Medtech majors used this week’s virtual J.P. Morgan healthcare conference to talk up their plans in the hot, increasingly competitive robotic surgery sector. Here, we round up what executives from Intuitive Surgical, Johnson & Johnson, Medtronic and Zimmer Biomet said about their activities in the area.

Intuitive still facing COVID-19 risks

The robotic surgery incumbent used the conference to pre-announce its fourth quarter results, revealing sales that beat Wall Street consensus. Intuitive exceeded revenue predictions despite procedure growth falling short of analyst expectations amid the resurgence of the COVID-19 pandemic late in the fourth quarter. The company's growth and sales beat came from system placements. Intuitive placed 326 systems in the quarter, compared to the 297 predicted by analysts.

CEO Gary Guthart told investors fourth quarter results benefited from “some budget flushing at the end of the year.” Guthart said the spending late in 2020 could translate into a tougher 2021 than expected but overall the CEO argued the fact hospitals are still buying systems among competing priorities as a good sign.

Other signs are less encouraging for Intuitive and the broader healthcare sector. Diagnostic pipelines are yet to refill after the pandemic stopped procedures, Guthart said, and colonoscopies and routine prostate cancer screening remain below historical levels.

The CEO expects procedures to pick up once the pandemic is under control and Intuitive to be well-positioned when it does. However, it remains unclear how long the disruption will last and how damaged the economy will be by the time it ends.

Those factors are shaping analyst perceptions of Intuitive. Analysts at SVB Leerink view Intuitive as a “premium” medtech but warned the uncertainty around COVID-19 and hospital capital expenditures limit its prospect of beating expectations.

UBS analysts called the medtech still the class-leading, but warned of "ongoing risks from competition and pressure on capital budgets."

Rosa placements best yet for Zimmer

Zimmer is among the companies seeking to muscle in on the robotic surgery market. Having seen placements of Zimmer’s Rosa robotic knee surgery system pass 200 in the third quarter, CEO Bryan Hanson used the J.P. Morgan event to speak qualitatively about the performance of the business over the last three months of 2020. Hanson said the fourth quarter was Zimmer’s best yet for Rosa placements, adding that the pipeline is as strong as it has ever been.

If everything goes to plan, Zimmer will expand the addressable market for its robotic surgery system in 2021 by introducing its partial knee application. Zimmer is involved in more than 50% of partial knees done globally, Hanson said, making the application a “huge opportunity” for the company.

Other companies are interested in some of the robotic surgery opportunities targeted by Zimmer. However, Hanson argued its data would help it stand out.

“The most important thing is we're going to build data faster than others. And that data is going to be very powerful.”

Medtronic closes in on commercialization

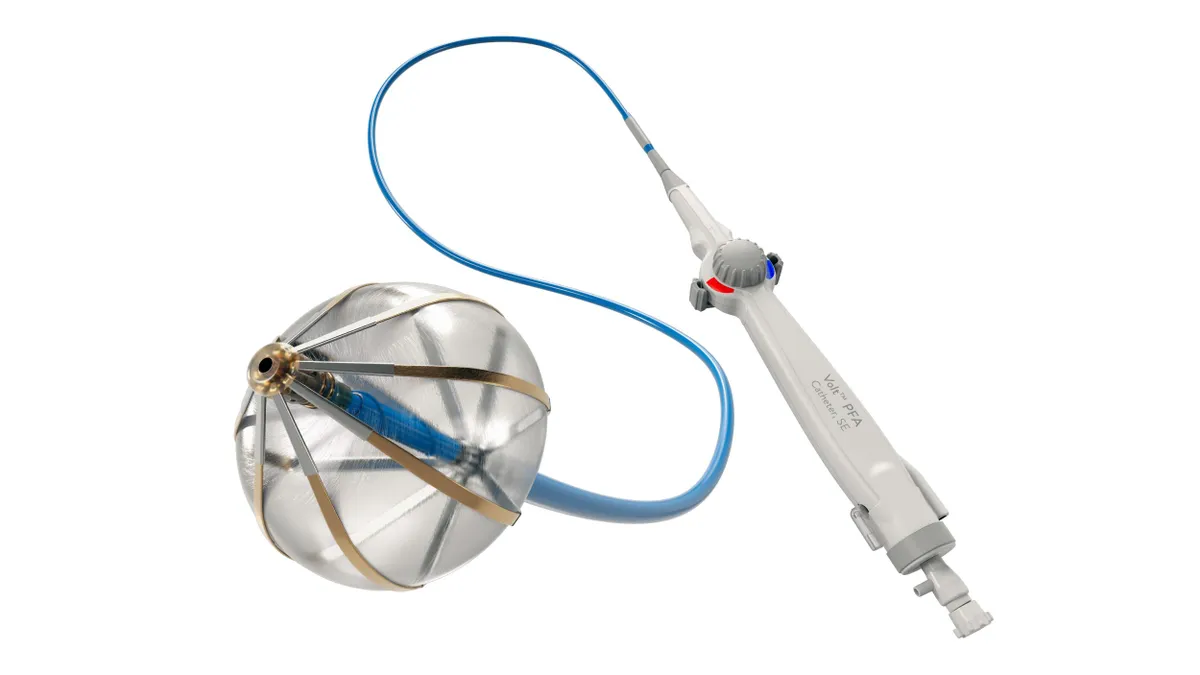

Medtronic expects its robotic program to reach major milestones in the coming months. CEO Geoff Martha told attendees at the J.P. Morgan event that the soft tissue robotic team plans to make a CE mark submission and U.S. investigational device exemption filing in March, moving Medtronic closer to commercialization. Medtronic expects to come to market with a differentiated offering.

