Dive Brief:

-

Hologic has bought Austin, Texas-based Acessa Health for $80 million upfront to add a treatment for benign uterine fibroid to its women’s health portfolio.

-

The acquisition, disclosed Tuesday, centers on a laparoscopic system that uses ultrasound visualization and radiofrequency ablation to treat fibroids.

-

Hologic will market the device, Acessa ProVu, alongside its existing fibroid removal technology MyoSure, using its current infrastructure to try to grow sales beyond the $13 million forecast for fiscal 2021. However, Cowen analysts said in a Tuesday note that the deal "isn't needle-moving" in the near term.

Dive Insight:

Hologic added MyoSure to its gynecological surgical division in the 2011 takeover of Interlace. That deal, which was worth $125 million upfront, equipped Hologic to meet demand for products used in the removal of polyps and fibroids. MyoSure enables physicians to cut polyps and fibroids into small pieces and remove them from the body.

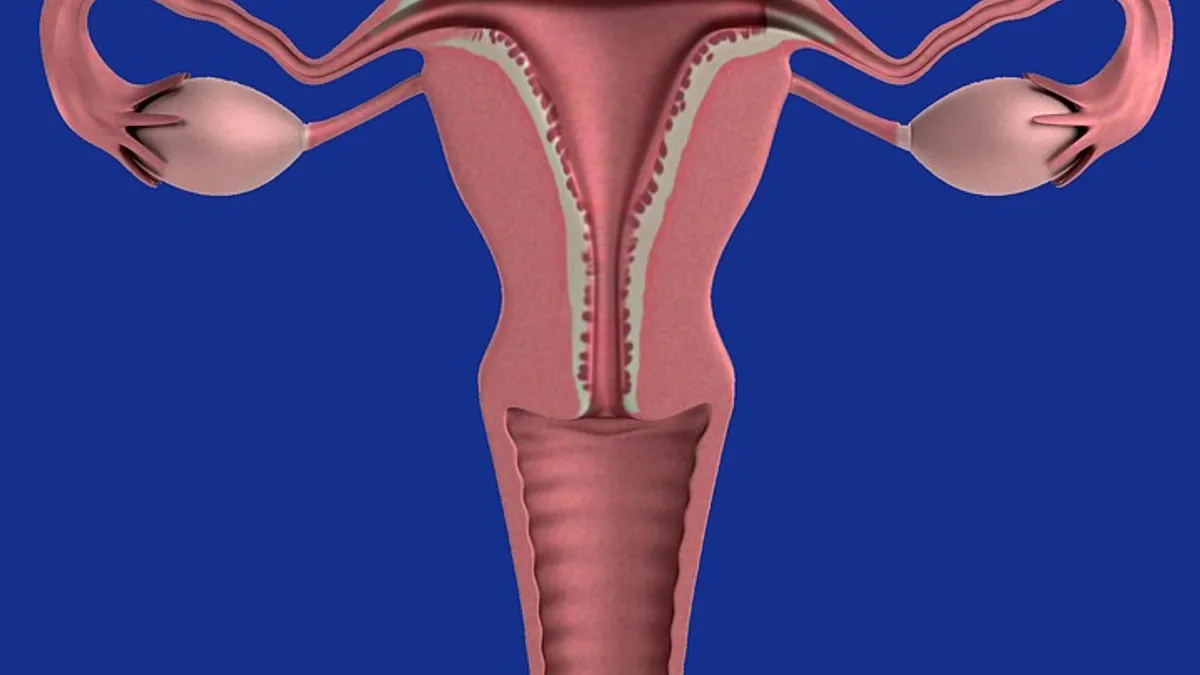

Almost a decade later, Hologic has identified Acessa ProVu as complementary to MyoSure. Physicians use Acessa ProVu to laparoscopically treat fibroids in the wall of the uterus and on its surface. That differentiates the device from MyoSure, which facilitates the hysteroscopic removal of fibroids from the uterine cavity.

While the devices have slightly different applications, Hologic sees overlap between the physicians who use them, enabling it to use the commercial infrastructure built to support MyoSure to promote Acessa ProVu. Analysts at Cowen see merit in Hologic’s thinking.

“The strategic rationale looks sound given that Acessa Health's product appears to be complementary to MyoSure and should be able to leverage HOLX's extensive OB/GYN commercial infrastructure,” the analysts wrote in a Tuesday note to investors.

While the analysts believe the deal rationale appears solid, they acknowledge that the Acessa Health takeover "isn't needle-moving in the near-term."

Hologic expects Acessa Health to generate sales of $13 million in fiscal 2021. That makes the acquired company a small part of Hologic, which generated revenues of $2.4 billion over the first nine months of its current fiscal year.

Nonetheless, Acessa Health has carved out a niche for itself, to the extent that materials from a gynecologic surgery professional association present its name as synonymous with laparoscopic radiofrequency ablation of fibroids.

Hologic's takeover of Acessa Health comes weeks after CEO Steve MacMillan told investors he would probably accelerate an existing bolt-on acquisition strategy amid COVID-19. MacMillan is interested in striking deals to add to the surgical and diagnostics businesses, although “lofty valuations” in the testing sector could cause Hologic to stay on the sidelines until the effect of COVID-19 abates.