Medical and scientific equipment manufacturers that do business in China are preparing for demand from the country to soften as economic growth slows, an anti-corruption campaign targets hospitals and new policies encourage local investment in domestic vendors.

Companies from lab instrument suppliers to imaging system and surgical robot makers could soon feel the pinch.

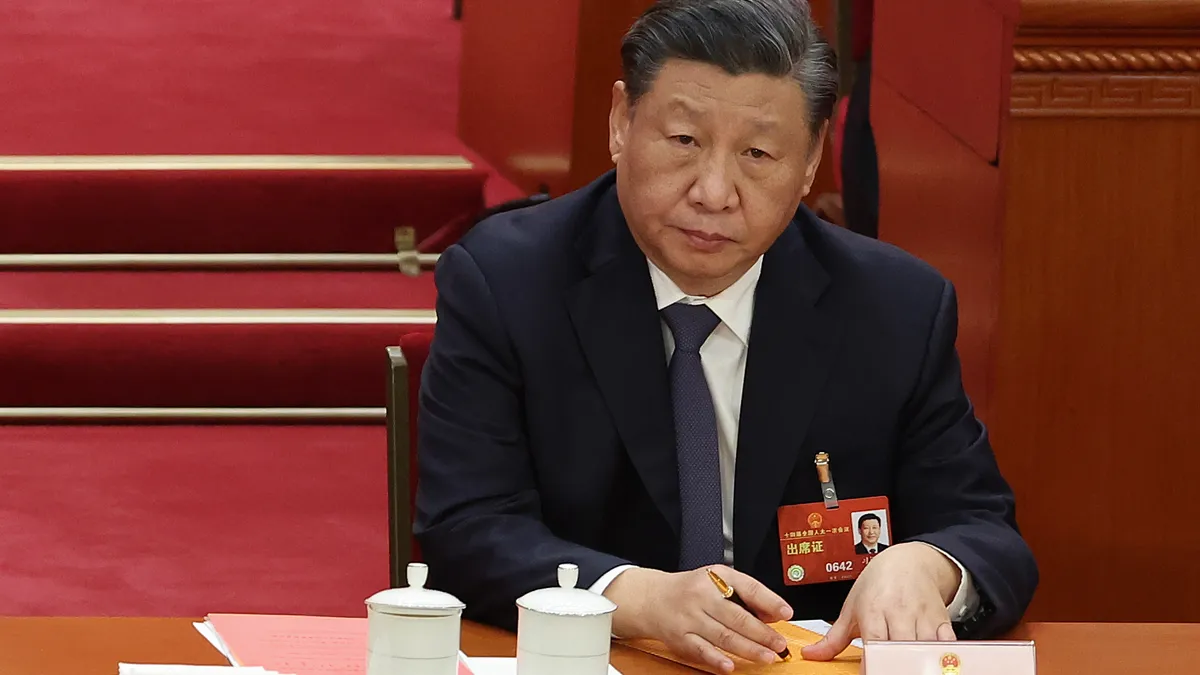

After a decades-long economic boom, China’s growth is stalling, economists believe, posing a challenge to President Xi Jinping’s strategies for keeping development on track. U.S. President Joe Biden has called China’s economy a “ticking time bomb.”

At the same time, China has launched an anti-corruption initiative in the healthcare system that some observers speculate is intended to stimulate domestic consumption among an increasingly frustrated public.

The potential for near-term disruption from the corruption crackdown and weakening economy to dampen medical equipment orders is being closely watched by U.S. medtech executives and industry analysts.

“The environment in China remains a source of uncertainty into 3Q earnings and management commentary this week continued to tilt cautious,” analysts at Goldman Sachs said in a note to clients last Friday.

Intuitive Surgical is one company bracing for a slowdown in China. The robotic surgery leader reported strong procedure growth in China in the second quarter due to pent-up demand after three years of lockdowns and other strict COVID prevention measures. But it also cautioned that local competitors are increasingly participating in tender processes under a national quota system and pressuring prices.

CFO Jamie Samath, speaking last week at a Wells Fargo healthcare conference, said the new anti-corruption initiative, whose targets include hospital procurement officials, adds another potential constraint on capital equipment placements in China. “We see that as an activity that is going to last about a year,” Samath told investors.

Siemens Healthineers and Philips, which make imaging systems, and Elekta, a maker of radiation therapy machines, also acknowledged that some near-term equipment orders were likely to be delayed due to China’s anti-corruption campaign, the Goldman Sachs analysts said. Medtronic, Zimmer Biomet and Stryker said they were monitoring the situation but had not yet seen any impact.

Thermo Fisher Scientific CEO Marc Casper this week suggested economic conditions in China have deteriorated further over the past several weeks. The scientific instruments maker in July lowered growth forecasts and announced it would make $450 million in additional cost cuts this year to offset cautious spending by customers in both the U.S. and China.

On Wednesday, the CEO said the outlook for market growth in 2023, already reduced from a forecast of 4% to 6% at the start of the year, had deteriorated further. Market growth is now likely “trending at the lower end” of the zero-to-2% range projected in July, Casper told investors at a Morgan Stanley healthcare conference.

“The conditions that we saw in Q2 continue -- with probably additional softening in China and certainly customer caution existing,” said Casper, who chairs the US-China Business Council and visited the country in August. Although China will be challenged this year, the anti-corruption effort ultimately will be a “huge positive for multinational companies,” he observed.

Thermo Fisher is among a number of life science tools suppliers, including Danaher, Illumina and Agilent Technologies, that have signaled they expect weaker demand from Chinese customers in the second half of the year. Lab equipment makers are also contending with sluggish demand from biopharma customers experiencing a funding downturn.

Casper’s comments suggest there is more downside to come in China, TD Cowen analyst Dan Brennan said in a note to clients Wednesday.

“China life science customers appear ready to spend and favorable end market drivers are in place, but the broader economy is challenged and near term stimulus/improvement doesn’t seem evident,” Brennan wrote.

Chinese purchases represent 10% to 20% of revenues on average for leading companies in the life science tools sector and have served as a driver of outsized growth since 2016, according to research from Jefferies analysts.

Management teams at private Chinese companies have sharply curtailed spending as confidence in government policies has declined and “seem confident that current headwinds are not due to intensifying local competition,” Jefferies analyst Brandon Couillard wrote to clients on Tuesday.

“For now, it's hard to know how much of the China pullback is cyclical vs. more permanent demand destruction. Regardless, we view China as the biggest swing factor for 2024,” Couillard said.

Canaccord Genuity analyst Kyle Mikson, in a report issued last week on the challenges for scientific tools and diagnostics companies in China, said Chinese R&D spending continues to accelerate, and the country’s share of global research and development expenditures is rising.

“It appears that the country remains highly committed to investing in R&D. The primary driver of this focus is likely the country’s objective to reduce its reliance on technologies and products developed by foreign vendors. Consequently, we believe China will remain a source of leading technological innovation going forward (likely at an increasing rate),” Mikson wrote.

He predicted China’s economic woes, however, could weigh on the sector for up to two years.