“Our unique offering is designed to increase access to robotics by going after the barriers that have limited robotic surgery adoption to-date, namely cost and utilization challenges,” Martha said.

Medtronic’s soft tissue system will slot into a robotic surgery portfolio featuring the spine technology the medtech major acquired in its 2018 takeover of Mazor Robotics. Last year, Medtronic added to its spine technologies with the takeover of Medicrea. Like Zimmer, Medtronic is looking to build a portfolio of products such as AI-driven planning and personalized implants around its robots.

The use of robotics at Medtronic extends beyond surgical theaters. Martha said robotics is becoming a “core technology” at Medtronic that is being applied across the business. At manufacturing plants, Medtronic is using the technology to implement wafer-scale fabrication techniques. According to Martha, Medtronic is the first company to apply the techniques to medtech.

In doing so, Martha said Medtronic is reducing both the cost and size of its devices. Martha cited the LINQ II insertable cardiac monitor as being among the first Medtronic devices to benefit from the techniques. Continuous glucose sensors are next on the list of medical devices Medtronic wants to manufacture using wafer-scale fabrication techniques.

J&J looks past setback

J&J’s multi-front robotic surgery strategy has hit setbacks in recent months as it dropped plans to file a 510(k) filing for one platform and delayed a regulatory submission for another system. However, the Monarch robotic lung cancer system has gained a foothold since being cleared by FDA in 2018 and J&J remains committed to what it sees as a long-term growth opportunity.

Talking to investors at the J.P. Morgan event, J&J CEO Alex Gorsky said his team sees robotic surgery as something that will shape the business for the next decade, not a one or two year opportunity. On that timeline, the delays may be inconsequential but setbacks provide opportunity for rivals to enter markets ahead of J&J or entrench their existing commercial positions.

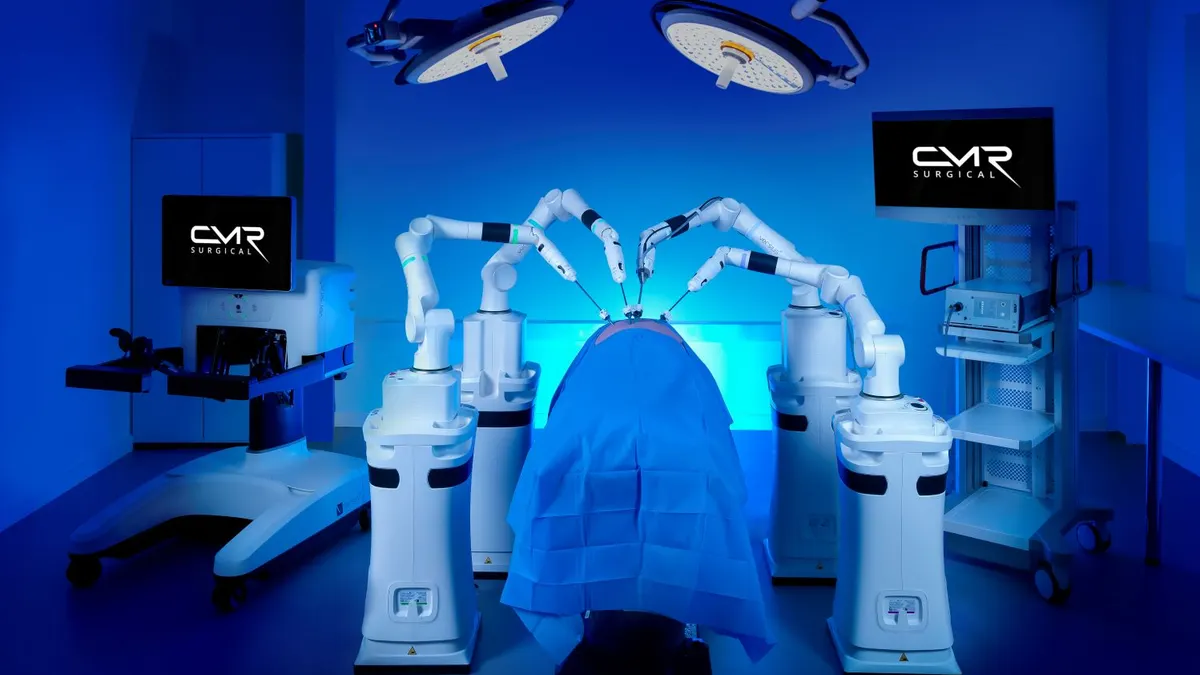

J&J outlined its medical device business for investors in November, saying that sales overall have taken a hit due to the pandemic. The company also spoke on a number of robotics offerings, including its six-armed Ottava system that is meant to compete with Intuitive's da Vinici robot and Medtronic's forthcoming soft-tissue robot Hugo.

The company is pursuing U.S. market clearance through the FDA's De Novo pathway and expects Ottava to enter first-in-human trials in the second half of 2022.