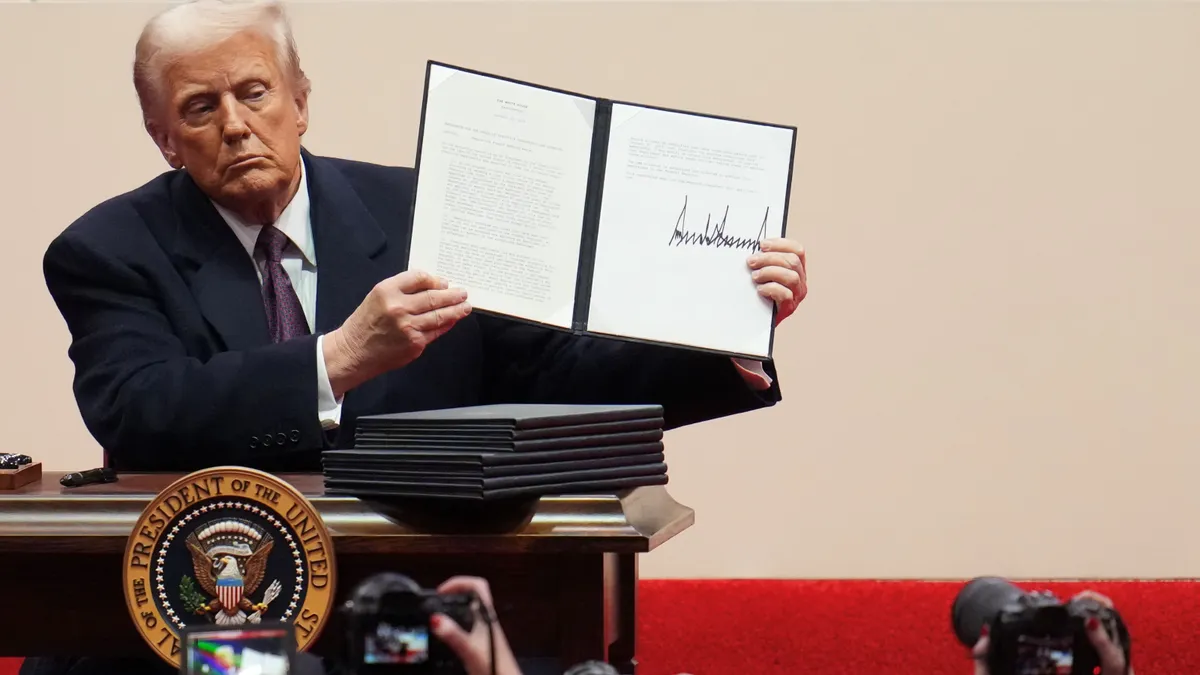

Medtech earnings season gets started the week of April 18 with a series of updates that will shed light on whether elective surgery recovery is strong enough to offset a range of headwinds that are buffeting the industry.

Johnson & Johnson will kick off the earnings season on April 19, followed by Abbott Laboratories and Intuitive Surgical. As in earlier quarters, the companies' presence at the vanguard of the reporting season will make them bellwethers for the broader industry, with analysts and investors scrutinizing the results for implications for medtech companies that report in the coming weeks. Analysts at Bank of America set the scene in a note to investors on Monday.

"We enter Q1 earnings with a multitude of crosscurrents to consider. Most investors expect a better elective recovery offset to some degree by supply disruptions that could negatively impact Q1 sales and inflation/[foreign exchange] that will bring in future margin/EPS outlooks. The question is more magnitude and duration of the hits,” the analysts wrote.

