Mammoth Biosciences, a biotech startup co-founded by CRISPR pioneer Jennifer Doudna, is expanding its efforts to turn the gene editing technology into curative treatments for disease, announcing Thursday $150 million in new funding that will help it expand beyond its current focus on diagnostic tests.

"Traditionally, Mammoth has been positioned as a diagnostics company," Janice Chen, a co-founder who serves as the company's chief technology officer, said. "But really, our vision is much broader than that. We're thinking about CRISPR as a search engine at large."

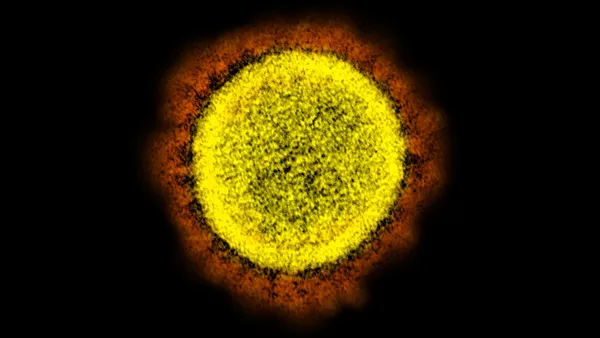

Chen said the company, which pivoted quickly at the beginning of the pandemic to develop a CRISPR-based coronavirus test, saw an opportunity to use its technology to improve upon the first generation of medicines based on the gene editing technology.

"In the very beginning, we already had an exciting new product, which was these new diagnostic applications," Trevor Martin, another co-founder and current CEO of Mammoth, said. "But it wasn't lost on us that as we continue to explore the diversity of life, there can be exciting things in therapeutics."

The Series D round, which follows 10 months after Mammoth raised $45 million, was led by Redmile Group, with support from Foresite Capital, Senator Investment Group, Sixth Street, Mayfield, Decheng Capital and NFX.

With the fundraising, Mammoth claims it's now worth more than $1 billion, a sizable sum but significantly less than the market valuations of public CRISPR drugmakers like Intellia Therapeutics, CRISPR Therapeutics and Editas Medicine.

Those companies are well out in front in using CRISPR to craft human medicines. Each is currently in clinical testing and initial results from Intellia and CRISPR Therapeutics are promising. The first data from Editas are expected later this month.

All three are researching CRISPR gene editing as a technique to modify patients' cells in a laboratory as well as directly inside the body. It's the latter, more challenging task that Mammoth plans to focus on.

Mammoth owns rights to CRISPR-associated cutting proteins that are particularly small, an advantage when trying to package the editing tool into a delivery vehicle that can enter cells inside the body. Martin said these "ultra-small" proteins will help the company aim at tougher-to-reach disease targets, although he didn't disclose which ones.

The proteins Mammoth uses are known scientifically as Casφ, Cas12, Cas13 and Cas14, each a different flavor of enzyme than the Cas9 protein that Doudna and others made famous a decade ago. In addition to their small size, Mammoth claims these enzymes are more temperature stable and capable of high fidelity editing.

Both Martin and Chen are former students of Doudna's in her lab at the University of California, Berkeley, where they launched Mammoth.

Mammoth gained recognition earlier in this year by developing a diagnostic test for COVID-19 based on CRISPR science. Researchers discovered Cas12 enzymes could be employed to identify and tag the coronavirus' genetic sequence, which then provides a visual result that can be read by a machine. The company partnered with the National Institutes of Health, the Defense Advanced Research Projects Agency and GlaxoSmithKline to develop the test and recently secured emergency authorization for it from the Food and Drug Administration.

Mammoth will continue to work with "both industry and government agencies" to create CRISPR diagnostics for this pandemic and future ones, too, Chen said. She said the coronavirus pandemic served as a "proving ground" for the company.

PerkinElmer and Qiagen are among other medtechs to target the rapidly growing CRISPR market with technologies designed to aid gene editing to correct genetic defects and treat cancer, hemophilia, sickle cell anemia and other diseases.

With a $1 billion valuation, Mammoth could be the next Doudna-founded company to go public, though the company did not respond to questions on whether it plans to do so. Caribou Biosciences, another Doudna-associated startup using CRISPR, recently raised more than $300 million in an IPO.