UPDATE: February 27, 2019: Tandem Diabetes stock was up more more than 25% Wednesday morning after the manufacturer reported an 89% year-over-year increase in fourth quarter revenues, raking in $76.2 million the last three months of 2018, toppling analysts' estimates of $56.4 million.

The insulin delivery company said its total revenues reached $189.3 million on the year, citing a 102% increase in insulin pump shipments.

Tandem also told investors CEO Kim Blickenstaff will transition out of the leading role after nearly 12 years, with COO John Sheridan taking over Friday. Executives project 39% to 47% growth in 2019.

Dive Brief:

-

Tubeless insulin delivery system maker Insulet beat consensus estimates late Monday with fourth quarter revenue jumping 26% year over year to $164.9 million, fueled by a 22% increase in U.S. sales of Omnipod and a 55% increase internationally, putting it on track to its goal of becoming a billion-dollar medtech by 2021.

-

The company's rising diabetes device sales mirrored growth in diabetes businesses across recent results from specialized companies like Dexcom and larger corporations like Abbott and Medtronic, despite increasingly crowded markets as more companies look to expand offerings.

-

Insulet competitor Tandem Diabetes, whose recent FDA approval for its interoperable t:slim X2 insulin pump created a new class FDA is calling Alternate Controller Enabled infusion pumps, is expected to report quarterly earnings of roughly $56.4 million late Tuesday, which would mark higher than 40% year-over-year growth.

Dive Insight:

Pure-play companies and diversified medtechs alike are enjoying uptake of newer technologies like continuous glucose monitors (CGM) and automated insulin delivery systems after a slew of FDA and international marketing clearances in recent years, with additional players racing to develop and market their own versions of these devices.

Dexcom reported 2018 sales last week that passed the $1 billion mark on strength of its G6 integrated CGM, which got FDA approval in March 2018, followed by CE marking in June and a nod from Health Canada this month. The glucose monitoring company, which lists both Insulet and Tandem as its preferred insulin delivery partners, set a 2019 revenue guidance between $1.175 billion and $1.225 billion.

Analysts at Jefferies called Dexcom "one of the best-positioned medtech stories" and said in a note to investors the quarter "capped off a banner year for DXCM as CGM awareness and adoption are on a steep curve."

The analysts noted CGM adoption currently sits at 25% to 30% among U.S. Type 1 diabetics, with somewhat negligible rates in people with Type 2, leaving significant room for market expansion.

Dexcom's 10-day G6 was one-upped by the July 2018 FDA clearance of the 14-day edition of Abbott FreeStyle Libre, neither of which require a fingerstick for calibration. Abbott’s diabetes sales hit $1.93 billion in 2018, a reported increase of 36.7% over 2017 and 28.3% on the quarter, with the last three months of the year driven by 300,000 new users. The company reported in January the total number of active users worldwide had reached 1.3 million, and CEO Miles White said the company is looking to expand the technology to reach more people with Type 2 diabetes.

