Dive Brief:

- Johnson & Johnson's medical device sales during the third quarter posted their best adjusted operational growth in about four years, the big pharma and medtech reported Tuesday.

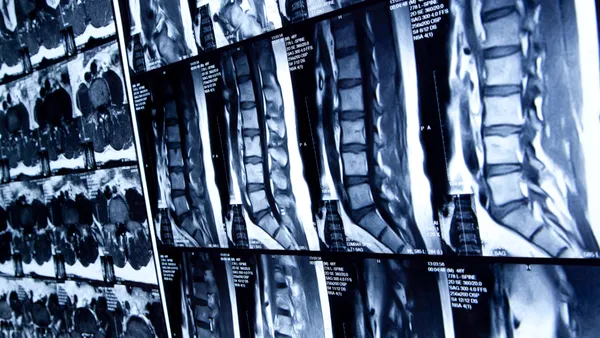

- The company's highlight reel for the medical device unit largely mirrored its second-quarter talking points on rising adoption of electrophysiology and international energy products. Notable upticks in knee sales in international markets, contact lens and wound closure product purchases, and better-than-expected spine revenues amid persistent pricing pressures in orthopaedics also contributed to the $6.38 billion in divisional revenue, topping analysts' predictions.

- R&D spending will continue to be funneled toward robotics and digital surgery investments, management said. Ashley McEvoy, executive vice president of medical devices, affirmed J&J is targeting a mid-2020 FDA submission related to its Orthotaxy robot-assisted orthopaedic surgery technology.

Dive Insight:

Amid legal troubles across its businesses — related to opioids, antipsychotic drug Risperdal, talcum powder and pelvic mesh — J&J delivered a beat-and-raise quarter.

Aside from a 3.1% decline in overall medical device revenues attributed to M&A activity like the $2.8 billion divestiture of the Advanced Sterilization Products business, completed in April, and the $2.1 billion sale of diabetes business LifeScan, closed in October 2018, adjusted operational growth of 5.3% represented the unit's strongest quarter since 2015, executives said.

J&J doesn't appear to be taking a big hit from the U.S.-China trade war, RBC Capital Markets analyst Brandon Henry told investors Tuesday, citing 19% year-over-year growth in the devices market. McEvoy said J&J struck a distribution agreement during the third quarter with Tinavi, the only orthopaedic robotic surgery company operating in China with a spine indication. While spine revenues declined both domestically and abroad, international market trends weren't as weak.

Management attributed declining knee revenues in the U.S. market to "competitive pressures," with Henry estimating Stryker is likely taking share. But those losses were "more than offset" by new product growth in international markets, executives said. J&J's orthopaedics arm DePuy Synthes launched a new cementless knee during the quarter.

J&J saw more balanced results in hip sales, which grew 1.1% in the U.S. and 2.7% internationally. Management highlighted DePuy Synthes' September acquisition of navigation software maker JointPoint to assist surgeons with hip replacement operations.

The trauma business saw the fastest U.S. growth among J&J's orthopaedics businesses at 5.1%. Outside of orthopaedics, the Interventional Solutions led acceleration among all medical device businesses with 13.4% reported growth, driven in part by a rise in atrial fibrillation procedures using J&J ablation catheters.

Executives also said daily disposable contact lenses boosted the Vision unit, which grew 5.4% overall on big international growth in surgical devices (9.9%) and contact lenses (7.4%). Management said some of that growth was inflated by forward buying in Japan ahead of a consumption tax change there.

The company raised expectations on reported sales for the year to the range of $81.8 million to $82.3 million, up from $80.8 million to $81.6 million. Executives anticipate adjusted operational growth to reach between 4.5% and 5%, up from the 3.2% to 3.7% projection offered last quarter.

Shares in Johnson & Johnson were up more than 2% Tuesday morning.