Medtech companies hit the brakes on large mergers and acquisitions last year with 11 transactions valued above $1 billion compared with 21 “megadeals” in 2021, according to data from consulting and accounting firm EY.

The slowdown may be short-lived, industry observers say.

While medtech dealmakers and advisers expect a slow start to 2023, they point out that despite higher interest rates and a volatile stock market, there are signs that buying and selling medtech companies in whole or in part is is poised to rebound.

For example, digital health innovations from AI-guided surgery to remote care and wearables are attractive as potential bolt-on acquisitions for bigger companies. GE HealthCare said on Jan. 11 that it will pay an undisclosed sum for France’s Imactis, whose CT-Navigation system helps surgeons in minimally invasive operations and reduces procedure time.

Others like Medtronic and Johnson & Johnson are divesting entire divisions this year, presenting acquisition opportunities. Meanwhile, device makers with a footprint in China may look to exit the world’s most populous country amid a combination of protectionist trade policies, lower prices and the COVID-19 pandemic.

What do all these signals mean for medtech M&A? MedTech Dive reached out to industry observers for their views on potential activity in 2023.

Their comments have been edited for length and clarity.

Jeff Haxer, Chicago-based partner in healthcare and life sciences at consulting firm Bain:

I just think everybody hit pause a bit, but [for] ‘23, if you just take two data points: the market is still rewarding growth more than margin improvement, and there's a lot of cash on the sidelines. And then I'll add a third piece: the IPO markets aren't really available for a ton of other assets. So you have this confluence, where ‘23 is going to be a big M&A year for medtech. As soon as there's any clarity in the debt markets, you're going to see a lot of activity: A couple of large-category leadership plays where people are filling out their portfolio, exploration of “what do I do with my China assets?” Because with the uncertainty there, even with the reopening, it's not clear how you monetize anything in China. You’re going to see some interesting exits from strategics or JV’s, as companies ask “How do I monetize whatever the heck I have in China?” You might see some folks either exit what they have in China to a JV or just say, look, it's too expensive, and it's too risky to play there. The bulk pricing [means] it is going to be difficult for folks to make any money directly in China. You take the margin out, and that market is not particularly attractive. There's more skepticism now on China than I've seen in the last 10 years, [and] the “Can I make money in China?” question no longer has a clear answer. [Particularly for] people that have a large footprint, they're trying to figure out what to do with that footprint.

