The medical technology industry — imaging in particular — is bracing for what could be rough times as a number of companies are hit by tariffs and counter-tariffs in an escalating trade war between the U.S. and China.

The battle has ramped up considerably in recent months. The Trump administration imposed 25% duties on $34 billion in Chinese goods in early July, then slapped tariffs on an additional $16 billion worth of imports earlier this month.

The administration has also directed the U.S. Trade Representative to look into imposing a 25% tariff on $200 billion worth of additional products from China, including parts and materials used to make medical devices.

Each time, China has fired back with dollar-for-dollar tariffs on U.S. products, the latest on Aug. 7 with $16 billion worth of tariffs on U.S. exports. Among the items caught in the crossfire are MRIs, electrocardiograms, CT scanners, ultrasound devices and X-rays equipment.

“If this keeps escalating and the retaliation goes back and forth, a tit-for-tat game without any end in sight, that’s very concerning to our industry and ultimately to patient care,” said Patrick Hope, executive director of the Medical Imaging & Technology Association, which represents heavyweights like GE Healthcare, Medtronic and Philips, among others.

Layoffs and cuts in R&D

MITA surveyed members to gauge impact the tariffs might have on productivity in the medical imaging sector. The response, “pretty categorically,” was imposition of tariffs would lead to layoffs and major cutbacks in research and development, slowing innovation, he told MedTech Dive.

“If we are passing on the cost, alternatively, to the healthcare provider, then that reduces their ability to make purchase, particularly when margins are so tight in all hospital facilities in the U.S.,” Hope said. “And so those decisions to buy the latest and greatest innovative technology will be diminished, and that will hurt patient care as well.”

The tariffs have Hope and others in the industry scratching their heads. Historically, healthcare products have been excluded from tariffs for humanitarian reasons and because they are seen as an asset to public health. And according to AdvaMed, the U.S. enjoys a trade surplus with China for the medical products on the USTR list and had an overall deficit with China of less than $400,000 last year.

If the desired outcome is to level the playing field between the world’s two largest economies, then the administration should look elsewhere, they say. Rather than grow U.S. productivity, there will be less trade and a smaller surplus — in medical imaging at least.

“We remain concerned that these tariffs could make it harder for U.S. manufacturers to compete in the global economy, and will shrink rather than expand U.S. exports,” GE Healthcare spokeswoman Kelley Sousa said in an email.

Some companies face double tax

The tariffs and retaliatory duties are particularly harmful to companies with manufacturing plants in China, amounting in essence to a double tax when components or whole systems are sent back and forth between the two countries. “Levying a tax on both those transactions really inflates the cost,” Hope said.

“The inclusion [MRIs] ... is a huge shock for the industry,” said Leon Lei, marketing specialist at China Med Device, a consulting firm based in North Andover, Massachusetts. “Siemens has 35.1%, GE 30.4% and Philips 22% in China MRI market share in 2017. Will the big players move more facilities to China is a big question.”

Faced with the tariffs and other advantages for domestic-made products, Lei predicts more foreign companies may choose to set up local manufacturing facilities in China. Other reasons include the Chinese government’s encouragement of contract manufacturing and increased intellectual property protections.

China’s government is particularly interested in medical capital equipment from an industrial development perspective, and it is a sector where Chinese companies are increasingly competitive, noted Stephen Sunderland, a partner at L.E.K. Consulting based in Shanghai.

“If the dispute worsens, I expect we’ll see further tariff action in that area,” he told MedTech Dive in an email. “Those customers who have a strong preference for the latest in global technology may choose to defer their purchase from the U.S. (e.g., if prices have increased due to tariff action) or re-consider switching to a European competitor.”