Medical device revenue in 2021

| Company | Q1 revenue | Q2 | Q3 | Q4 | Full year (YoY growth) |

|---|---|---|---|---|---|

| Johnson & Johnson's medical device unit | $6.6B | $7B | $6.6B | $6.9B | $27.1B (18%) |

| Abbott Laboratories | $10.5B | $10.2B | $10.9B | $11.5B | $43.1B (25%) |

| Intuitive Surgical | $1.3B | $1.5B | $1.4B | $1.6B | $5.7B (31%) |

SOURCE: SEC quarterly earnings filings

Johnson & Johnson will be the first company to provide results that shed light on those questions. The continuation of the COVID-19 pandemic, particularly in China and other parts of Asia, has tempered analyst expectations about the performance of J&J’s medical device unit. Earlier this month, J.P. Morgan analysts forecast J&J will miss the consensus sales forecast by $557 million, primarily because of a shortfall in its medtech business.

“On the MedTech business, we are moderately lowering estimates to reflect (a) the near-term impact of Omicron challenges on 1H22 procedure volumes particularly in China and broader Asia while (b) we expect growth stabilization in what we hope to be a normalized 2H22. We expect softer 1Q/2Q 2022 results and guidance based on challenges from Omicron particularly with ongoing China disruptions,” the analysts wrote in a note to investors.

The extent that COVID-19 cases affect results will depend on a geographic sales mix, with the anticipated recovery of elective procedures in the U.S. and Europe after the winter wave contrasting with the situation in China, where almost all of the 26 million people in Shanghai have been locked down.

Intuitive, which will report results on April 21, has limited exposure to China. Analysts at Bank of America put China’s share of Intuitive procedures at 4%, suggesting the company can weather disruption in the country if volumes rebound in the U.S. The analysts are upbeat about Intuitive’s prospects, naming the company as one of their top picks going into the quarter.

The bullish assessment reflects a belief that the 10.9% procedure growth expected by Wall Street “looks like a low bar looking at sequential growth.” Yet, like other high-tech medtech companies, the robotic surgery specialist needs semiconductors, as an ongoing shortage has affected the medical device sector and a host of other industries.

Intuitive has highlighted supply chain disruption as a risk factor in 2022, according to analysts at RBC Capital Markets, and faced minor, immaterial limitations on the supply of skill simulators in the fourth quarter. However, the BofA analysts said the company "sounded good on chip availability for this quarter" at an event held last month. If supply disruptions pressure margins, the BofA analysts think the company has some flexibility to offset margins given its plus-20% growth in operating expenses.

The RBC analysts named Intuitive alongside Abbott on the list of medtech companies that may be exposed to disruption to the supply of electronic components. Abbott will reveal the extent to which the supply situation has affected its business when it reports earnings on April 20.

RBC took a deeper look at the supply risk earlier in the month, breaking the disruption up into three buckets. First, with oil prices rising 33% during the first quarter, freight costs may have gone up. Second, the cost of raw materials, notably electronic component costs, are rising. Third, shortages of staff could affect labor costs, although the analysts said costs currently appear to be stable.

The analysts expect rising freight costs and chip shortages to hit Abbott, although, with the company forecasting a $500 million supply chain and inflation headwind going into the year, some of the pressure is baked into its forecast. In COVID-19 testing, Abbott has a potential tailwind to counter rising costs.

In late January, Abbott provided full-year guidance that included an initial COVID-19 testing-related sales forecast of $2.5 billion, which the company expects to occur early in the year and will update on a quarterly basis. However, RBC in a note last month said the U.S. Department of Defense increasing their contract with Abbott from $360 million to over $1 billion "is not incorporated into Abbott's COVID testing guidance, since management only includes contracts they have visibility into at the time of issuance."

The RBC analysts expect the COVID-19 testing business to more than offset challenges elsewhere. Analysts at J.P. Morgan expressed similar sentiments.

"Following the Omicron surge early in the quarter and with cases on the rise in several international countries, we once again expect a beat on COVID-19 testing sales in the quarter and see room for numbers to continue moving higher over the balance of the year," the J.P. Morgan analysts wrote.

A similar set of factors will influence the results of companies such as Baxter, Becton Dickinson, Stryker and Zimmer Biomet, which are scheduled to report later in the earnings season, although how much depends on the specifics of each business. For example, the RBC analysts identified Stryker among the medtech companies that may be most affected by China's zero-COVID policy.