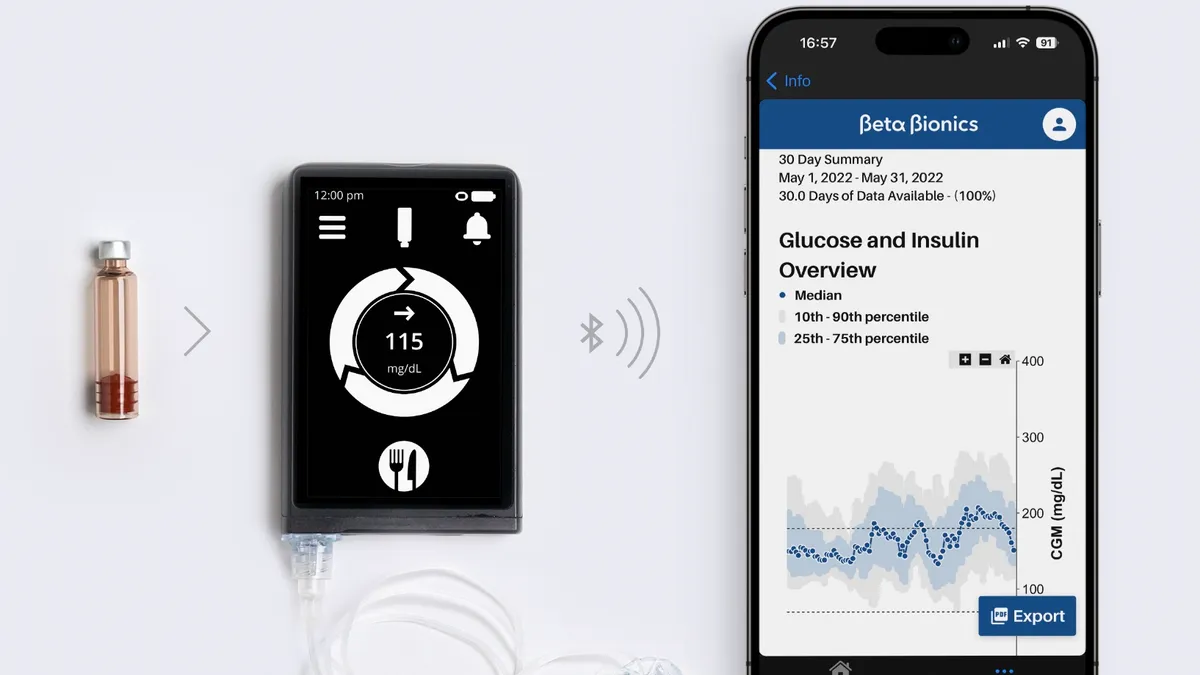

Digital may be another growth area for M&A in ‘23, particularly when you talk about how do I use something other than hardware to drive revenues? And that can be interconnected devices, that can be how do I take data from all the procedures that I do and monetize it in some way? There are a lot of players there, and there's not a clear winner. And there's a lot of investors there, which means you can place relatively smaller bets, and place multiple bets with different deal theses in the hopes that you bet on a winner. It's a way to deploy capital in a smaller way.

Dave Sheppard, co-founder and director of MedWorld Advisors, which counsels small- and medium-size medtechs, and a former senior executive at Medtronic:

On the on the strategic side, you've got a few spinoffs taking place, like GE HealthCare, just spun off from from from GE, that's going to drive some some M&A on their side, because they haven't been able to make their own decisions for quite some time, they've had to get the cash flow back to the mothership at GE, and now they don't have to do that. Now, they can put that capital to work, to be able to help them grow GE HealthCare. Johnson & Johnson's putting up its consumer health unit, Medtronic is about to split off their respiratory group. Getting these new planets in orbit out there, that's going to be helpful to M&A overall. And I think you will see some additional portfolio pruning because of that on both sides where they might even divest further, but they also will acquire a few things.

The strategics have difficulty disrupting themselves, so they're always looking for new technology. Right now we're really in a renaissance of technology for medtech, mostly in digital health. You’ll see that drive a lot of M&A on the strategic side. On the private-equity side, there's still so much dry powder out there, funds continue to get raised, they have money to spend. Private-equity people don't make money unless they put it to use, and what they have come to realize over the years is that the medtech industry is a great place to be when the rest of the economy is unstable. Because [with an aging population] the demographics are in the favor of more medtech procedures taking place. Private equity understands that and so it's a safe bet for them to put their money to work in medtech.

[The past decade’s investment in digital health] has created a great ecosystem for new technology, new innovators, but now that money is starting to dry up because the valuations are too crazy. And so what we're already starting to see in our practice is some consolidation: The pure winners are either going to get snapped up for a nice valuation from a strategic, or they're going to go IPO, as they continue to build their company. And solid middle players are going to combine with each other or have to buy a smaller player to strengthen themselves to survive. And the players that are just don't have the strength or don't have their game together, they're going to be swallowed up or they're going to go away.

One area that's pretty hot is hospital-to-home, getting patients out of expensive, money-losing beds. But nobody's really executed on that really well yet. The technology and the channels are there, but they’re ahead of policy, so the reimbursement is holding that back. Still, people are snapping up some of that technology, because sooner or later that's going to have to change — it’s just pure economics. Private equity has come in to kind of help drive some of the change, buying ambulatory surgery centers. They see it's technology that's going to drive some of the M&A, with growth in procedures, in cardio and respiratory areas.

Jim Welch, global medtech leader for Ernst & Young:

With the activity so far down in 2022, the 2023 outlook is certainly going to be a little bit more active than that. But we're still seeing valuations for high-growth medtechs at really high levels. Organizations that can demonstrate high cash flow or low technology risk are still commanding significant valuations in the marketplace. And given all the spinoffs and portfolio moves by the bigger players, we think in the back half of the year, that'll create their need to do bolt-on acquisitions and shore up the remaining parts of their portfolios.The IPO market is still going to be pretty slow. A lot of the private-equity organizations are looking to exit some of their portfolio plays in the back half of the year when the market comes back a little bit. So you'll see a little bit more of going in that direction.

That said, the middle-market debt market is still still open for business. We're seeing with all the technology advances that are coming and the need for more technology to deal with the [skilled labor shortage]. So, if you’ve got a potential for cash flow and a technology solution that is going to address some of the macro risks, then you should still have a pretty good opportunity to get funding, it's just going to be a higher hurdle than it was before. And I would argue that is a little bit more realistic than in the past, when there was so much cash being thrown around. So I wouldn't I don't look at it as a dire situation.