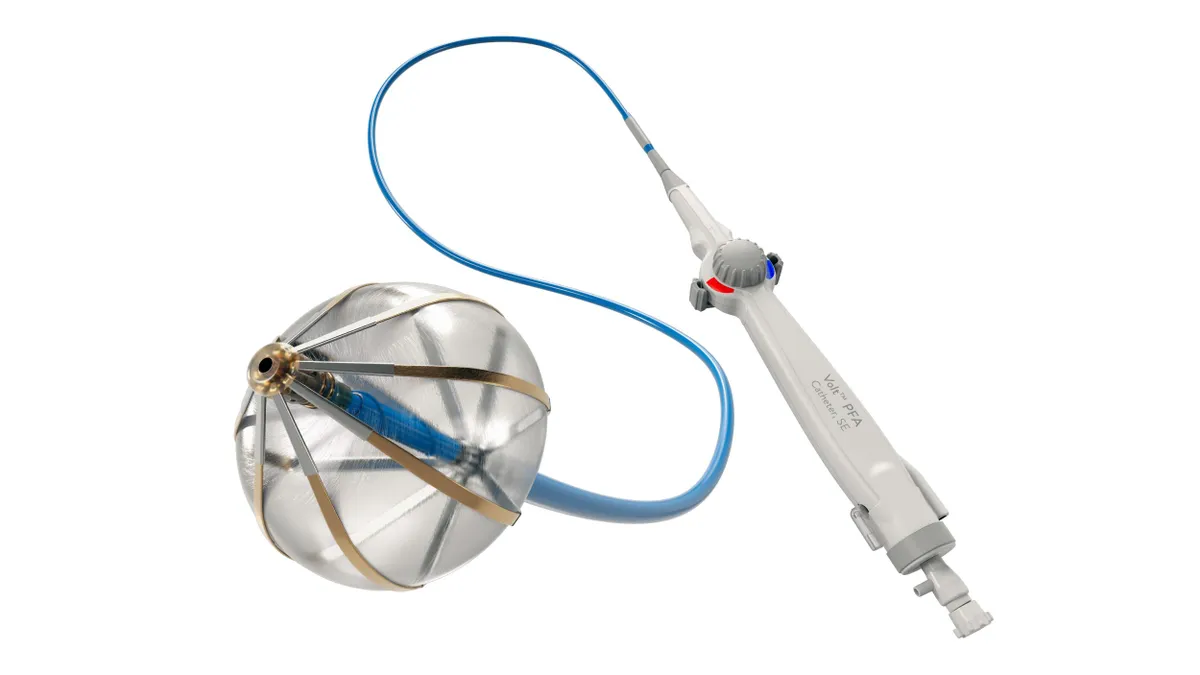

Other medical devices are also affected, including pacemakers, anesthesia devices, in vitro diagnostic reagents and medical gloves, as well as raw materials, components and accessories. In a petition to the USTR seeking exemption from the duties, American Diagnostic Corporation said being forced to absorb tariffs on a component of one of its patient monitors would “wipe out our entire corporate profit,” while discontinuing the items to avoid losses would force it to lay off up to 10% of its staff.

Since the tax plan includes ophthalmic devices and accessories, Lei said a global ophthalmic device supplier that exports products from the U.S. to China is contemplating shifting its U.S. business to India or Indonesia or building a manufacturing facility in China.

Profitability will suffer

The USTR has set up a process for companies to seek exemptions from the tariffs, and AdvaMed and MITA are encouraging affected members to do so. Hope said he has not heard any reports of success to date.

In the meantime, manufacturers of medical imaging technologies are trying to calculate the toll the tariffs could take on their business and drawing up contingency plans to deal with the impact.

“It’s my view that the tariffs will bite unavoidably on the short term profitability of sales of medtech products in China for those companies importing from the US in the affected categories,” Sunderland wrote. “Over the longer term, however, the effects are very complex and specific to the company and product.

One of the reasons the short-term impact will focus on profitability is that prices for larger-volume products like orthopedic joints and intraocular lenses tend to be periodically fixed through public tendering processes, he said. As a result, there is not likely to be an immediate pass-through change in prices of U.S.-made products.

Consumers are not likely to see an immediate trickle down effect from tariffs on medical technology, but over the long term, patient care could suffer, Hope warned.

"The providers that are purchasing equipment, if the cost is increased by 25%, for example, that’s going to certainly lessen their ability to buy that capital," Hope said. "I don’t think we’ll see that people won’t get a scan, but they’ll get it on older equipment that probably needs to be updated."