseSelect, to treat atrial fibrillation and is making progress on bringing its Affera system to the U.S. market.

Diabetes

The market for intensive insulin patients is shifting from primarily standalone continuous glucose monitoring with multiple daily injections to dosing with either automated insulin delivery or smart MDI systems, Martha said. “By the end of the decade, we believe smart dosing systems will be the technology used by the majority of the market,” he said.

Medtronic’s U.S. pump sales were up 30% sequentially last quarter, driven by the launch of the 780G system. “Given the success of the launch, we're expecting our U.S. business to return to growth here in the second half of the fiscal year,” Martha said.

In addition to pumps, the company’s insulin-delivery devices include pens now and a patch system that is under development, he said.

Structural heart

The $6 billion-plus market for transcatheter aortic valve replacement (TAVR) is growing in the high-single to low-double digits, Martha said. The company’s Evolut FX TAVR system has been doing “extremely well” in the U.S. and Japan and is now launching in Europe, he said.

Further, the company is focused on near-term growth catalysts in areas including ear, nose and throat, where it acquired sinus implants Propel and Sinuva; cardiac surgery, through the launch of the Penditure left atrial appendage exclusion device; neuromodulation, where it is awaiting U.S. approval for the Inceptiv spinal cord stimulator and Percept rechargeable deep brain stimulation device; and artificial intelligence-assisted colonoscopy to better detect polyps.

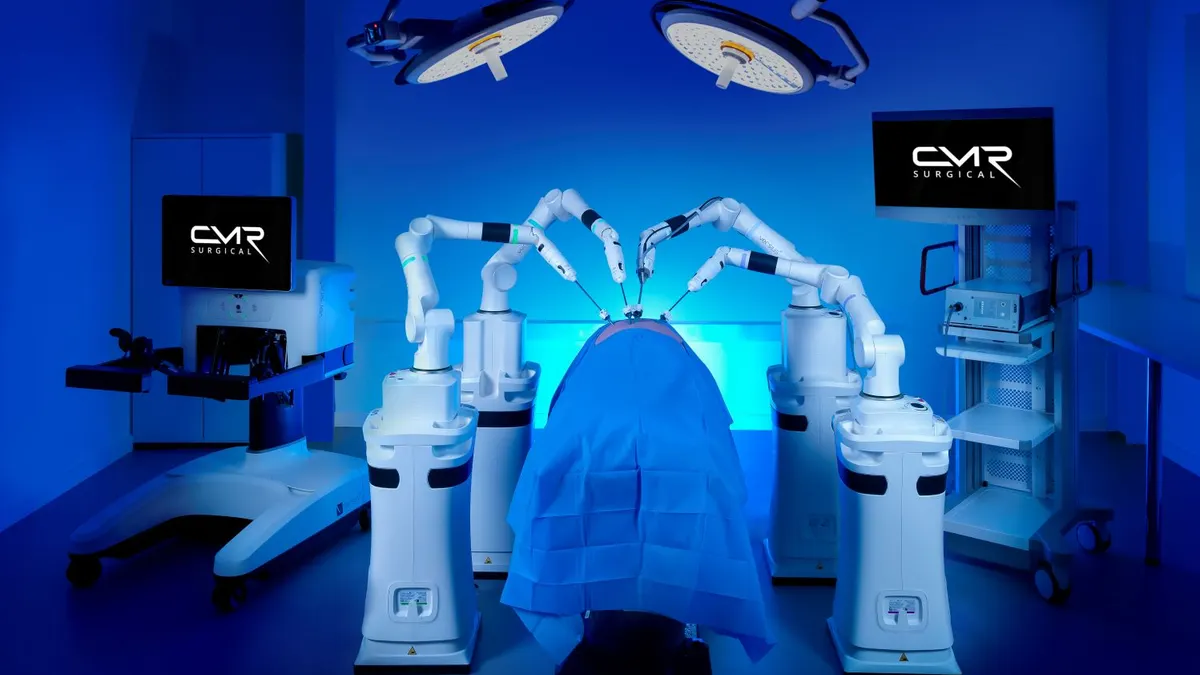

New technologies are also projected to help the company gain share in established markets such as cardiac rhythm management and spine surgery.

In renal denervation, where Medtronic gained Food and Drug Administration approval in November for its Symplicity Spyral system to treat hypertension, the company sees a “massive” market opportunity and is in “active conversations” with the Centers for Medicare and Medicaid Services and private payers about reimbursement, Martha said.