Versant Ventures' Kirk Nielsen and New Enterprise Associates' Justin Klein are already two deals in to the dozen investments they plan to make from Vensana Capital's inaugural $225 million medtech fund, officially launched last month.

Venture investment in medtech has inched up the last few years, with EY reporting it hit about $8.5 billion in the year ended June 30. But few significant, pure medtech venture capital and growth equity firms exist. The Vensana pair is looking to begin to "fill that gap" with their first fund over the next three years.

Why now? Beyond the personal and professional stars aligning for Klein and Nielsen, it's a "healthy ecosystem" and "just a really undercapitalized sector in terms of private investment," Nielsen said.

Part of that has to do with big medtechs' reliance on smaller players for fresh tech, Klein said, likening the pattern to pharma's tendency to build drug pipelines via acquisitions. M&A will continue, he said, as major companies lack the capacity to support a robust pipeline based on internal R&D alone.

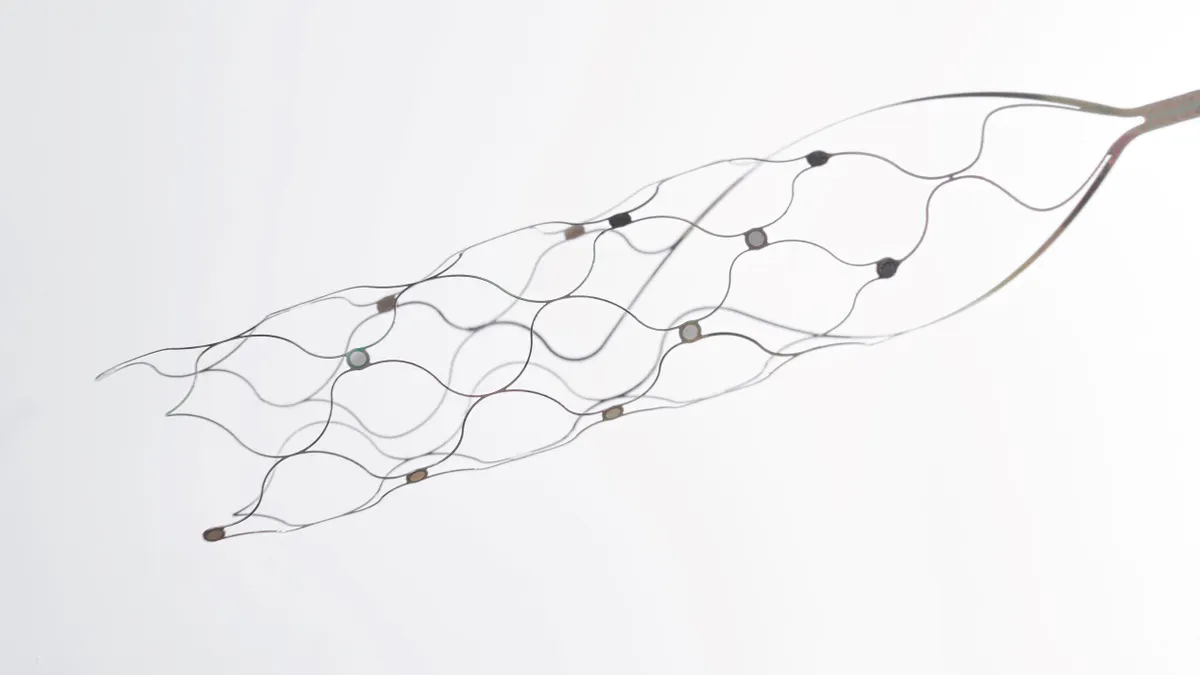

Since transitioning to Vensana last December, the pair has invested in Intact Vascular, which is developing medical devices for minimally invasive peripheral vascular procedures, and a spin-out company, Vesper Medical, which is working on a venous stent system.

The business partners will consider "anything outside of biopharma,” which they define as medical devices, diagnostics and data science, drug delivery, digital health, and tech-enabled services — although they expect the majority of their first funds to land with traditional devices.

Questions and responses have been edited for clarity and brevity.

You've said before you're interested in opportunities in chronic disease. Are there specific areas you find most interesting? Do you seek out companies in those areas, or simply look for which companies in the broader marketplace are most attractive?

