Dive Brief:

- A federally funded randomized trial assessing treatment strategies for patients with stable ischemic heart disease found interventional procedures are no better for reducing major cardiovascular events compared to medication-based therapy alone.

- Investors in stent manufacturers like Boston Scientific had anticipated the results from ISCHEMIA (International Study Of Comparative Health Effectiveness With Medical And Invasive Approaches), presented this weekend at the American Heart Association's Scientific Sessions, because of their potential to deter doctors from recommending interventional procedures.

- But the top-line results were largely unsurprising and within expectations, numerous sell-side analysts said. Additionally, secondary quality-of-life results indicated people with chest pain symptoms experienced meaningful benefits from interventional procedures, perceived as a win for medtechs.

Dive Insight:

The goal of ISCHEMIA was to settle the debate over which management strategy is best for higher-risk patients with stable ischemic heart disease. Specifically, investigators want to know whether cardiac catheterization followed by optimal revascularization, on top of optimal medical therapy, or drugs, would result in better outcomes on a cardiovascular events composite compared to drugs alone.

Funded by the National Heart, Lung, and Blood Institute, the more than 5,000-participant, 320-site study assessed individuals 21 years of age or older who demonstrated at least moderate ischemia on a qualifying stress test.

The primary outcome measure was a composite of cardiovascular death,heart attack, resuscitated cardiac arrest, or hospitalization for unstable angina or heart failure, with approximately 3.5 year follow-up. The secondary purpose of the study was to determine whether a surgery as an initial strategy would improve symptoms and quality of life.

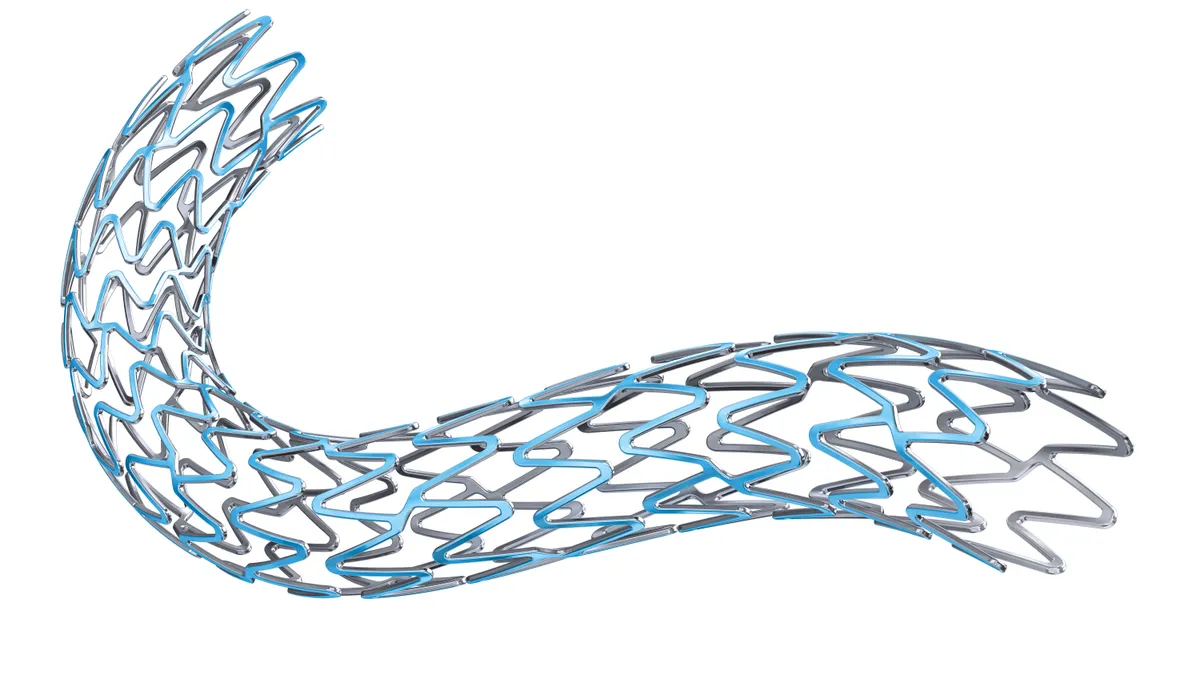

Patients in the conservative strategy group were put on a behavior change course related to diet, physical activity and smoking cessation as well as drugs like antiplatelets and statins. The invasive strategy group also was put on the lifestyle changes in addition to implementation of cardiac catheterization, coronary artery bypass graft surgery, and percutaneous coronary intervention.

"The trial showed that heart procedures added to taking medicines and making lifestyle changes did not reduce the overall rate of heart attack or death compared with medicines and lifestyle changes alone," the trial's investigators concluded. "However, for people with chest pain symptoms, heart procedures improved symptoms better than medicines and lifestyle changes alone. The more chest pain to begin with, the more symptoms improved after getting a stent or bypass surgery."

In the months leading up to the AHA meeting, investors had braced for impact from potentially unfavorable results, which could reduce doctors' readiness to recommend interventional procedures within the stable heart disease population. Boston Scientific's stents account for about 7% of the company's overall sales, per Needham analyst Mike Matson. Other major medtechs with exposure to a decline in PCI procedures include Medtronic and Abbott.

Boston Scientific CEO Mike Mahoney previously called impact from ISCHEMIA's unknown results "highly manageable in all scenarios." He said on the company's third quarter earnings call Oct. 23 that a potential $40 million loss, resulting from a possible 5% to 10% drop in revenue related to treatment of patients with coronary syndromes, would be the worst-case scenario.

Global Chief Medical Officer Ian Meredith added that 80% of patients undergoing percutaneous coronary intervention procedures in the U.S. have unstable angina or acute coronary syndromes, which were not the populations of focus in ISCHEMIA.

"Given that only around 20% of patients treated with coronary stents have stable angina, and within this population there are a significant range of considerations which could influence clinicians’ decision to treat with a stent vs. guideline directed medical therapy (GDMT), we expect the ISCHEMIA study to have only a modest and gradual impact on treatment patterns," analysts at Credit Suisse wrote in a note to investors.

The Credit Suisse analysts also noted that patient compliance and adherence to medications are more closely monitored in a trial like ISCHEMIA, which could cast doubt on whether the outcomes in the conservative approach cohort would be a strong in the 'real world.'

Analysts at Stifel pegged the volume of PCI procedures on the line as being closer to 2%, when considering the various stable angina patients who had factors excluding them from inclusion in the trial.

"While ISCHEMIA may have shown 2% of patients do not benefit from PCI, there is good reason to believe that there will not be a 100% headwind to this portion of procedures ... Even if the 2% of stable asymptomatic PCI procedures did go away, BSX management indicated that there could be some potential offset from currently symptomatic patients that had withheld treatment now getting a procedure due to the convincing quality of life benefit," analysts at Stifel wrote. "Essentially, fewer inappropriate patients will get PCI than are treated today, but more appropriate patients not treated today will be treated."

In a note to investors Sunday, Jefferies analysts cited a previous survey of 29 interventional cardiologists conducted by the investment firm demonstrating that in the event of apparent equivalence between the conservative and invasive arms, less than half (34%) expected a decline in PCI volumes. The average decline expected was 18%.

As such, Jefferies is modeling a negative $13 million impact on Boston Scientific's sales, which it says equates to 0.1% of the $12.1 billion it's forecasting in total revenue for the company in 2020.

Shares in Boston Scientific, Medtronic and Abbott were all roughly stable in early trading Monday.

Results from ISCHEMIA will likely be published in medical journals beginning in early 2020, according to the trial's website.