For the strategics, the model is looking at the portfolio, and trying to understand the assets that you've acquired over time, with markets and healthcare delivery changing, do they still fit together logically? Not only GE [with the healthcare spin off], but announcements by Medtronic and Baxter and others. It’s the natural course of evolution of large companies, looking at the portfolio, and better understanding where you can apply capital for growth, and where capital competes inside an organization that's healthy or unhealthy. What we've seen is that allowing capital to be deployed inside of a smaller organization that's more focused is going to drive innovation. And that's good for the smaller companies coming up — their ability to sell or license with or partner with companies like this is going to be much better so that we think this is accretive to the overall market, top to bottom, especially at this time, given all the technology advances.

What are those advances? In the diagnostic space you've gotten AI on imaging diagnostics, which has been the fastest growing space for several years, genomics. But also from a healthcare delivery standpoint, around clinical communications and being able to connect to platforms that the healthcare systems are using both inside or outside the hospital, to help improve workflow to better integrate the data from your particular devices or equipment, into decision making and eventually outcomes. Remote monitoring, clinical communications workflow, advanced decision making, being able to use data to not only demonstrate good outcomes across populations, but also predict outcomes before they actually happen. And they're all commanding more investment from both from the big players and the VC firms as well. So I think that the shifts and healthcare delivery, I think, continue to make it a technology-based play.

Mark Goldwasser, CEO of Ceros Financial Services, who fundraises for early stage medical technology companies focused on diagnostic and non-invasive procedures.

You've got to think about American healthcare in the post-Covid environment. Hospitals have been overrun, and they failed, particularly for patients who were waiting in line for elective surgery or other surgeries. So what we're doing now is looking for minimally invasive, artificial intelligence, digital companies, robotics, data: the better, cheaper, and more economic solutions for hospitals. And we've found something interesting. People prefer an ambulatory setting to the hospital if they're going to have surgery. So all the devices [we are looking at investing in] are smaller, lighter, they can fit in and work with ambulatory outfits. I can't mention names, but one has a medical waste disposal business, another is involved in acute kidney injury — they have a delivery system and a therapeutic that goes in once they get to the right spot. Non-invasive surgery is another big area we are looking at: An Israeli firm that has a less invasive way to perform hysterectomies, another that does non-invasive brain surgery and a remote monitoring system for people with congestive heart failure.

The big picture is there's no shortage of people with cash. I get emails almost every second. The majors are sitting on cash. Johnson and Johnson just paid $16.6 billion for Abiomed. When they see something, they’ll find the cash to buy it. We are hoping that the public markets open up in the new year because we in the space of small privately held companies know there is a relationship between the public companies and the private market in the same space. So if public companies are in the tank, it's very, very difficult to get the private stuff. The IPO market has been dead the last six months as well as the stock market. That said, prices have come down. What was 12 to 18 times revenue is now six to 12 times revenue.

Post-COVID, we are at a fulcrum point where people are going to decide what they want to be. Some people will want to get out of certain lines of business, and they're going to go into new lines of business. And devices are going to be smaller, cheaper, quicker, more economic. And they'll be able to fit into surgical centers in ambulatory settings. And hospitals, which have lost a lot of money during COVID are very wary about cost. So if you've got something smaller, cheaper, quicker, less invasive, it's your product that’s going to be bought by somebody.

Consulting firm KPMG, in their 2023 Healthcare and Life Sciences Investment Outlook, subtitled “Sustained turbulence in a post-pandemic market,” based on a survey by the firm of corporate and private-equity dealmakers:

A surge in demand for some device makers could help shape the medical device deal-making outlook. But 51% of survey respondents expect medical device deal-making to be characterized by small strategic tuck-ins. Only 29% anticipate strategic partnerships, and only 20% expect large consolidations. In last year’s survey, small strategic tuck-ins had only a slight edge over strategic partnerships. [And] 88% of survey respondents said their plans are being influenced by the FTC’s increasing scrutiny of industry consolidation.

Wearable tech for remote monitoring of blood pressure, oxygen saturation, falls, and other vital signs continue to gain popularity, and the use of virtual reality for training, pain management, and other applications is increasing. With more and more devices connected to the internet, the need for cybersecurity is also getting attention from medical device companies, with blockchain technology expected to be a crucial resource.

The resumption of elective surgery and procedures across most medical specialties that began in 2021 continued in 2022 and should encourage deal-making for medical device manufacturers in 2023. If public markets trend upward while potential sellers become more realistic about valuations, it could release pent up demand for M&A.