KLEIN: I think there are some obviously still very large unmet needs in a lot of different chronic disease categories, so we try to pay attention to them. I think from a medtech perspective, we particularly focus on areas where those diseases are currently really well under-served by drugs, and a medical technology solution — whether it's a product or a tech-enabled service — is something that addresses some of those core reasons that drugs have fallen short. It could be mechanism of action, and some underlying physiology or anatomic issue that makes the disease hard to manage for a drug. It could also be something related to compliance or adherence. And knowing that, frequently, our therapeutic solutions may be a one-time procedure, or something that can better enable the patient to live with their condition, we think medical technologies can play a really valuable role in chronic disease.

I think the second way in which we look at these categories and prioritize them is according to the broader landscape of large commercial acquirers in the medtech space. The way our ecosystem works is that, in general, I think venture-backed companies have provided a lot of the next-generation innovations and product opportunities that either make existing categories better, or create new markets of opportunity that can be adjacent to where some of the big businesses are today.

So we think a lot about ways in which our companies are developing products that ultimately may be best scaled through some of the largest existing medtech companies today because they have significant advantages around economies of scale and distribution and manufacturing and quality systems. And so when we think about figuring out some unmet need, we also think a lot about where the big companies have existing footprints today, and might be able to really build big businesses, if we can help provide them with the best new products and technologies to go after those clinical issues.

Can you talk about due diligence in medtech? How much clinical evidence do you need to see before making an investment?

NIELSEN: We really want to stick to the areas that we know best. I think, at times, investors can get into trouble when you invest in a market where you don't know what you don't know ... As we've seen different categories grow, the appeal of potential technology opportunities impacting healthcare is obviously really significant, and it's attracted a lot of investors to some of these companies where they may not be specialists or have that domain expertise. So I think we want to avoid those types of challenges ... we've grown up really focused on medtech, and that's where we remain committed on focusing the fund.

The kinds of companies that we intend to back are those where we feel like you can create meaningful value in more compressed timeframes. And so, in certain areas, that's going to be a commercial-stage product where we're funding launch or we're funding growth. In other areas where we feel like the corporate buyers are going to be more aggressive, we would be comfortable investing at the clinical stage. And I think where we'd invest depends a little bit on that category. There are going to be some for sure where they'll likely have pilot data, and we may come in and fund a pivotal study that we think has the chance to drive an exit or create meaningful value.

There are other areas, like Vesper for example, where we actually invested before they had clinical data, but it's in a category that's really well understood. You've got other products that have gone before, that have kind of pioneered in that space. You understand the mechanism of action fully, and you understand the risks that you're going to manage. And you've got a well-blazed regulatory path in an existing market. So in those cases, we may go a bit earlier.

Is there a recent medtech exit that stood out to you the most?

NIELSEN: There have been a lot of big ones. If you look at private medtech, on the investment side, there's some pockets that have heated up a little bit. But for the most part, relative to biotech, there's still a lot of value in private medtech (or relative to tech, for that matter.) But the exit market has been probably as strong as we've seen in a long time, and maybe ever.

You've got Auris that sold for $3 billion-plus … that was a company that was just about to launch commercially in the U.S. And then you've had a number of really solid, what I'd call down-the-middle, medtech exits — $300 million to $600 million exits, which are kind of the lifeblood of the sector.

And then you've had an IPO window that's been open. You've had a variety of companies that have gone out and done well; you've got a number of them trading at billion or billion dollar-plus market caps, either with relatively modest revenues, or even, in some cases, pre-commercially. So it's been a really interesting time in the sector in the last 12 to 24 months.

Generally, I think big-cap medtech right now — or mid-cap for that matter, or small-cap, or any public company in medtech — they're really being valued based on projected growth. And so I think that's why you're seeing some of these acquisitions either have products that are in their core, or adjacent to their core. They're all struggling with the same thing, especially the big medtech companies, which is: how do they turn? How do they become a 6-7-8-9-10% grower versus a 0 to 2% grower? Because if you look at the multiples between those two groups, it's striking how different they are. And so I think a lot of them, they're always going to have ‘goal times' they can do within the core businesses, but I think a lot of them are starting to look at adjacencies.