Dive Brief:

- An EU Court of Justice ruling Tuesday imposes limits on the European Commission’s review authority under Article 22 of the EU Merger Regulation. The EC had taken up the $7.1 billion sale of cancer-screening firm Grail to Illumina in 2021 at several countries’ request despite Grail’s revenue not meeting notification thresholds.

- The Grail litigation was a critical legal test for EC review actions under Article 22 and showed that EU regulators are monitoring for potential competition violations by dominant companies, even if an acquisition doesn’t meet notification terms, according to a WilmerHale analysis of the case in October 2023. The commission had argued that Grail’s revenue did not accurately reflect its competitive significance in the market for blood-based cancer testing as shown by its $7.1 billion deal valuation.

- EU Competition Commissioner Margrethe Vestager said in a statement that the commission will continue to accept Article 22 referrals for competition reviews “where the applicable legal requirements are met.”

Dive Insight:

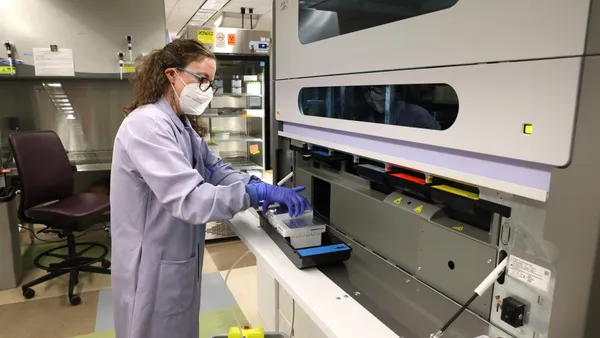

Gene sequencing company Illumina took a legal gamble in the summer of 2021, closing on its purchase of Grail, a former business unit it spun off in 2016, before European competition regulators had passed judgment on the deal. Grail makes technology to screen for cancers at an early stage using a blood test.

“Grail has no business in the EU, and the company believes that the European Commission does not have jurisdiction to review the merger as the EU merger thresholds are not met, nor are they met in any EU member state,” San Diego-based Illumina said at the time in a press release.

The move infuriated European Commission officials in Brussels and led to a record €432 million euro ($477 million) fine, or roughly 10% of Illumina’s annual revenue, the maximum levy possible. Regulators also ordered Illumina to unwind the transaction. The Court of Justice ruling nulls the financial penalty.

The EC “will consider the next steps to ensure that the Commission is able to review those few cases where a deal would have an impact in Europe but does not otherwise meet the EU notification thresholds,” Vestager said in her statement Tuesday.

The EC had taken up the review over the possibility that a combined Grail-Illumina “could restrict access to or increase prices of next generation sequencers and reagents” in genomic cancer tests.

“Genomic cancer tests, having the potential to identify a wide variety of cancers in asymptomatic patients, are expected to be game-changers in the fight against cancer,” the commission said in April 2021 when it accepted the referral. “It is therefore important to ensure that patients get access to this technology as quickly as possible, from as wide sources as possible, and at a fair price.”

In the U.S., the Federal Trade Commission had also opposed Illumina’s acquisition of Grail. The FTC dismissed the case last month following Grail’s spin-off to shareholders in June 2024 and its debut as a public company. Illumina retained a 14.5% stake in Grail.

Illumina’s then-CEO told MedTech Dive in early 2022 that the Grail acquisition would help save “hundreds of thousands of lives,” which compelled the company to move forward with the deal before it expired. Grail would have been owed a $300 million termination fee and a $300 million investment if the deal failed to close within the specified timeframe.