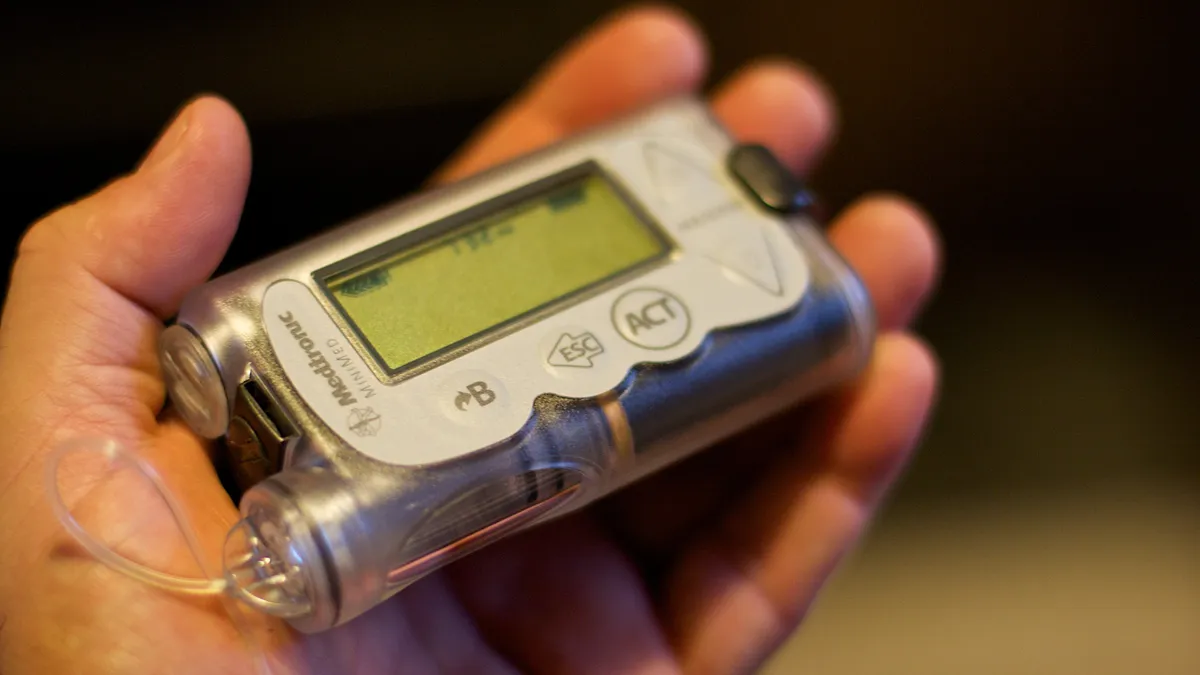

Unlike Dexcom and Abbott's businesses, Medtronic's diabetes unit, the smallest of its major groups, incorporates monitoring as well as insulin delivery. Medtronic's MiniMed 670G system was approved by FDA in 2016 as the first hybrid closed loop system for people with Type 1 diabetes, connecting the MiniMed 670G insulin pump with its Guardian Connect CGM. Still, the diabetes unit had a comparatively weak recent quarter, reporting 4.5% growth, and Leerink analysts predicted in January Medtronic's pump benefit will decline, likely to lose market share to Tandem and Insulet.

But a new offering is on an accelerated path for Medtronic, with the company focusing on development of a personalized closed loop system, which received breakthrough device designation from FDA earlier this month.

"The PCL device appears to add automated meal-time calculations and addresses one of the main shortcomings of automated systems: the lag in interstitial glucose after eating a meal," Jefferies analysts wrote. "By automating the feature, the new device moves ever closer to a true artificial pancreas."

Insulet, whose incoming CFO Wayde McMillan was picked up from Medtronic’s Minimally Invasive Therapies Group, is currently building its own hybrid closed loop, personal smartphone-controlled system, the Omnipod Horizon, set to launch in the back half of 2020.

Analysts at William Blair noted that Insulet hit its first full year of GAAP profitability in 2018 with operating margins of 9.8%.

"Insulet once again saw a record number of domestic patient adds in the fourth quarter and we estimate the U.S. installed base grew around 20% for full year 2018," they wrote. "Record patient adds should provide a strong tailwind to 2019 sales growth as Insulet continues to benefit from expanded market access."

Partnerships on the diabetes tech horizon include Dexcom and Google-backed Verily working to create the next generation G7 CGM by the end of 2020. Dexcom will also be the preferred CGM provider for Verily's Onduo management system in development for people with Type 2 diabetes. Likewise, Abbott has been aligned with Bigfoot Biomedical since 2017, with startup Bigfoot planning to incorporate the FreeStyle Libre CGM technology into its automated insulin delivery system, anticipated to launch next year.

Tandem's earnings call Tuesday will likely address its recently cleared product, which FDA said in its approval notice will allow patients to "tailor their diabetes management to their individual device preferences." Senseonics, the fourth FDA-approved CGM manufacturer which sells a 90-day product, will report earnings March 12.