Procedure volumes have been one of the most-watched topics for medtechs in 2021, particularly for companies like Johnson & Johnson, Stryker and Boston Scientific, which are more dependent on surgeries to drive revenues.

After the industry looked like it was rebounding in the second quarter, the coronavirus delta variant hit medtechs in the third quarter. Now, as the year is coming to a close, the omicron variant is spreading across the globe, driving COVID-19 cases and hospitalizations up and forcing hospitals to, once again, limit certain procedures.

Ashley McEvoy, J&J's worldwide chairman of medical devices, contends the continual hit to procedure volumes has forced the company to work with hospitals around the world on strategies like turning overnight surgeries into day surgeries, finding new sites of care or using telehealth for pre- and post-operation visits.

Even with the pressure on procedures throughout the year, J&J's medical devices business maintained growth over both the pandemic-hit 2020 and pre-pandemic 2019 through the third quarter.

McEvoy spoke to MedTech Dive about the potential impact of the omicron variant and other pressures from the pandemic like staffing shortages. The device chief also spoke about how J&J's recently announced split will impact the medical device business and gave an update on the medtech's robotic surgery projects.

This interview has been edited for clarity and brevity.

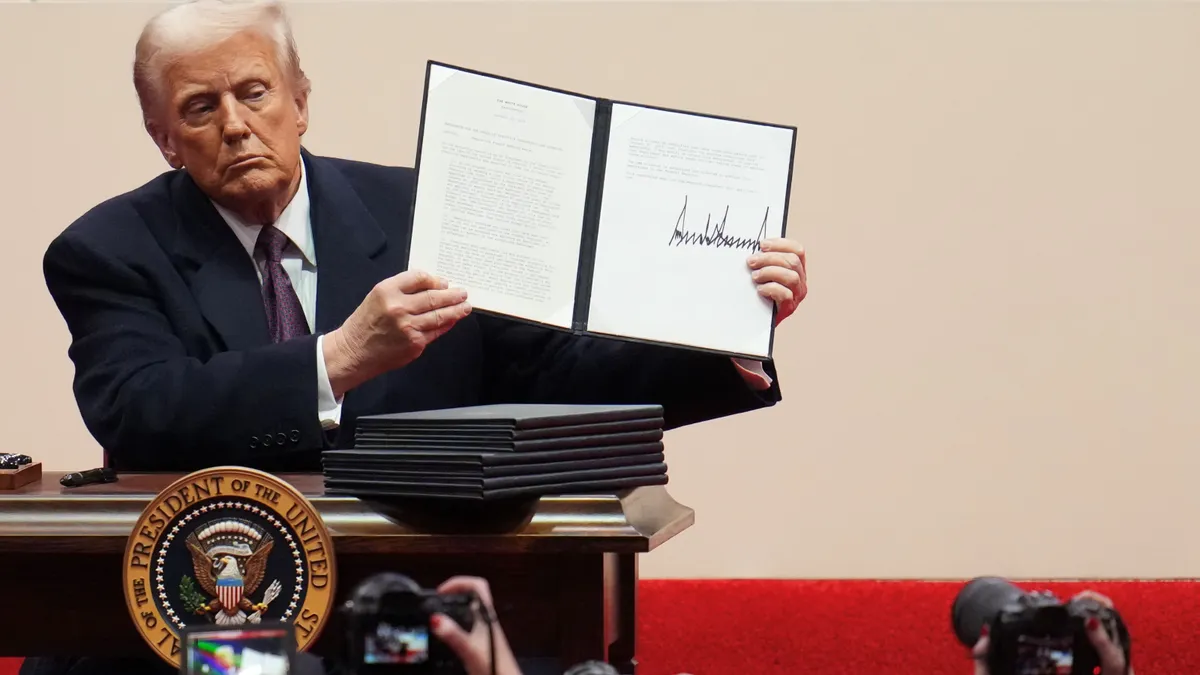

MEDTECH DIVE: There was an announcement a few weeks ago about J&J splitting the consumer health brands from pharmaceutical and medical devices. How will the split impact the medical devices business? What opportunities does it open up?

ASHLEY MCEVOY: Our mission is pretty similar — the pharma and medtech businesses — around the five leading causes of death. It's not just going to be a pure biologic that solves some of these challenges. It's probably going to take the best access, which medtech is world-renowned for. There's technologies like the miniaturization of devices, smart catheters and smart sensors that are used to access really difficult parts of the anatomy. This can help with the ability to disperse localized drugs that may have an immune effect.

If we want to solve lung cancer, bladder cancer or genitourinary cancer, it's going to take the combination of software, biopharmaceuticals and medtech.

By being a little more focused on just pharma and devices, will the split open up more opportunities for M&A?

MCEVOY: We spent $10 billion of capital the past couple of years, and I plan to continue to use external innovation to complement our internal pipeline. My ambition is that we grow faster than the market and we bring to life new standards of care. That's what we've been focusing on the past couple of years.

