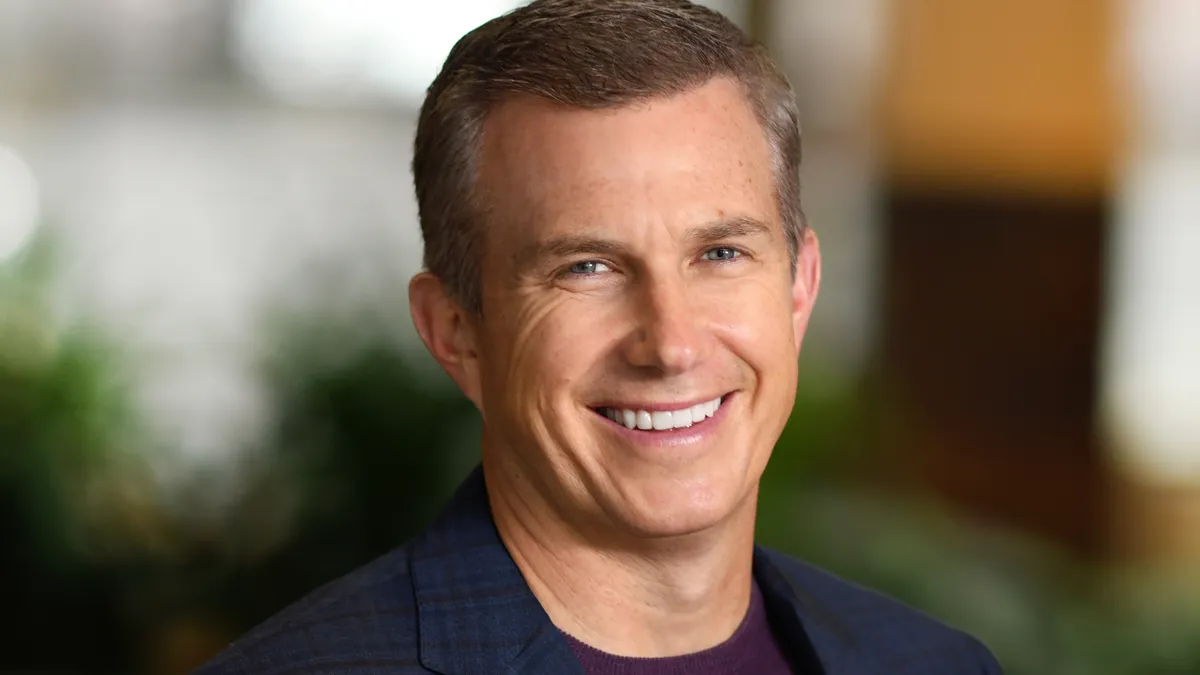

With plans to spin off three major divisions this year, Medtronic CEO Geoff Martha said he’s taking his foot off the gas. The Dublin and Minneapolis-based medical device firm, the world’s largest by revenue, has announced the divestiture of its dialysis business into a new firm with DaVita, and a plan to turn its respiratory interventions and patient monitoring firms into a separate, connected care business.

“That's a lot. That totals 8% percent of our revenue and there are some operational entanglements we've got to undo,” Martha said at the J.P. Morgan Health Conference on Monday. “Over the near term, from a divestiture standpoint, I wouldn't count on others. However, that being said, the portfolio review [is] ongoing.”

Martha said the company plans to invest more money into segments with high growth and high-return opportunities. Those include structural heart, neurovascular, cardiac ablation solutions, surgical robotics and diabetes, despite rumors that Medtronic might look to divest the latter.

“We continue to evaluate it, but we like how this portfolio shaping up,” Martha said. “And this is what gives us the confidence in our ability to deliver durable growth over the long term.”

Medtronic still faces a warning letter related to its handling of a recall of the MiniMed 600 series insulin pumps. Martha said the company has met all of the requirements for the warning letter, but does not know when the FDA might lift it, which would be needed for the firm to secure approval for the new MiniMed 780G insulin pump.

“From a long-term perspective, I’m excited about our diabetes products in the U.S.,” Martha said, noting the segment’s growth in Europe and the market interest in automated insulin delivery.

Martha also said he was excited about Medtronic’s launch of its Hugo robotic-assisted surgery system, which has a CE Mark in Europe but is still an investigational product in the U.S.

“I know there's a lot of skepticism out there because it took us so long to get this product out there and other competitors have struggled to get a competitive system out there against the DaVinci,” Martha said. “But we're getting really good feedback, and I think we have something to build from here.”

Most of the medical device markets have returned to normal, except for some more elective surgeries, such as transcatheter aortic valve replacement, percutaneous coronary intervention, and spinal cord stimulation, he said.

“Most of those are unchanged so far, except coronary has gotten slightly better in the last couple of weeks. We're kind of scratching our head as to what happened, why it was slower, but it is coming back,” Martha said.

The company is also watching China, both for rising COVID-19 cases and the country’s shift to a value-based procurement system. From a COVID perspective, Martha said the virus has moved through the company “unbelievably quickly,” but that the supply chain hasn’t had any problems yet.

On this shift to value-based purchasing, Martha said Medtronic had gone through the process with its coronary stents and spine business, and expects to have done so with half of the company’s revenue through the end of fiscal year 2023, reaching 80% by fiscal year 2024, “giving us a new, albeit lower revenue base to grow from going forward.”