The other big question is regarding the emergence of the omicron variant. Are you seeing procedure volumes dropping as COVID-19 cases are spiking again?

MCEVOY: We always thought the COVID-19 pandemic would be more like a one-year effect or a two-year effect. Now, I think it's probably going to be a three-year effect.

I always say it depends where you are in the world. Asia is having some bumpiness with COVID affecting procedural volumes. Europe also had some challenges in the third quarter and, now, in quarter four. In the U.S., the data shows that hospitalizations are up around 24% the past two weeks. So, you know, we're not out of the woods yet. How COVID cases are managed in the winter months will be important.

On top of the procedure volume complexity, you can add the labor shortage, some supply constraints and some patient hesitancy to seek care in that environment. Those are the areas that are not in our favor.

But to balance that out, relative to historically where we've been, there are effective vaccines available now, there are effective boosters available, and we're much more battle-tested. You can only delay care in certain disease states for a certain period of time before it affects mortality rates. So, I feel like there's actually a demand upside, potentially, coming our way if we can weather through these surges.

Are you concerned — just with the timing of the omicron surge — that this is going to impact businesses in the first quarter of 2022?

MCEVOY: We're just being practical. Everybody's looking at different models and trying to, most importantly, partner with healthcare systems so they can deliver the most efficient and effective care. We're working a lot around the world, creating more day surgeries versus an overnight stay, for example. We're finding new sites of care where patients can go and feel like they're in a safer environment. And we're exploring how we can expand telehealth for things like pre- or post-op visits. Those types of strategies are going to continue to be integrated into the way we do business.

I don't think that the pandemic will have the effect that it did in year one, but I don't think that we're going to be "back to normal" in 2022.

From a long-term perspective, is your thinking or strategizing shifting away from a rebound or return to normal, like many people thought at the beginning of 2021, and shifting more to this time of variants being the standard going forward?

MCEVOY: We're going to be living in an endemic, and we have to learn how we can collaborate, continue to do innovation and continue to deliver both COVID-19 patient care and also traditional care, like orthopaedics and cardiac treatments.

Quite honestly, I'm amazed at the resiliency of the industry.

I always say there's not a linear line, because you might take four steps forward and maybe one step back. But I actually see the sun at the end of this.

During the third-quarter earnings call, you mentioned that procedure volumes weren't just down but diagnostics visits were also down, which can impact future surgery volumes. Where are diagnostics volumes at now?

MCEVOY: The good news is they're not lower than the procedures themselves, which tells you that patients are coming back. There was a point where those diagnostics visits were well below procedure volumes. For example, in the first wave in the second quarter of 2020, which I would tell you would be our trough.

We saw a huge improvement in quarter two, and we saw a little bit of a stabilization in quarter three, and that diagnostic visit volumes were trending ahead of how surgical procedures were performing. Now, if you were to ask me what do I expect, I think it might be a little bumpy right now given how COVID is performing and having an effect in Europe, in particular, and in the U.S.

In 2021, J&J rolled out the Velys surgical robotic-assisted surgery system for orthopaedics. How has the launch gone and how do you plan to expand the system?

MCEVOY: We're going to continue to share more as we get more data on Velys over the next 12 months. Right now, we're really gearing up for knee procedures to come back.

We're focusing on our placement strategy, working to get full utilization and getting optimal utilization before expanding out everywhere. We want to get surgeons who are new to Velys more comfortable with the system and have it be more broad based than one surgeon in that practice before we start to go to another practice.

Can you give an update on the Ottava delay? Is there any concern about competing with Intuitive Surgical and Medtronic now that you're falling two years behind the original plan?

MCEVOY: When you're dealing with breakthrough technology, you're gonna have temporary setbacks. You have to be a little more patient. These are decadeslong decisions for something like the architecture of the system. So, we have to make the right calls. We have to get it right. We need to have high confidence that it's worthy of the J&J name and that it's going to compete and be differentiated in the marketplace.

We all wish we had one sooner, but we have to be patient enough to do it the right way and have a very clear vision of the future of surgery and get the right experts around the table. We are going to find a way to absolutely compete in the space in the future.

One issue impacting the entire healthcare industry is staffing shortages. How is J&J dealing with that challenge and what can be done to try and solve, or at least improve, the problem?

MCEVOY: I was just looking at data recently, and I think nursing staffing numbers are down about 20%. That didn't happen overnight. We're looking at different source strategies, we're looking at different training strategies and we're looking at different development strategies to help with the issue.

The world needs nurses, the world needs nurse techs and the world needs surgical techs. This is a situation that has been developing for years that has been exacerbated by the pandemic. You're seeing everybody changing their strategies. A lot of hospital systems have been making sure that they're managing not just the compensation but the leadership and making sure that people feel valued.

There's also a huge recovery element of energy and grief and fatigue and energy for performance that hospital systems are doing. So, it's not just compensation. It's really treating the whole human being who is on the front line and hasn't been getting any breaks.

There's no magic answer. We're going to work our way through it. It's not going to be solved in a quarter.